North America E-Commerce Apparel Market Overview

- The North America E-Commerce Apparel Market is valued at approximatelyUSD 250 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing penetration of smartphones and the internet, along with changing consumer preferences towards online shopping. The convenience of e-commerce platforms, the rise of social media marketing, and the integration of innovative technologies such as AR/VR and AI-driven recommendation engines have further accelerated the demand for apparel in the online space. Additionally, the growing emphasis on sustainable and ethical fashion, as well as the expansion of social commerce, are shaping market dynamics .

- The United States dominates the North America E-Commerce Apparel Market due to its large population, high disposable income, and advanced logistics infrastructure. Cities like New York, Los Angeles, and Chicago serve as major hubs for fashion and retail, attracting both consumers and businesses. Canada and Mexico also contribute significantly, with growing e-commerce adoption and a rising middle class. The presence of leading e-commerce apparel companies such as Amazon, Walmart, Nike, Macy’s, and Target further strengthens the region’s market position .

- In 2023, the U.S. government implemented regulations to enhance consumer protection in online shopping. TheFederal Trade Commission’s “Business and Data Security Guidance,” 2023, mandates that e-commerce platforms provide clear return policies and ensure data privacy for consumers. This initiative aims to build trust in online transactions and promote a safer shopping environment for consumers across the country by requiring transparent disclosures, secure data handling, and accessible redress mechanisms .

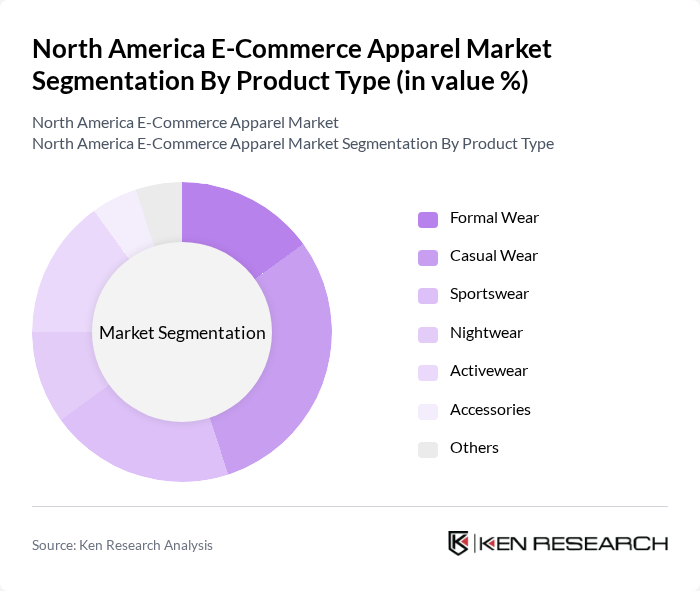

North America E-Commerce Apparel Market Segmentation

By Product Type:The product type segmentation includes various categories such as Formal Wear, Casual Wear, Sportswear, Nightwear, Activewear, Accessories, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse nature of the apparel market .

TheCasual Wearsegment is currently dominating the market due to the increasing trend of relaxed and comfortable clothing, especially post-pandemic. Consumers are gravitating towards versatile apparel that can be worn for both leisure and work-from-home scenarios. This shift in consumer behavior has led to a surge in demand for casual clothing, making it a significant contributor to the overall market growth .

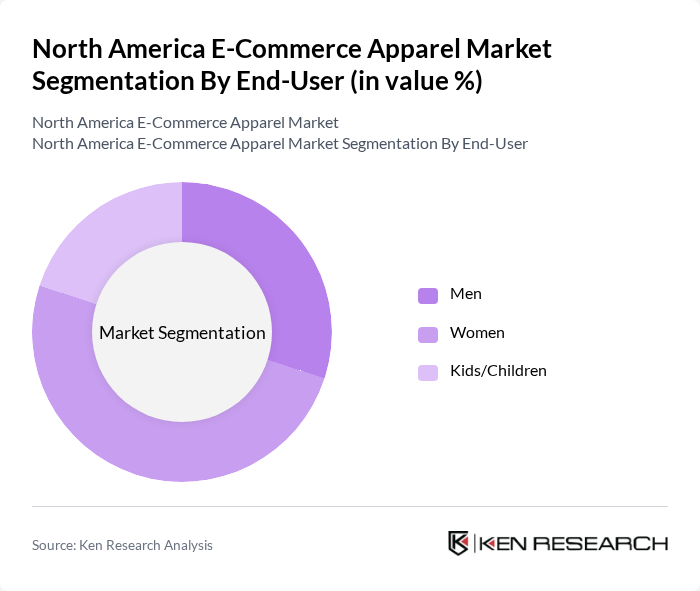

By End-User:The end-user segmentation includes Men, Women, and Kids/Children. Each category reflects distinct purchasing behaviors and preferences, influencing the overall dynamics of the e-commerce apparel market .

