Region:North America

Author(s):Shubham

Product Code:KRAB0677

Pages:95

Published On:August 2025

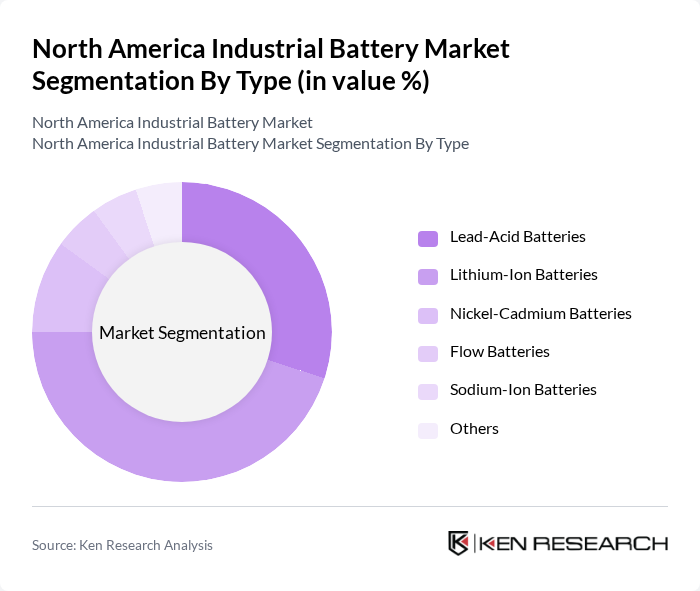

By Type:The North America Industrial Battery Market is segmented into Lead-Acid Batteries, Lithium-Ion Batteries, Nickel-Cadmium Batteries, Flow Batteries, Sodium-Ion Batteries, and Others.Lithium-Ion Batteriesare the leading segment, driven by their high energy density, long life cycle, and declining costs, making them the preferred choice for electric vehicles, renewable energy storage, and critical backup systems.Lead-Acid Batteriesmaintain a significant share due to their reliability and cost-effectiveness in backup power systems, telecom, and material handling equipment.Nickel-Cadmium BatteriesandFlow Batteriesare used in specialized industrial and grid applications, whileSodium-Ion Batteriesare emerging as an alternative for stationary storage .

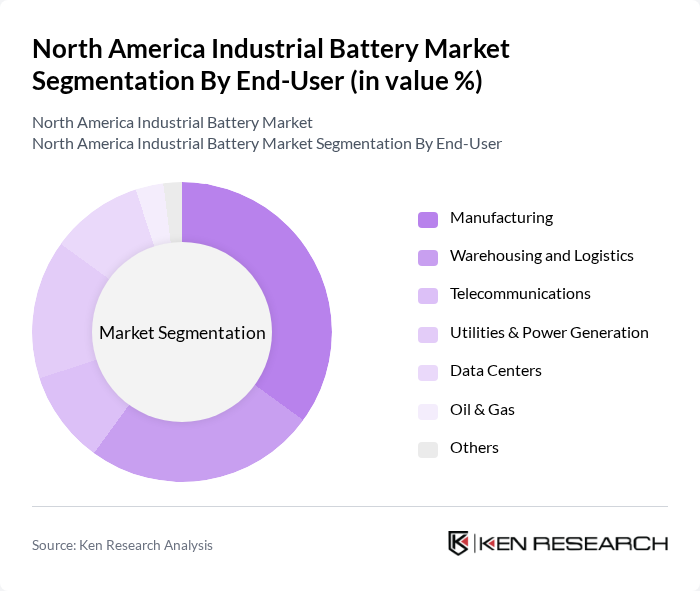

By End-User:The market is segmented by end-user industries, including Manufacturing, Warehousing and Logistics, Telecommunications, Utilities & Power Generation, Data Centers, Oil & Gas, and Others.Manufacturingis the largest end-user, driven by the need for reliable power sources for machinery, robotics, and automation systems.Warehousing and Logisticsis rapidly expanding, fueled by the adoption of electric forklifts and automated guided vehicles (AGVs) requiring efficient battery solutions.TelecommunicationsandData Centersrely on industrial batteries for uninterrupted backup power, whileUtilities & Power Generationincreasingly deploy batteries for grid stabilization and renewable integration.Oil & GasandOther sectorsutilize batteries for remote operations and safety systems .

The North America Industrial Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as EnerSys, East Penn Manufacturing Company, Exide Technologies, Johnson Controls International plc, Panasonic Corporation, LG Energy Solution (LG Chem Ltd.), Saft Groupe S.A., A123 Systems LLC, Duracell Inc., Toshiba Corporation, Samsung SDI Co., Ltd., BYD Company Limited, Contemporary Amperex Technology Co., Limited (CATL), VARTA AG, NorthStar Battery Company, LLC, Crown Battery Manufacturing Company, C&D Technologies, Inc., GS Yuasa Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The North American industrial battery market is poised for significant transformation, driven by technological advancements and increasing regulatory support for clean energy initiatives. As companies invest in innovative battery technologies, the integration of AI in battery management systems is expected to enhance efficiency and performance. Furthermore, the growing emphasis on sustainability will likely lead to increased recycling efforts and the development of second-life battery applications, creating a more circular economy within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Lead-Acid Batteries Lithium-Ion Batteries Nickel-Cadmium Batteries Flow Batteries Sodium-Ion Batteries Others |

| By End-User | Manufacturing Warehousing and Logistics Telecommunications Utilities & Power Generation Data Centers Oil & Gas Others |

| By Application | Backup Power Systems (UPS) Material Handling Equipment (e.g., forklifts) Renewable Energy Storage Electric Vehicles (Industrial/Commercial) Grid Stabilization & Frequency Regulation Others |

| By Distribution Channel | Direct Sales Distributors/Wholesalers Online Sales Retail Others |

| By Region | United States Canada Mexico Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Technology | Smart Batteries Standard Batteries Advanced Battery Management Systems Solid-State Batteries Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Battery Usage | 100 | Operations Managers, Production Supervisors |

| Telecommunications Backup Power Solutions | 60 | Network Engineers, Facility Managers |

| Renewable Energy Storage Applications | 50 | Project Managers, Energy Analysts |

| Automotive Industry Battery Integration | 80 | R&D Engineers, Product Development Managers |

| Logistics and Distribution Battery Needs | 40 | Supply Chain Managers, Logistics Coordinators |

The North America Industrial Battery Market is valued at approximately USD 15 billion, driven by the increasing demand for energy storage solutions, electric vehicles, and advancements in battery technology, particularly lithium-ion and next-generation chemistries.