Region:North America

Author(s):Shubham

Product Code:KRAA0718

Pages:80

Published On:August 2025

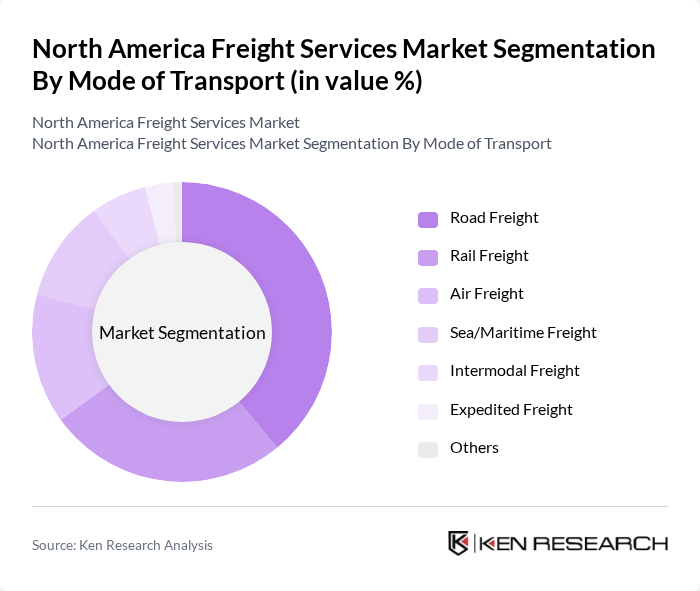

By Mode of Transport:The freight services market is segmented by mode of transport, which includes various methods of transporting goods. Each mode has its unique advantages and is chosen based on factors such as cost, speed, reliability, and the nature of the goods being transported. The dominant modes include road, rail, air, sea, intermodal, expedited, and others, each catering to specific logistics needs. Road freight remains the largest segment due to its flexibility and extensive network coverage, while rail and maritime modes are preferred for bulk and long-distance shipments. Air freight is utilized for high-value and time-sensitive goods, and intermodal solutions are increasingly adopted for efficiency and sustainability .

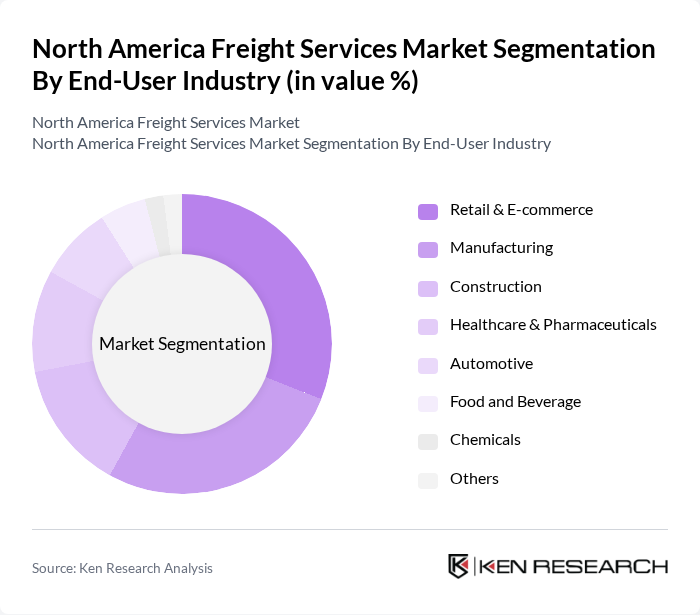

By End-User Industry:The freight services market is also segmented by end-user industry, which includes various sectors that rely on freight services for their operations. Key industries include retail and e-commerce, manufacturing, construction, healthcare and pharmaceuticals, automotive, food and beverage, chemicals, and others. Each industry has distinct logistics requirements that influence the choice of freight services. The wholesale and retail trade segment leads the market, driven by robust e-commerce growth and rising consumer expectations for fast delivery. Manufacturing and automotive sectors also represent significant shares due to ongoing industrial activity and supply chain complexity .

The North America Freight Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as FedEx Corporation, United Parcel Service (UPS), XPO Logistics, J.B. Hunt Transport Services, Schneider National, C.H. Robinson Worldwide, Old Dominion Freight Line, Yellow Corporation (formerly YRC Worldwide), TFI International, Knight-Swift Transportation Holdings, Saia Inc., Landstar System, ArcBest Corporation, Estes Express Lines, R+L Carriers, Canadian National Railway (CN), Canadian Pacific Kansas City (CPKC), Union Pacific Corporation, CSX Corporation, Norfolk Southern Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The North America freight services market is poised for transformative growth driven by technological innovations and evolving consumer expectations. As companies increasingly adopt digital solutions and automation, operational efficiencies will improve, enabling faster delivery times. Additionally, the focus on sustainability will drive the adoption of green logistics practices. The integration of advanced data analytics will further enhance decision-making processes, ensuring that freight services can adapt to changing market dynamics and consumer demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transport | Road Freight Rail Freight Air Freight Sea/Maritime Freight Intermodal Freight Expedited Freight Others |

| By End-User Industry | Retail & E-commerce Manufacturing Construction Healthcare & Pharmaceuticals Automotive Food and Beverage Chemicals Others |

| By Service Type | Full Truckload (FTL) Less Than Truckload (LTL) Dedicated Contract Carriage Freight Brokerage Freight Forwarding Warehousing & Distribution Others |

| By Logistics Model | First-Party Logistics (1PL) Second-Party Logistics (2PL) Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| By Fleet Ownership | Owned Fleet Leased Fleet Outsourced Fleet Others |

| By Customer Type | B2B B2C Government Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Truck Freight Services | 100 | Fleet Managers, Logistics Coordinators |

| Rail Freight Operations | 60 | Operations Directors, Rail Network Planners |

| Air Cargo Services | 40 | Air Freight Managers, Cargo Operations Supervisors |

| Maritime Freight Solutions | 50 | Shipping Managers, Port Operations Heads |

| Third-Party Logistics (3PL) | 60 | 3PL Executives, Supply Chain Analysts |

The North America Freight Services Market is valued at approximately USD 1,480 billion, reflecting significant growth driven by increased demand for logistics solutions, e-commerce expansion, and the need for timely delivery across various sectors.