North America Data Center Power Market Overview

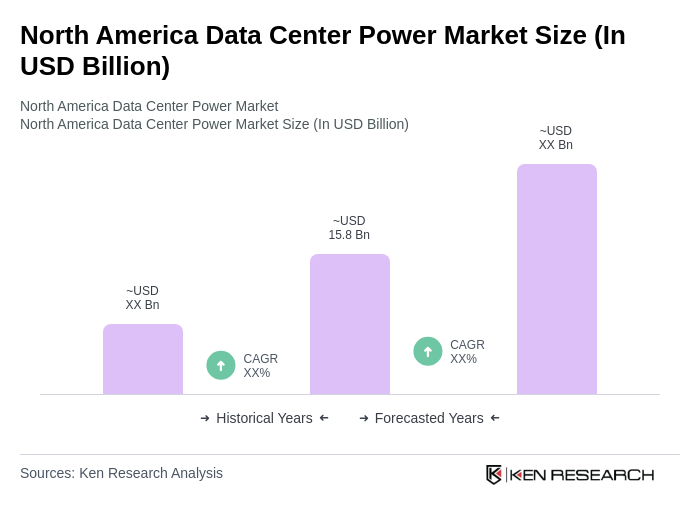

- The North America Data Center Power Market is valued at USD 15.8 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for data storage and processing capabilities, fueled by the rise of cloud computing, big data analytics, artificial intelligence (AI), and the Internet of Things (IoT). The need for reliable and efficient power solutions in data centers has become critical as organizations seek to enhance operational efficiency, ensure uptime, and support high-density computing workloads .

- Key players in this market include the United States and Canada, with cities such as New York, Dallas, and Toronto leading the charge. The dominance of these regions is attributed to robust technological infrastructure, availability of skilled labor, and favorable business environments that attract significant investments in data center facilities. The presence of major technology companies and hyperscale service providers in these areas further solidifies their market position .

- Recent years have seen increased regulatory and policy focus on energy efficiency and sustainability in data centers. The U.S. federal government and several states have introduced incentives and guidelines promoting the adoption of energy-efficient technologies and renewable energy sources in data centers. These initiatives are designed to reduce the carbon footprint of data centers and promote sustainable practices within the industry .

North America Data Center Power Market Segmentation

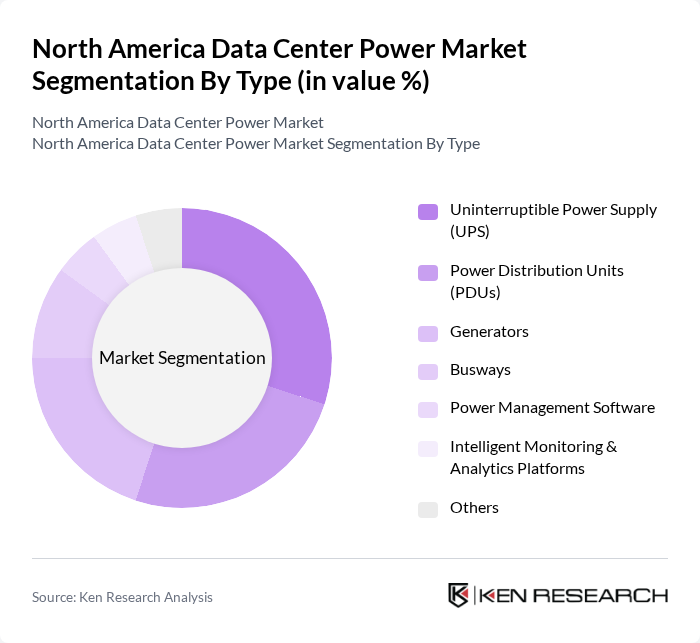

By Type:The segmentation of the market by type includes various components essential for data center operations. The subsegments are Uninterruptible Power Supply (UPS), Power Distribution Units (PDUs), Generators, Busways, Power Management Software, Intelligent Monitoring & Analytics Platforms, and Others. These components are critical to ensuring the reliability, scalability, and efficiency of power delivery in modern data centers, supporting both centralized and edge computing environments .

