Region:North America

Author(s):Dev

Product Code:KRAB0338

Pages:83

Published On:August 2025

By Type:The market is segmented into various types of gums, including Chewing Gum, Bubble Gum, Functional Gum, Energy Gum, Sugar-Free Gum, and Others. Among these, Chewing Gum remains the most popular segment, driven by its widespread consumption and strong brand loyalty. The demand for Sugar-Free Gum has surged due to increasing health awareness, making it a significant player in the market. Functional gums, including energy-boosting and vitamin-enriched variants, are gaining traction as consumers seek added benefits from their gum products.

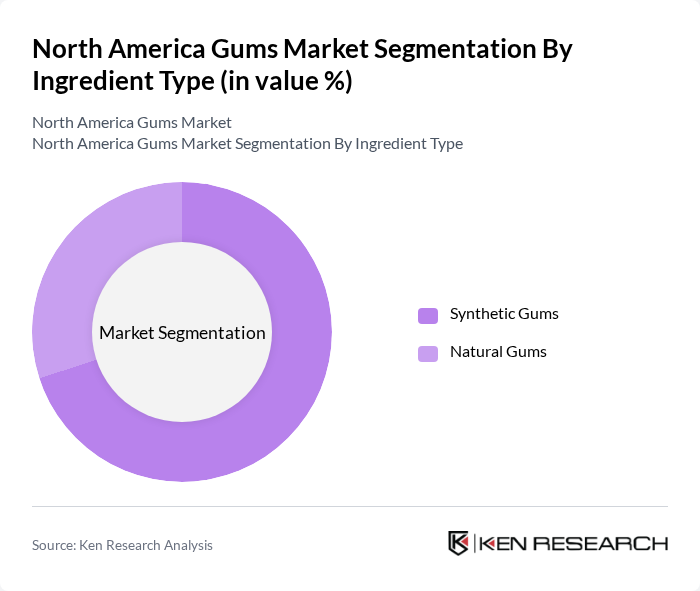

By Ingredient Type:The gums market is also categorized by ingredient type, which includes Synthetic Gums and Natural Gums. Synthetic Gums dominate the market due to their cost-effectiveness and versatility in flavoring. However, Natural Gums are gaining traction as consumers increasingly prefer products made from natural ingredients, reflecting a shift towards healthier options and sustainability. Plant-based and biodegradable gum formulations are emerging as notable trends in response to consumer demand for clean-label and eco-friendly products.

The North America Gums Market is characterized by a dynamic mix of regional and international players. Leading participants such as Wrigley Company (Mars, Incorporated), Mondelez International (Trident, Dentyne), Perfetti Van Melle (Mentos, Chupa Chups), The Hershey Company (Ice Breakers), Ford Gum & Machine Co., Simply Gum, Tootsie Roll Industries (Dubble Bubble), Haribo GmbH & Co. KG, Ferrero Group (Tic Tac), GSK Consumer Healthcare (Nicorette), PUR Company Inc., CANDYRIFIC, BUBBLEMATE contribute to innovation, geographic expansion, and service delivery in this space.

The North America gums market is poised for significant growth, driven by evolving consumer preferences and technological advancements. The increasing focus on health and wellness will likely lead to a surge in demand for functional and natural gum products. Additionally, the rise of e-commerce platforms is expected to enhance product accessibility, allowing manufacturers to reach a broader audience. As sustainability becomes a priority, companies will need to adopt eco-friendly practices to remain competitive in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Chewing Gum Bubble Gum Functional Gum Energy Gum Sugar-Free Gum Others |

| By Ingredient Type | Synthetic Gums Natural Gums |

| By End-User | Retail Consumers Food Service Industry Healthcare Sector Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores Others |

| By Flavor | Mint Fruit Herbal Cinnamon Chamoy Others |

| By Packaging Type | Pouches Bottles Blister Packs Others |

| By Price Range | Economy Mid-Range Premium |

| By Region | United States Canada Mexico Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 100 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceutical Companies | 60 | Formulation Scientists, Regulatory Affairs Managers |

| Cosmetics and Personal Care Brands | 40 | Brand Managers, R&D Directors |

| Gum Suppliers and Distributors | 50 | Sales Managers, Supply Chain Coordinators |

| Market Research Analysts | 40 | Market Analysts, Industry Consultants |

The North America Gums Market is valued at approximately USD 4.75 billion, reflecting a significant growth trend driven by consumer demand for innovative and functional gum products, particularly sugar-free options.