Region:North America

Author(s):Rebecca

Product Code:KRAD0200

Pages:80

Published On:August 2025

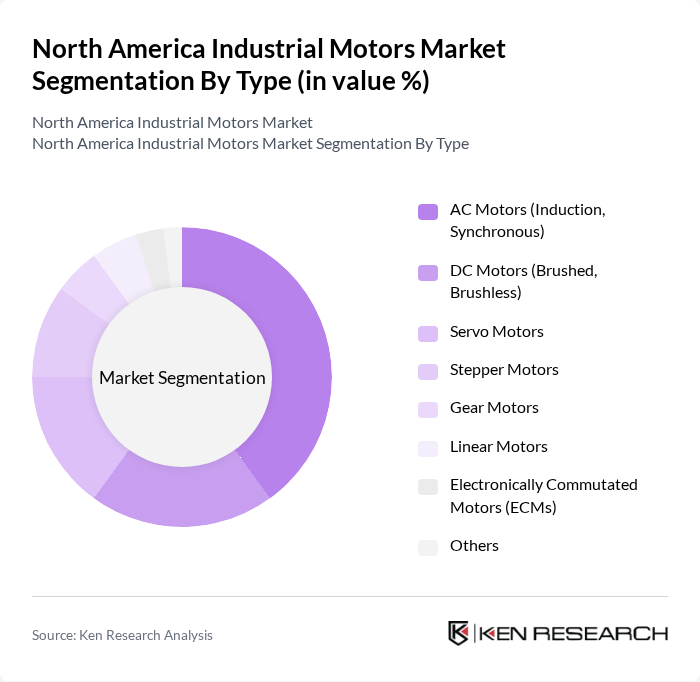

By Type:The market is segmented into various types of motors, including AC Motors, DC Motors, Servo Motors, Stepper Motors, Gear Motors, Linear Motors, Electronically Commutated Motors (ECMs), and Others. Among these, AC Motors, particularly induction motors, dominate the market due to their widespread application in industrial settings. The preference for AC Motors is driven by their reliability, energy efficiency, and lower maintenance costs, making them ideal for manufacturing, processing, and utility applications.

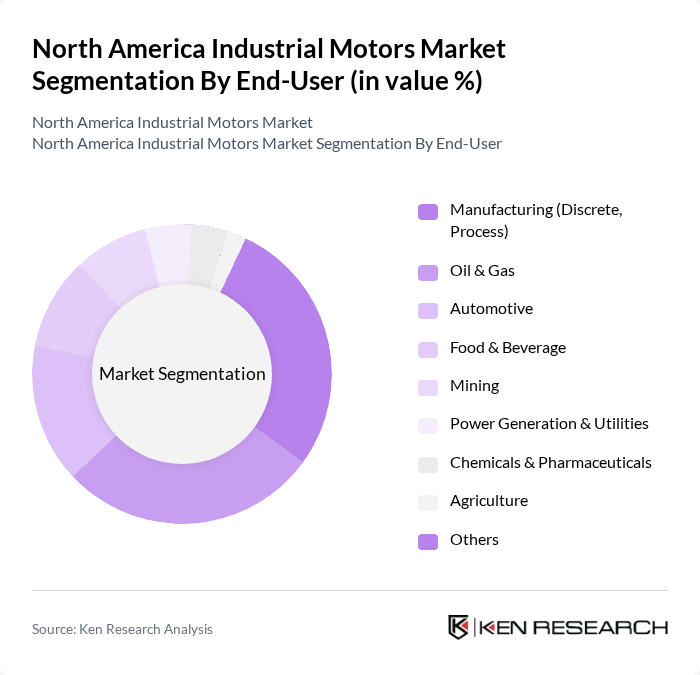

By End-User:The end-user segmentation includes Manufacturing (Discrete, Process), Oil & Gas, Automotive, Food & Beverage, Mining, Power Generation & Utilities, Chemicals & Pharmaceuticals, Agriculture, and Others. The manufacturing sector is the largest end-user of industrial motors, driven by the increasing automation and demand for efficient production processes. The oil & gas sector is also a significant contributor, supported by ongoing investments in shale oil, natural gas, and electrification of upstream operations. The automotive industry continues to adopt advanced motor technologies for assembly lines and robotics.

The North America Industrial Motors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, General Electric Company, ABB Ltd., Rockwell Automation, Inc., Schneider Electric SE, Nidec Corporation, Emerson Electric Co., Mitsubishi Electric Corporation, Baldor Electric Company (A Member of ABB Group), Regal Rexnord Corporation, Parker Hannifin Corporation, Danfoss A/S, Yaskawa Electric Corporation, Toshiba Corporation, WEG S.A., TECO-Westinghouse Motor Company, Franklin Electric Co., Inc., Marathon Electric (A Division of Regal Rexnord), Brook Crompton, Leeson Electric (A Brand of Regal Rexnord) contribute to innovation, geographic expansion, and service delivery in this space.

The North American industrial motors market is poised for transformative growth driven by technological advancements and sustainability initiatives. As industries increasingly adopt smart manufacturing solutions, the integration of IoT technologies will enhance operational efficiency and predictive maintenance capabilities. Furthermore, the shift towards electrification and renewable energy sources will create new opportunities for innovation. In future, the market is expected to witness a significant increase in demand for energy-efficient and smart motor solutions, aligning with broader environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Type | AC Motors (Induction, Synchronous) DC Motors (Brushed, Brushless) Servo Motors Stepper Motors Gear Motors Linear Motors Electronically Commutated Motors (ECMs) Others |

| By End-User | Manufacturing (Discrete, Process) Oil & Gas Automotive Food & Beverage Mining Power Generation & Utilities Chemicals & Pharmaceuticals Agriculture Others |

| By Application | Pumping Systems Conveyor Systems HVAC Systems Material Handling Robotics & Automation Fans & Compressors Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | United States Canada Mexico Others |

| By Price Range | Low-End Motors Mid-Range Motors High-End Motors |

| By Technology | Traditional Motors Smart Motors (IoT-enabled, VFD-integrated) Hybrid Motors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Motors | 100 | Production Managers, Maintenance Supervisors |

| Oil & Gas Industry Applications | 60 | Operations Engineers, Procurement Specialists |

| Renewable Energy Solutions | 50 | Project Managers, Technical Directors |

| HVAC Systems Integration | 40 | Facility Managers, HVAC Technicians |

| Automated Manufacturing Processes | 45 | Automation Engineers, System Integrators |

The North America Industrial Motors Market is valued at approximately USD 7.5 billion, driven by increasing automation demands in manufacturing, oil & gas, and utilities, along with a growing need for energy-efficient solutions.