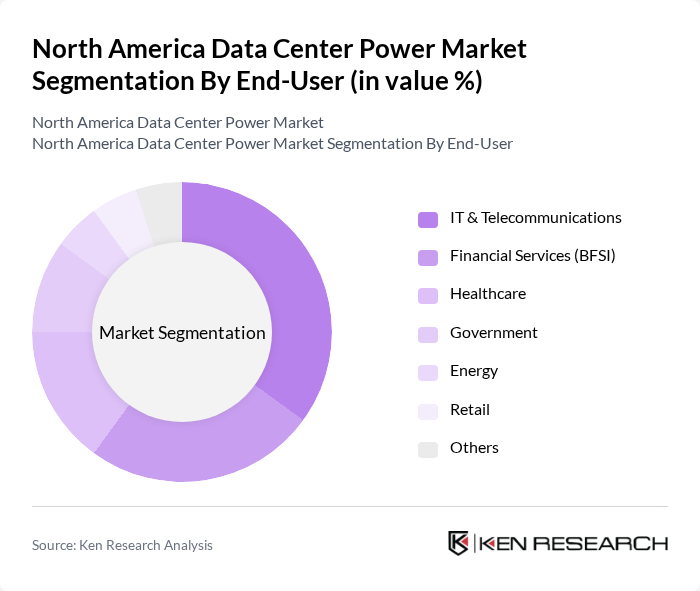

By End-User:The end-user segmentation includes various sectors that utilize data center power solutions. The subsegments are IT & Telecommunications, Financial Services (BFSI), Healthcare, Government, Energy, Retail, and Others. Each sector has distinct power requirements and operational challenges, influencing their demand for advanced, resilient, and energy-efficient data center power solutions .

North America Data Center Power Market Competitive Landscape

The North America Data Center Power Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schneider Electric, Eaton Corporation, Vertiv Holdings Co., Siemens AG, ABB Ltd., General Electric Company, NTT Ltd., Digital Realty Trust, Inc., CyrusOne Inc., QTS Realty Trust, Inc., Iron Mountain Incorporated, Rackspace Technology, Inc., CoreSite Realty Corporation, Equinix, Inc., Vantage Data Centers contribute to innovation, geographic expansion, and service delivery in this space.

North America Data Center Power Market Industry Analysis

Growth Drivers

- Increasing Demand for Cloud Services:The North American cloud services market is projected to reach $500 billion in the future, driven by businesses transitioning to cloud-based solutions. This surge in demand necessitates robust data center power infrastructure, as companies require reliable energy sources to support their operations. The growth of remote work and digital transformation initiatives further amplifies this demand, compelling data centers to enhance their power capabilities to accommodate increased workloads and data processing needs.

- Rising Energy Costs:Energy costs in North America have seen a significant increase, with average electricity prices rising to approximately $0.14 per kWh in the future. This trend is prompting data centers to invest in more efficient power solutions to mitigate operational expenses. As energy prices continue to climb, operators are compelled to adopt advanced power management systems and energy-efficient technologies, ensuring they remain competitive while managing their energy consumption effectively.

- Focus on Energy Efficiency:The North American data center sector is increasingly prioritizing energy efficiency, with investments in energy-efficient technologies expected to exceed $25 billion in the future. This focus is driven by both regulatory pressures and corporate sustainability goals. Companies are implementing strategies such as optimizing cooling systems and utilizing energy-efficient hardware, which not only reduces operational costs but also aligns with broader environmental objectives, enhancing their market competitiveness.

Market Challenges

- High Initial Capital Investment:Establishing a data center requires substantial capital investment, often exceeding $12 million for a mid-sized facility. This high upfront cost can deter new entrants and limit expansion opportunities for existing operators. Additionally, the need for advanced infrastructure and technology further escalates these costs, making it challenging for smaller companies to compete effectively in a market dominated by larger players with more financial resources.

- Regulatory Compliance Issues:Data centers in North America face stringent regulatory compliance requirements, including energy efficiency standards and environmental regulations. For instance, the Energy Policy Act mandates specific energy efficiency benchmarks that data centers must meet. Non-compliance can result in significant fines, which can reach up to $600,000, creating a financial burden for operators. Navigating these regulations requires dedicated resources and expertise, posing a challenge for many companies in the sector.

North America Data Center Power Market Future Outlook

The North American data center power market is poised for transformative growth, driven by technological advancements and a shift towards sustainable practices. As companies increasingly adopt renewable energy sources, the integration of solar and wind power into data center operations is expected to rise significantly. Additionally, the growing trend of edge computing will necessitate localized data centers, further enhancing energy efficiency and reducing latency. These developments will shape the market landscape, fostering innovation and competitive advantages for early adopters.

Market Opportunities

- Adoption of Renewable Energy Sources:The transition to renewable energy is gaining momentum, with investments in solar and wind energy projected to exceed $60 billion in the future. This shift presents a significant opportunity for data centers to reduce their carbon footprint and operational costs while meeting regulatory requirements. By leveraging renewable energy, operators can enhance their sustainability profiles and attract environmentally conscious clients.

- Technological Advancements in Power Management:Innovations in power management technologies, such as AI-driven energy optimization systems, are expected to revolutionize data center operations. These advancements can lead to energy savings of up to 35%, significantly reducing operational costs. As data centers adopt these technologies, they can improve efficiency and reliability, positioning themselves favorably in a competitive market landscape.