Region:North America

Author(s):Dev

Product Code:KRAD0449

Pages:99

Published On:August 2025

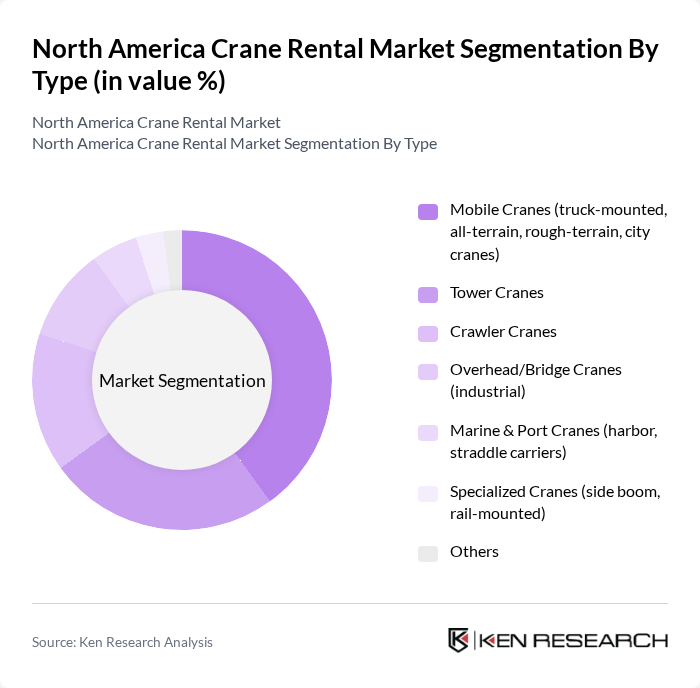

By Type:The crane rental market can be segmented into various types, including mobile cranes, tower cranes, crawler cranes, overhead/bridge cranes, marine & port cranes, specialized cranes, and others. Among these, mobile cranes are the most widely used due to their versatility, transportability, and ability to operate across constrained urban jobsites and industrial facilities, making them a preferred choice for construction and industrial applications.

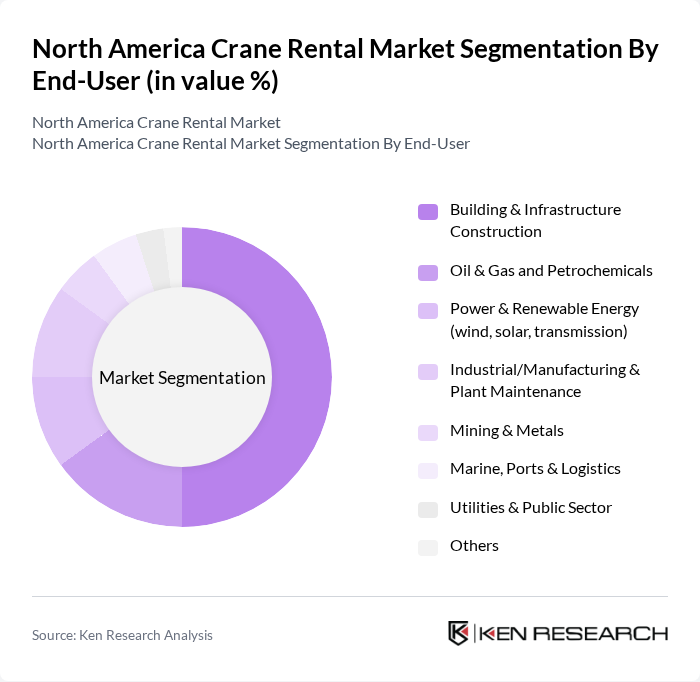

By End-User:The end-user segmentation includes building & infrastructure construction, oil & gas and petrochemicals, power & renewable energy, industrial/manufacturing & plant maintenance, mining & metals, marine, ports & logistics, utilities & public sector, and others. The building & infrastructure construction segment leads the market, supported by ongoing urban development, bridge and highway upgrades, data center construction, and warehousing/logistics builds; energy (including wind installation and grid work) and industrial maintenance are important secondary demand pillars.

The North America Crane Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Maxim Crane Works, L.P., Bigge Crane and Rigging Co., ALL Erection & Crane Rental Corp., NBIS, Inc. (Specialty insurance & risk partner for crane rental), Sterett Crane & Rigging, Barnhart Crane & Rigging, Morrow Equipment Company, LLC (tower crane rental), Essex Crane Rental Corp., AmQuip Crane Rental, LLC, TNT Crane & Rigging, Inc., Buckner HeavyLift Cranes, Sims Crane & Equipment Co., Digging & Rigging, Inc., NessCampbell Crane + Rigging, Imperial Crane Services, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The North American crane rental market is poised for growth, supported by ongoing infrastructure investment programs and the diffusion of digital technologies in equipment management. As urbanization and redevelopment continue, demand for efficient construction solutions is expected to favor rental models. The shift toward sustainability is prompting greater attention to fuel efficiency and lower-emission equipment within fleets.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Cranes (truck-mounted, all-terrain, rough-terrain, city cranes) Tower Cranes Crawler Cranes Overhead/Bridge Cranes (industrial) Marine & Port Cranes (harbor, straddle carriers) Specialized Cranes (side boom, rail-mounted) Others |

| By End-User | Building & Infrastructure Construction Oil & Gas and Petrochemicals Power & Renewable Energy (wind, solar, transmission) Industrial/Manufacturing & Plant Maintenance Mining & Metals Marine, Ports & Logistics Utilities & Public Sector Others |

| By Application | Heavy Lifting & Erection (turbines, modules, bridges) Material Handling & Logistics Construction & Assembly Shutdowns, Turnarounds & Maintenance (STM) Demolition & Decommissioning Wind Turbine Installation & Repowering Others |

| By Rental Duration | Short-Term Rentals (hourly to weekly) Long-Term Rentals (monthly to multiyear) Project-Based/EPC Contracts |

| By Region | United States (Northeast, Midwest, South, West) Canada (Western, Central, Atlantic, Northern) Mexico (North, Central, South) Rest of North America Cross-Border/Energy Corridors |

| By Pricing Model | Time-Based Rates (hourly, daily, weekly, monthly) Turnkey/Lump-Sum with Engineering & Rigging Performance-Based (uptime, availability) Bundled Fleet + Operator + Transport |

| By Service Type | Bare Rentals (equipment only) Operated & Maintained (O&M) Rentals Project Services (engineering, lift planning, rigging) Maintenance, Parts & Support Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Project Management | 120 | Project Managers, Site Supervisors |

| Oil & Gas Sector Equipment Rental | 90 | Operations Managers, Procurement Specialists |

| Manufacturing Facility Crane Usage | 70 | Facility Managers, Production Supervisors |

| Infrastructure Development Projects | 100 | Government Officials, Urban Planners |

| Heavy Equipment Rental Companies | 80 | Business Development Managers, Sales Directors |

The North America Crane Rental Market is valued at approximately USD 1718 billion, driven by increasing construction and infrastructure activities, particularly in urban megaprojects, and a growing preference for renting equipment to minimize upfront costs and maintenance responsibilities.