TheWomensegment is leading the market, driven by a wider variety of apparel options and a growing focus on fashion among female consumers. Women are more likely to shop online for clothing, influenced by social media trends and targeted marketing strategies. This trend has resulted in a significant increase in the market share for women's apparel, making it the most dominant segment .

North America E-Commerce Apparel Market Competitive Landscape

The North America E-Commerce Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon.com, Inc., Walmart Inc., Target Corporation, Macy's, Inc., Nordstrom, Inc., Gap Inc., Lululemon Athletica Inc., Zappos.com, Inc., ASOS plc, Stitch Fix, Inc., Bonobos, Inc., Uniqlo Co., Ltd., H&M Hennes & Mauritz AB, Adidas AG, Nike, Inc., Shopify Inc., eBay Inc., Revolve Group, Inc., Boohoo Group plc, Urban Outfitters, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

North America E-Commerce Apparel Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:As of future, approximately93%of the North American population has access to the internet, according to the World Bank. This widespread connectivity facilitates online shopping, allowing consumers to browse and purchase apparel conveniently. The rise in internet users, estimated atover 3 million annually, directly correlates with increased e-commerce sales, which reachedover USD 900 billionin recent periods. This trend is expected to continue, driving growth in the e-commerce apparel sector.

- Rise in Mobile Shopping:Mobile commerce is projected to account forapproximately 45%of total e-commerce sales in North America by future, as reported by eMarketer. With over300 million smartphone usersin the region, the convenience of mobile shopping is reshaping consumer behavior. The average consumer spends aroundUSD 1,000 annuallyon mobile purchases, highlighting the significant impact of mobile platforms on the apparel market. This trend is expected to enhance sales and customer engagement in the e-commerce apparel sector.

- Expansion of Logistics and Delivery Services:The logistics sector in North America is projected to grow byapproximately 4%in future, driven by advancements in delivery services. Companies like Amazon and FedEx are investing heavily in infrastructure, reducing average delivery times to under two days forabout 70%of orders. This improvement in logistics not only enhances customer satisfaction but also encourages more consumers to shop online for apparel, further propelling market growth in the e-commerce apparel industry.

Market Challenges

- Intense Competition:The North American e-commerce apparel market is characterized by fierce competition, withover 15,000 online retailersvying for market share. Major players like Amazon and Walmart dominate, making it challenging for smaller brands to establish a foothold. This competitive landscape leads to price wars, which can erode profit margins. In future, the average profit margin for e-commerce apparel retailers is estimated ataround 5%, underscoring the financial pressures faced by businesses in this sector.

- High Return Rates:The return rate for online apparel purchases in North America is approximately25%–30%, significantly higher than in physical stores. This high return rate results in increased operational costs for retailers, including reverse logistics and restocking fees. In future, the estimated cost of returns in the e-commerce apparel sector isover USD 60 billion, impacting profitability. Retailers must develop effective return policies and strategies to mitigate these costs while maintaining customer satisfaction.

North America E-Commerce Apparel Market Future Outlook

The North American e-commerce apparel market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. The integration of artificial intelligence and machine learning is expected to enhance personalization in shopping experiences, leading to increased customer loyalty. Additionally, the growing emphasis on sustainability will likely push brands to adopt eco-friendly practices, appealing to environmentally conscious consumers. As these trends unfold, the market will continue to adapt, presenting new opportunities for growth and innovation in the apparel sector.

Market Opportunities

- Growth of Sustainable Fashion:The sustainable fashion market is estimated to be worthover USD 7 billionin North America. As consumers increasingly prioritize eco-friendly products, e-commerce apparel brands that adopt sustainable practices can capture this growing segment. This shift not only aligns with consumer values but also enhances brand reputation, driving sales and customer loyalty in a competitive market.

- Integration of Augmented Reality in Shopping:The augmented reality (AR) market in retail is estimated to beover USD 1 billionin North America. E-commerce apparel brands that implement AR technology can offer virtual fitting rooms, enhancing the online shopping experience. This innovation can reduce return rates and increase conversion rates, providing a significant competitive advantage in the evolving e-commerce landscape.