Region:North America

Author(s):Shubham

Product Code:KRAA2262

Pages:100

Published On:August 2025

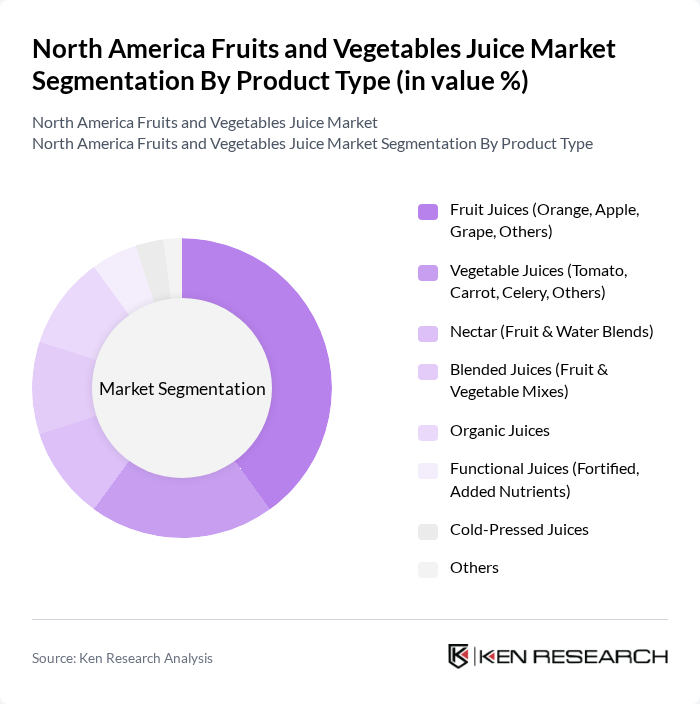

By Product Type:The product type segmentation includes various categories such as fruit juices, vegetable juices, nectar, blended juices, organic juices, functional juices, cold-pressed juices, and others. Among these, fruit juices, particularly orange and apple, dominate the market due to their popularity and established consumer preferences. The trend towards organic and functional juices is also gaining traction as consumers seek healthier options .

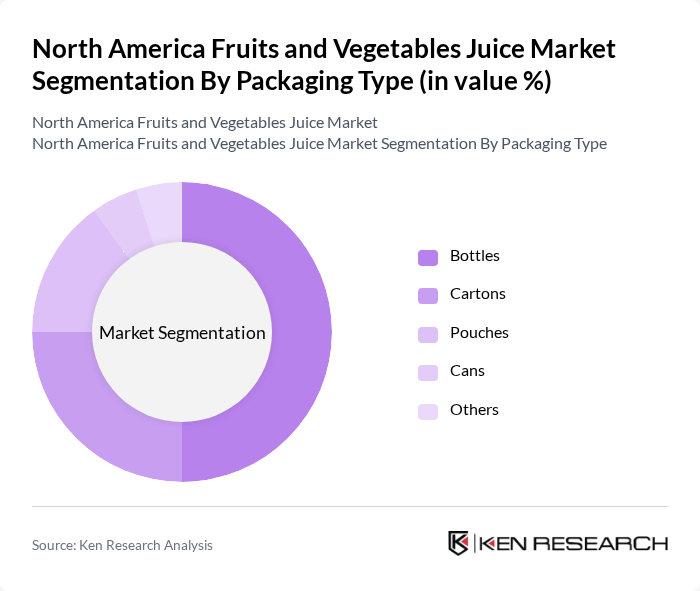

By Packaging Type:The packaging type segmentation includes bottles, cartons, pouches, cans, and others. Bottles are the most popular packaging format due to their convenience and consumer preference for on-the-go consumption. Cartons are also widely used, especially for larger volumes, while pouches and cans are gaining traction for their portability and ease of use .

The North America Fruits and Vegetables Juice Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tropicana Products, Inc. (PepsiCo, Inc.), Naked Juice Company (PepsiCo, Inc.), V8 (Campbell Soup Company), Ocean Spray Cranberries, Inc., Simply Orange Juice Company (The Coca-Cola Company), Bolthouse Farms, Inc. (Butterfly Equity), Minute Maid (The Coca-Cola Company), Dole Food Company, Inc., Welch's (National Grape Cooperative Association, Inc.), Suja Juice Co., BluePrint Juice (Hain Celestial Group, Inc.), Pressed Juicery, Inc., Greenhouse Juice Co., R.W. Knudsen Family (The J.M. Smucker Company), The Hain Celestial Group, Inc., Del Monte Foods, Inc., The Kraft Heinz Company, Keurig Dr Pepper Inc., Citrus World, Inc. (Florida's Natural), Nestlé S.A. contribute to innovation, geographic expansion, and service delivery in this space .

The North American fruits and vegetables juice market is poised for continued evolution, driven by consumer preferences for health-oriented products and innovative offerings. As the trend towards sustainability grows, companies are likely to invest in eco-friendly packaging and sourcing practices. Additionally, the rise of functional beverages, which offer added health benefits, will likely attract health-conscious consumers. These trends indicate a dynamic market landscape, with opportunities for brands that adapt to changing consumer demands and preferences.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fruit Juices (Orange, Apple, Grape, Others) Vegetable Juices (Tomato, Carrot, Celery, Others) Nectar (Fruit & Water Blends) Blended Juices (Fruit & Vegetable Mixes) Organic Juices Functional Juices (Fortified, Added Nutrients) Cold-Pressed Juices Others |

| By Packaging Type | Bottles Cartons Pouches Cans Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Health Food Stores Foodservice (Hotels, Cafés, Restaurants) Others |

| By End-User | Residential Commercial Food Service Institutional Others |

| By Region | United States Canada Mexico Others |

| By Price Range | Premium Mid-Range Budget |

| By Product Formulation | Pure Juices (100% Juice) Juice Concentrates Juice Blends Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Juice Sales | 150 | Store Managers, Category Buyers |

| Juice Manufacturing Insights | 100 | Production Supervisors, Quality Assurance Managers |

| Consumer Preferences in Juice | 150 | Health-Conscious Consumers, Regular Juice Buyers |

| Distribution Channel Analysis | 80 | Logistics Coordinators, Supply Chain Analysts |

| Market Trends and Innovations | 70 | Product Development Managers, Marketing Executives |

The North America Fruits and Vegetables Juice Market is valued at approximately USD 58 billion, reflecting a significant growth trend driven by increasing health consciousness and demand for natural products among consumers.