Region:North America

Author(s):Rebecca

Product Code:KRAA2185

Pages:82

Published On:August 2025

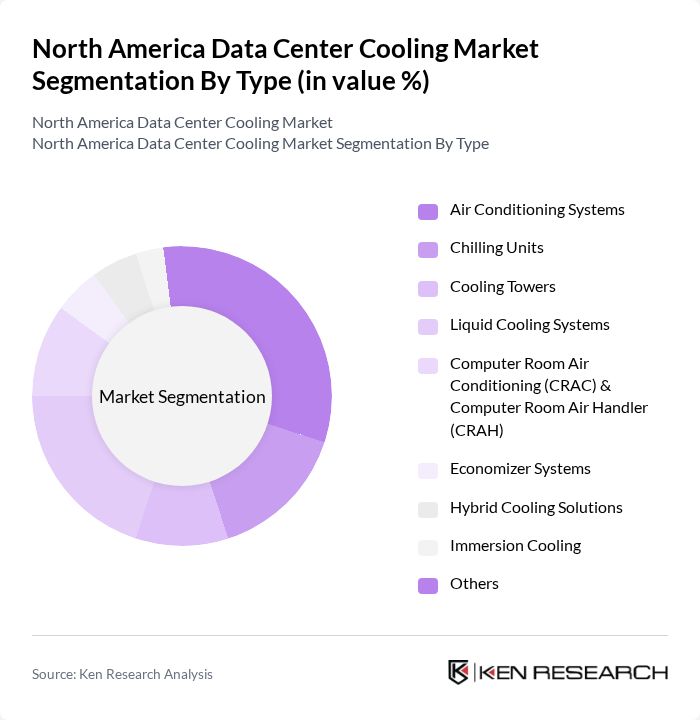

By Type:The market is segmented into various types of cooling solutions, including Air Conditioning Systems, Chilling Units, Cooling Towers, Liquid Cooling Systems, Computer Room Air Conditioning (CRAC) & Computer Room Air Handler (CRAH), Economizer Systems, Hybrid Cooling Solutions, Immersion Cooling, and Others. Among these, Air Conditioning Systems and Liquid Cooling Systems are particularly prominent due to their effectiveness in maintaining optimal temperatures in high-density data environments. Liquid cooling is gaining traction for its superior energy efficiency and ability to support next-generation workloads such as AI and HPC .

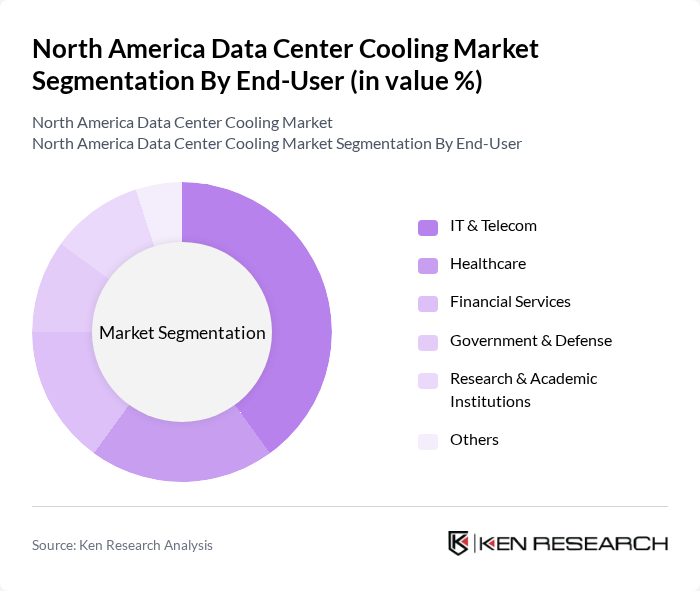

By End-User:The end-user segmentation includes IT & Telecom, Healthcare, Financial Services, Government & Defense, Research & Academic Institutions, and Others. The IT & Telecom sector dominates the market due to the increasing reliance on data centers for cloud services, big data analytics, and the Internet of Things (IoT), which require efficient cooling solutions to ensure operational reliability. Healthcare and financial services are also significant contributors, driven by the need for secure, high-performance data management .

The North America Data Center Cooling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schneider Electric, Vertiv Group Corp., Rittal North America LLC, STULZ USA, Inc., Airedale by Modine, Mitsubishi Electric Corporation, Emerson Electric Co., Johnson Controls International plc, Daikin Applied Americas Inc., Trane Technologies plc, CoolIT Systems Inc., Asetek, Inc., Black Box Corporation, Huawei Technologies Co., Ltd., Nlyte Software Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The North American data center cooling market is poised for transformative growth, driven by technological innovations and regulatory pressures. As companies increasingly adopt AI and IoT technologies, cooling systems will become more efficient and responsive to real-time demands. Additionally, the expansion of edge data centers will necessitate modular and scalable cooling solutions. The integration of renewable energy sources will further enhance sustainability efforts, positioning the market for significant advancements in energy efficiency and operational effectiveness in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Air Conditioning Systems Chilling Units Cooling Towers Liquid Cooling Systems Computer Room Air Conditioning (CRAC) & Computer Room Air Handler (CRAH) Economizer Systems Hybrid Cooling Solutions Immersion Cooling Others |

| By End-User | IT & Telecom Healthcare Financial Services Government & Defense Research & Academic Institutions Others |

| By Application | Colocation Data Centers Enterprise Data Centers Cloud Service Providers Edge Data Centers Hyperscale Data Centers Others |

| By Component | Cooling Units Chillers Cooling Towers Air Handling Units Control Units Others |

| By Service | Consulting & Training Installation & Deployment Maintenance & Support Others |

| By Cooling Type | Room-Based Cooling Rack-Based Cooling Row-Based Cooling Others |

| By Organization Size | Large Organizations Small & Medium Organizations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Data Centers | 120 | Data Center Managers, IT Directors |

| Colocation Facilities | 90 | Operations Managers, Facility Engineers |

| Cloud Service Providers | 60 | Infrastructure Architects, Energy Efficiency Consultants |

| Edge Computing Sites | 50 | Site Managers, Network Operations Specialists |

| Cooling Technology Suppliers | 40 | Product Managers, Sales Engineers |

The North America Data Center Cooling Market is valued at approximately USD 6.6 billion, driven by the increasing demand for data storage and energy-efficient cooling solutions to manage heat from high-density computing systems.