Region:North America

Author(s):Geetanshi

Product Code:KRAD0128

Pages:99

Published On:August 2025

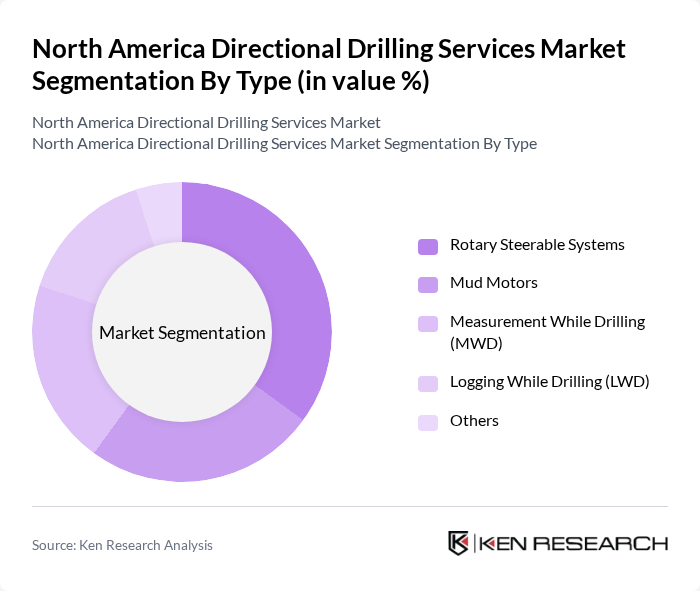

By Type:The market is segmented into Rotary Steerable Systems, Mud Motors, Measurement While Drilling (MWD), Logging While Drilling (LWD), and Others. Rotary Steerable Systems are gaining prominence due to their ability to enhance drilling accuracy and operational efficiency, especially in complex geological formations. The demand for MWD and LWD technologies continues to rise, driven by the need for real-time downhole data and improved decision-making during drilling operations.

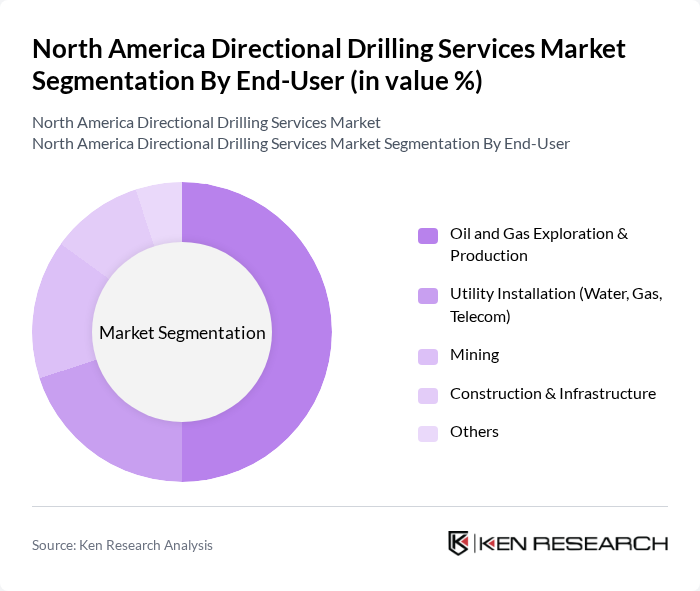

By End-User:The end-user segmentation includes Oil and Gas Exploration & Production, Utility Installation (Water, Gas, Telecom), Mining, Construction & Infrastructure, and Others. The Oil and Gas sector remains the largest end-user, driven by ongoing exploration and production activities in both shale and offshore reserves. Utility installations are also significant, as they require precise directional drilling techniques to minimize disruption in urban and developed areas.

The North America Directional Drilling Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Halliburton, Schlumberger (SLB), Baker Hughes, Weatherford International, Nabors Industries, Precision Drilling Corporation, Ensign Energy Services, National Oilwell Varco (NOV Inc.), Superior Energy Services, Transocean Ltd., Patterson-UTI Energy, KLX Energy Services Holdings, Inc., Helmerich & Payne, Basic Energy Services, TETRA Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The North American directional drilling services market is poised for significant transformation, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt automation and digital technologies, operational efficiencies are expected to improve, reducing costs and enhancing service delivery. Furthermore, the integration of renewable energy sources into traditional drilling practices will create new avenues for growth, positioning the market favorably in the evolving energy landscape. Strategic partnerships will also play a crucial role in fostering innovation and expanding service offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Rotary Steerable Systems Mud Motors Measurement While Drilling (MWD) Logging While Drilling (LWD) Others |

| By End-User | Oil and Gas Exploration & Production Utility Installation (Water, Gas, Telecom) Mining Construction & Infrastructure Others |

| By Application | Onshore Drilling Offshore Drilling Horizontal Drilling Multilateral Drilling Extended Reach Drilling Others |

| By Region | United States Canada Mexico Others |

| By Service Type | Directional Drilling Services Well Planning & Engineering Services Drilling Optimization & Consulting Services Survey & Logging Services Others |

| By Equipment Type | Drilling Rigs Downhole Tools Surface Equipment Measurement & Logging Tools Others |

| By Pricing Model | Fixed Pricing Time and Material Pricing Performance-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Onshore Directional Drilling Services | 100 | Drilling Engineers, Project Managers |

| Offshore Directional Drilling Services | 80 | Operations Managers, Field Supervisors |

| Directional Drilling Equipment Suppliers | 50 | Sales Directors, Product Managers |

| Oil & Gas Exploration Companies | 90 | Exploration Managers, Technical Directors |

| Regulatory Bodies and Industry Associations | 40 | Policy Analysts, Regulatory Affairs Managers |

The North America Directional Drilling Services Market is valued at approximately USD 5.8 billion, driven by the increasing demand for oil and gas exploration, particularly from unconventional resources like shale gas and oil sands.