Region:North America

Author(s):Shubham

Product Code:KRAB0540

Pages:88

Published On:August 2025

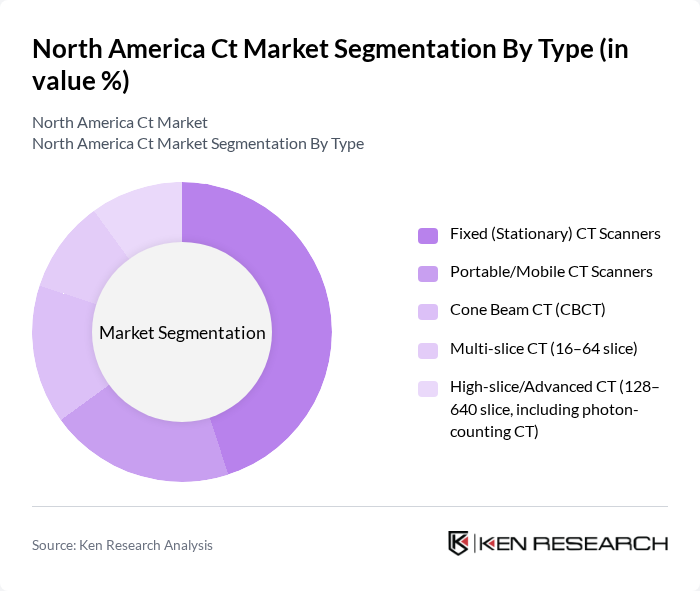

By Type:The CT market can be segmented into various types, including Fixed (Stationary) CT Scanners, Portable/Mobile CT Scanners, Cone Beam CT (CBCT), Multi-slice CT (16–64 slice), and High-slice/Advanced CT (128–640 slice, including photon-counting CT). Among these, Fixed CT Scanners are the most widely used due to their high image quality and reliability in hospitals and diagnostic centers. Portable CT Scanners are gaining traction for their flexibility and ease of use in emergency situations.

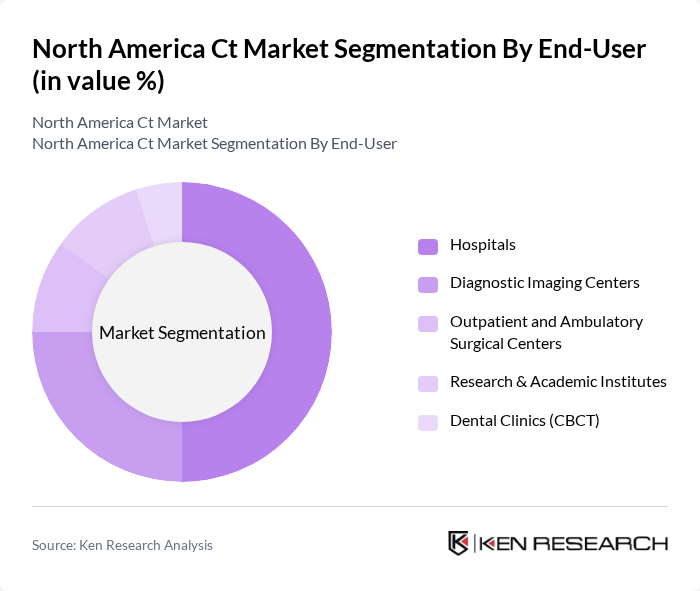

By End-User:The end-user segmentation includes Hospitals, Diagnostic Imaging Centers, Outpatient and Ambulatory Surgical Centers, Research & Academic Institutes, and Dental Clinics (CBCT). Hospitals are the leading end-users due to their comprehensive imaging services and high patient volumes. Diagnostic Imaging Centers are also significant, driven by the increasing demand for specialized imaging services.

The North America CT market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers AG, GE HealthCare Technologies Inc., Philips (Koninklijke Philips N.V.), Canon Medical Systems Corporation, Fujifilm Healthcare (Fujifilm Holdings Corporation), United Imaging Healthcare Co., Ltd. (UIH), Neusoft Medical Systems Co., Ltd., Carestream Health, Inc., Hologic, Inc. (for CBCT/dental and breast imaging adjacencies), Planmeca Oy (CBCT), Dentsply Sirona Inc. (CBCT), Samsung Electronics Co., Ltd. (Boston Imaging/NeuroLogica), NeuroLogica Corp. (a Samsung company; portable CT), Esaote S.p.A., Agfa-Gevaert Group (Agfa HealthCare imaging IT) contribute to innovation, geographic expansion, and service delivery in this space.

The North American CT market is poised for significant evolution, driven by technological advancements and changing healthcare dynamics. The integration of artificial intelligence in imaging is expected to enhance diagnostic accuracy and efficiency, while the shift towards value-based care will prioritize patient outcomes over volume. Additionally, the expansion of outpatient imaging services will cater to the growing demand for accessible healthcare solutions, ensuring that the market remains resilient and adaptive to future challenges and opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed (Stationary) CT Scanners Portable/Mobile CT Scanners Cone Beam CT (CBCT) Multi-slice CT (16–64 slice) High-slice/Advanced CT (128–640 slice, including photon-counting CT) |

| By End-User | Hospitals Diagnostic Imaging Centers Outpatient and Ambulatory Surgical Centers Research & Academic Institutes Dental Clinics (CBCT) |

| By Application | Oncology Neurology Cardiology and Vascular Trauma and Emergency Care Orthopedics and Musculoskeletal Dental and Maxillofacial (CBCT) |

| By Distribution Channel | Direct Sales (OEM) Value-Added Resellers/Distributors Group Purchasing Organizations (GPOs) Online and Tender-Based Procurement |

| By Region | United States Canada Mexico |

| By Price Range | Entry-Level CT Systems Mid-Range CT Systems Premium/High-End CT Systems |

| By Others | Service & Maintenance Contracts Refurbished CT Systems Software & AI Add-ons (reconstruction, dose optimization) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 120 | Radiology Directors, Imaging Technologists |

| Outpatient Diagnostic Centers | 90 | Center Managers, Radiologists |

| Healthcare Procurement Offices | 80 | Procurement Officers, Supply Chain Managers |

| Biomedical Engineering Teams | 70 | Biomedical Engineers, Equipment Maintenance Supervisors |

| Health Policy Experts | 40 | Healthcare Economists, Policy Analysts |

The North America CT market is valued at approximately USD 2.9 billion, driven by advancements in imaging technology, the rising prevalence of chronic diseases, and increased demand for diagnostic imaging services.