Region:North America

Author(s):Geetanshi

Product Code:KRAD0098

Pages:88

Published On:August 2025

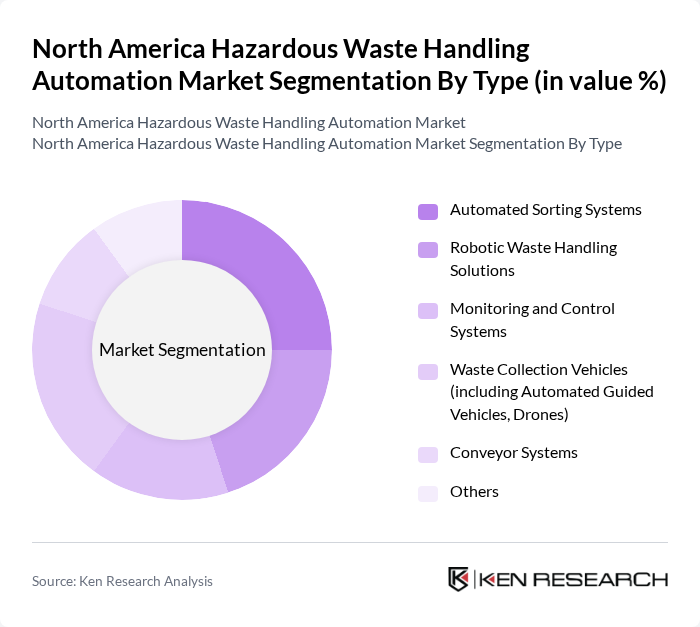

By Type:The market is segmented into various types of automation solutions that cater to hazardous waste handling. Key subsegments include Automated Sorting Systems, Robotic Waste Handling Solutions, Monitoring and Control Systems, Waste Collection Vehicles (including Automated Guided Vehicles, Drones), Conveyor Systems, and Others. Each of these subsegments plays a vital role in enhancing the efficiency and safety of hazardous waste management processes .

The Automated Sorting Systems subsegment is currently leading the market due to the increasing demand for efficient waste segregation and recycling processes. These systems utilize advanced technologies such as AI and machine learning to enhance sorting accuracy and speed, thereby reducing operational costs. The growing emphasis on sustainability, resource recovery, and minimizing landfill use is driving industries to adopt automated sorting solutions, making them a preferred choice in hazardous waste management .

By End-User:The hazardous waste handling automation market is segmented by end-user industries, including the Industrial Sector (Manufacturing, Chemical, Pharmaceutical), Healthcare Facilities, Municipalities, Construction and Demolition, and Others. Each of these sectors has unique requirements and challenges, driving the demand for tailored automation solutions .

The Industrial Sector is the dominant end-user in the hazardous waste handling automation market, primarily due to the high volume of hazardous waste generated in manufacturing and chemical processes. These industries are increasingly adopting automation solutions to comply with environmental regulations, improve operational efficiency, and minimize worker exposure to hazardous substances. The need for safe and efficient waste management practices is driving significant investments in automation technologies within this sector .

The North America Hazardous Waste Handling Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Environmental Services, Waste Management, Inc., Republic Services, Inc., Clean Harbors, Inc., Stericycle, Inc., Covanta Holding Corporation, GFL Environmental Inc., SUEZ Recycling and Recovery North America, Advanced Disposal Services, Inc. (now part of Waste Management, Inc.), Casella Waste Systems, Inc., Recology, Inc., Waste Connections, Inc., Tetra Tech, Inc., AECOM, HDR, Inc., PegEx, Inc., Red Technologies, EnviroSmart, EnviroCare contribute to innovation, geographic expansion, and service delivery in this space .

The future of the hazardous waste handling automation market in North America appears promising, driven by increasing investments in sustainable practices and technological innovations. As companies prioritize compliance and efficiency, the integration of smart waste management systems is expected to rise. Furthermore, the focus on data-driven decision-making will enhance operational transparency and accountability, fostering a culture of continuous improvement in waste management practices across various industries.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Sorting Systems Robotic Waste Handling Solutions Monitoring and Control Systems Waste Collection Vehicles (including Automated Guided Vehicles, Drones) Conveyor Systems Others |

| By End-User | Industrial Sector (Manufacturing, Chemical, Pharmaceutical) Healthcare Facilities Municipalities Construction and Demolition Others |

| By Application | Hazardous Waste Treatment Waste Collection and Transportation Waste Disposal Recycling and Recovery E-Waste Management Others |

| By Distribution Channel | Direct Sales Online Sales Distributors and Resellers Others |

| By Region | United States Canada Mexico Others |

| By Compliance Level | Fully Compliant Solutions Partially Compliant Solutions Non-Compliant Solutions |

| By Price Range | Budget Solutions Mid-Range Solutions Premium Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Waste Management | 100 | Plant Managers, Environmental Compliance Officers |

| Healthcare Facility Waste Handling | 70 | Healthcare Administrators, Waste Management Coordinators |

| Construction Industry Hazardous Waste | 60 | Site Managers, Safety Officers |

| Technology Providers for Waste Automation | 50 | Product Managers, Sales Directors |

| Regulatory Compliance in Waste Management | 40 | Regulatory Affairs Specialists, Environmental Consultants |

The North America Hazardous Waste Handling Automation Market is valued at approximately USD 12.1 billion, reflecting significant growth driven by regulatory pressures and advancements in automation technologies.