Region:North America

Author(s):Geetanshi

Product Code:KRAA1266

Pages:92

Published On:August 2025

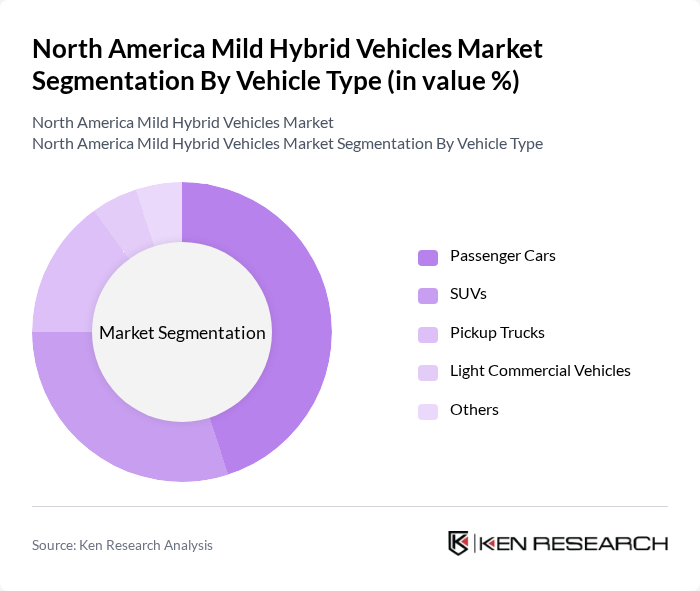

By Vehicle Type:The vehicle type segmentation includes Passenger Cars, SUVs, Pickup Trucks, Light Commercial Vehicles, and Others. Passenger Cars are currently leading the market, driven by individual consumers seeking fuel efficiency and lower emissions. SUVs are also gaining traction as consumers favor larger vehicles that incorporate hybrid technology for improved efficiency. Pickup Trucks maintain strong demand, particularly in North America, where they are preferred for both personal and commercial applications. Light Commercial Vehicles and other segments are experiencing steady growth as businesses seek to reduce fleet emissions .

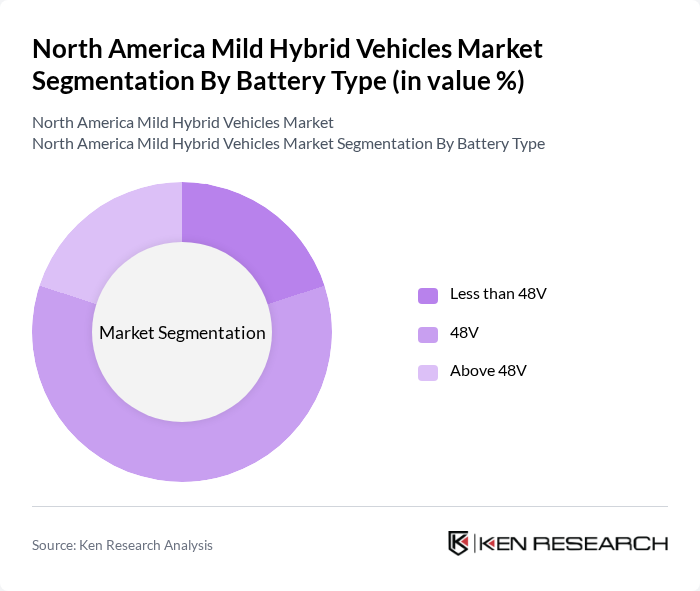

By Battery Type:This segmentation includes Less than 48V, 48V, and Above 48V battery types. The 48V battery type is currently the most popular choice among manufacturers and consumers, as it provides a good balance between performance and cost. Mild hybrid vehicles utilizing 48V systems are increasingly being adopted due to their ability to enhance fuel efficiency without significantly increasing vehicle costs. The demand for batteries above 48V is also growing, particularly in high-performance and luxury models .

The North America Mild Hybrid Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ford Motor Company, General Motors Company, Toyota Motor Corporation, Honda Motor Co., Ltd., Nissan Motor Co., Ltd., BMW AG, Mercedes-Benz Group AG, Hyundai Motor Company, Kia Corporation, Volkswagen AG, Subaru Corporation, Audi AG, Volvo Car Corporation, Mazda Motor Corporation, Stellantis N.V., Suzuki Motor Corporation, Denso Corporation, Robert Bosch GmbH, Continental AG, Magna International Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The North American mild hybrid vehicle market is poised for significant growth, driven by increasing regulatory pressures and evolving consumer preferences. As automakers invest in advanced hybrid technologies, the market is expected to see a rise in vehicle offerings that cater to eco-conscious consumers. Additionally, the expansion of charging infrastructure and partnerships with technology providers will enhance the appeal of mild hybrids. By future, the market is likely to witness a notable shift towards sustainable transportation solutions, aligning with broader environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Passenger Cars SUVs Pickup Trucks Light Commercial Vehicles Others |

| By Battery Type | Less than 48V 48V Above 48V |

| By End-User | Individual Consumers Fleet Operators Government Agencies |

| By Sales Channel | Direct Sales Dealerships Online Platforms |

| By Distribution Mode | Retail Wholesale |

| By Price Range | Budget Mid-Range Premium |

| By Component | Battery Electric Motor Control System Power Electronics |

| By Application | Personal Use Commercial Use Government Use |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Mild Hybrids | 120 | Car Owners, Prospective Buyers |

| Fleet Management Insights | 60 | Fleet Managers, Procurement Officers |

| Automotive Dealer Perspectives | 50 | Dealership Owners, Sales Managers |

| Regulatory Impact Assessment | 40 | Policy Makers, Environmental Analysts |

| Technological Adoption Trends | 45 | Automotive Engineers, R&D Managers |

The North America Mild Hybrid Vehicles Market is valued at approximately USD 100 billion, driven by consumer demand for fuel-efficient vehicles, advancements in hybrid technology, and government incentives aimed at reducing carbon emissions.