Region:North America

Author(s):Shubham

Product Code:KRAB0535

Pages:87

Published On:August 2025

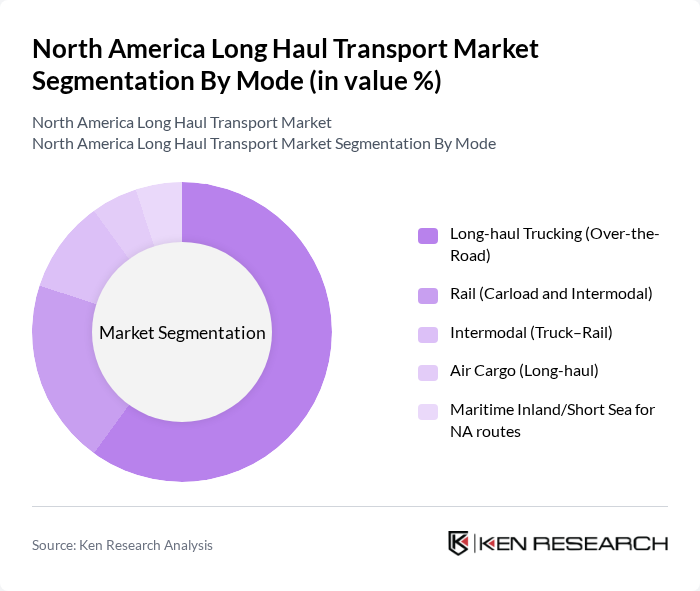

By Mode:The long haul transport market is segmented by mode into various categories, including Long-haul Trucking (Over-the-Road), Rail (Carload and Intermodal), Intermodal (Truck–Rail), Air Cargo (Long-haul), and Maritime Inland/Short Sea for NA routes. Among these, Long-haul Trucking is the most dominant mode due to its flexibility, extensive reach, and ability to transport a wide variety of goods directly to their destinations . Rail transport is also significant—especially for bulk commodities and unit trains—while intermodal services continue to gain traction as shippers blend truck and rail to improve cost and emissions performance .

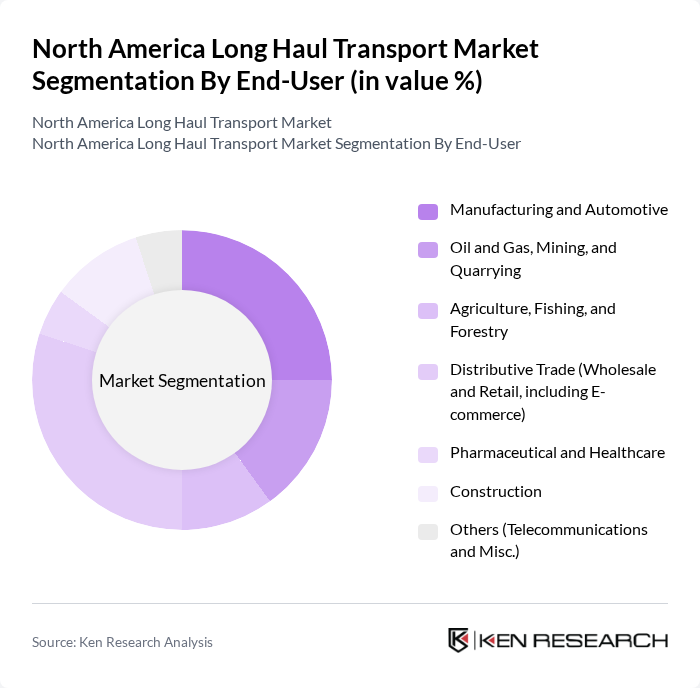

By End-User:The market is also segmented by end-user industries, including Manufacturing and Automotive, Oil and Gas, Mining and Quarrying, Agriculture, Fishing and Forestry, Distributive Trade (Wholesale and Retail, including E-commerce), Pharmaceutical and Healthcare, Construction, and Others (Telecommunications and Misc.). The Distributive Trade sector is the largest end-user, supported by sustained e-commerce growth and retailer logistics optimization across long-haul lanes . Manufacturing and Automotive are also key shippers, relying on time-definite long-haul moves for parts and finished vehicles; temperature-controlled flows in pharma and food continue to expand long-haul refrigerated demand .

The North America Long Haul Transport Market is characterized by a dynamic mix of regional and international players. Leading participants such as J.B. Hunt Transport Services, Inc., Schneider National, Inc., Knight-Swift Transportation Holdings Inc., Werner Enterprises, Inc., XPO, Inc., Landstar System, Inc., Old Dominion Freight Line, Inc., C.H. Robinson Worldwide, Inc., TFI International Inc., Saia, Inc., ArcBest Corporation, Estes Express Lines, R+L Carriers, ABF Freight (ArcBest), FedEx Freight, UPS Supply Chain Solutions, Penske Logistics, Ryder System, Inc., Bison Transport Inc., C.R. England, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The North America long haul transport market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As e-commerce continues to thrive, logistics companies will increasingly adopt automation and data analytics to enhance operational efficiency. Furthermore, sustainability initiatives will shape the industry, with a growing emphasis on reducing carbon footprints through electric and autonomous vehicles. These trends will create a dynamic landscape, fostering innovation and competitive strategies among market players in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Mode | Long-haul Trucking (Over-the-Road) Rail (Carload and Intermodal) Intermodal (Truck–Rail) Air Cargo (Long-haul) Maritime Inland/Short Sea for NA routes |

| By End-User | Manufacturing and Automotive Oil and Gas, Mining, and Quarrying Agriculture, Fishing, and Forestry Distributive Trade (Wholesale and Retail, including E-commerce) Pharmaceutical and Healthcare Construction Others (Telecommunications and Misc.) |

| By Service Type | Full Truckload (FTL) Less Than Truckload (LTL) Dedicated Contract Carriage (DCC) Intermodal Drayage and Linehaul Expedited/Time-definite Refrigerated/Temperature-Controlled |

| By Distribution/Contracting Model | Direct Shipper–Carrier Third-Party Logistics (3PL/Brokerage) Managed Transportation/4PL Freight Forwarding |

| By Fleet Ownership | Owned Fleet Leased Fleet Outsourced/Owner-Operator Network |

| By Cargo Type | Dry Van Bulk and Tank (Liquid/Gas) Reefer (Perishables) Hazardous Materials (HAZMAT) Oversized/Project Cargo |

| By Route | Domestic Cross-border (US–Canada) Cross-border (US–Mexico) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Long-Haul Trucking Operations | 140 | Fleet Managers, Operations Executives |

| Freight Brokerage Services | 90 | Brokerage Owners, Sales Managers |

| Logistics Technology Providers | 80 | Product Managers, IT Directors |

| Regulatory Compliance in Transport | 70 | Compliance Officers, Safety Managers |

| Environmental Impact Assessments | 60 | Sustainability Managers, Environmental Analysts |

The North America Long Haul Transport Market is valued at approximately USD 900 billion, reflecting significant contributions from trucking, rail, intermodal, air cargo, and domestic maritime sectors, driven by e-commerce growth and rising consumer demand.