Region:North America

Author(s):Geetanshi

Product Code:KRAA1984

Pages:98

Published On:August 2025

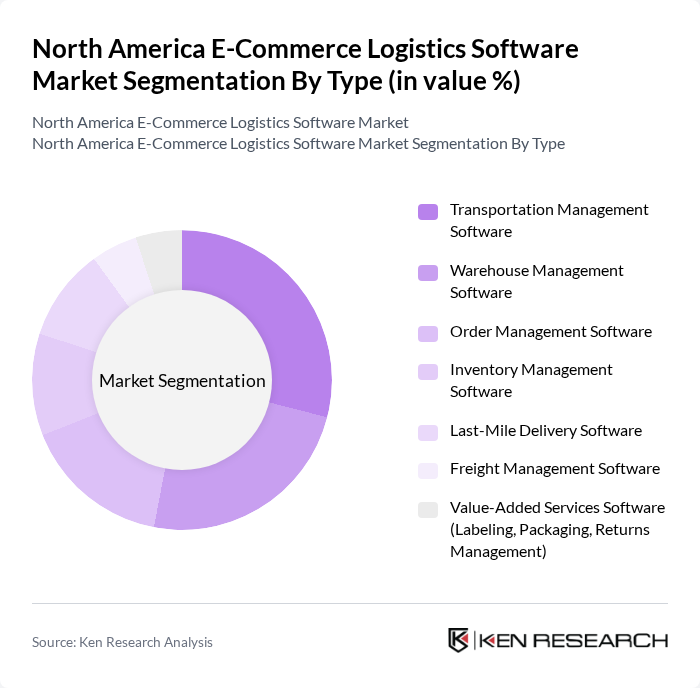

By Type:The market is segmented into various types of logistics software, including Transportation Management Software, Warehouse Management Software, Order Management Software, Inventory Management Software, Last-Mile Delivery Software, Freight Management Software, and Value-Added Services Software (Labeling, Packaging, Returns Management). Among these, Transportation Management Software is currently the leading segment due to its critical role in optimizing shipping routes, reducing transportation costs, and enabling real-time visibility. The increasing complexity of supply chains, demand for integrated analytics, and the need for end-to-end shipment tracking have further propelled its adoption .

By End-User:The end-user segmentation includes Retailers (Omnichannel, Pure-Play E-Commerce), Wholesalers, Manufacturers, E-Commerce Platforms & Marketplaces, Third-Party Logistics (3PL) Providers, Courier & Express Parcel Companies, and Others. Retailers, particularly those operating in omnichannel environments, are the dominant end-users of logistics software. The need for seamless integration between online and offline sales channels, real-time inventory visibility, and enhanced fulfillment speed has driven retailers to invest heavily in logistics solutions that improve operational efficiency and customer experience .

The North America E-Commerce Logistics Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shopify Inc., Oracle Corporation, SAP SE, Manhattan Associates, Inc., Blue Yonder (formerly JDA Software Group, Inc.), Infor, Inc., Descartes Systems Group Inc., ShipBob, Inc., Logiwa, Inc., 3PL Central, LLC, Freightos Limited, WiseTech Global Limited, Easyship Limited, NetSuite Inc. (Oracle NetSuite), Project44, Inc., FourKites, Inc., Körber Supply Chain Software, ShipStation (Auctane LLC) contribute to innovation, geographic expansion, and service delivery in this space.

The North American e-commerce logistics software market is poised for significant transformation as businesses increasingly prioritize automation and customer-centric solutions. With the rise of AI and machine learning, logistics providers are expected to enhance their operational efficiencies and improve service delivery. Additionally, the growing emphasis on sustainability will drive innovations in eco-friendly logistics practices, further shaping the market landscape. As companies adapt to these trends, the demand for advanced logistics software solutions will continue to rise, fostering a dynamic and competitive environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Software Warehouse Management Software Order Management Software Inventory Management Software Last-Mile Delivery Software Freight Management Software Value-Added Services Software (Labeling, Packaging, Returns Management) |

| By End-User | Retailers (Omnichannel, Pure-Play E-Commerce) Wholesalers Manufacturers E-Commerce Platforms & Marketplaces Third-Party Logistics (3PL) Providers Courier & Express Parcel Companies Others |

| By Deployment Model | Cloud-Based On-Premises Hybrid |

| By Sales Channel | Direct Sales Online Sales Resellers & System Integrators |

| By Distribution Mode | Road Rail Air Sea |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Platform Logistics | 120 | Logistics Coordinators, E-commerce Managers |

| Last-Mile Delivery Solutions | 90 | Operations Directors, Delivery Managers |

| Inventory Management Software | 60 | Supply Chain Analysts, IT Managers |

| Returns Management Systems | 50 | Customer Experience Managers, Returns Specialists |

| Warehouse Management Software | 70 | Warehouse Managers, Logistics Engineers |

The North America E-Commerce Logistics Software Market is valued at approximately USD 7.5 billion, driven by the rapid growth of online retail and advancements in logistics technologies such as automation and real-time tracking.