Region:North America

Author(s):Rebecca

Product Code:KRAA1475

Pages:90

Published On:August 2025

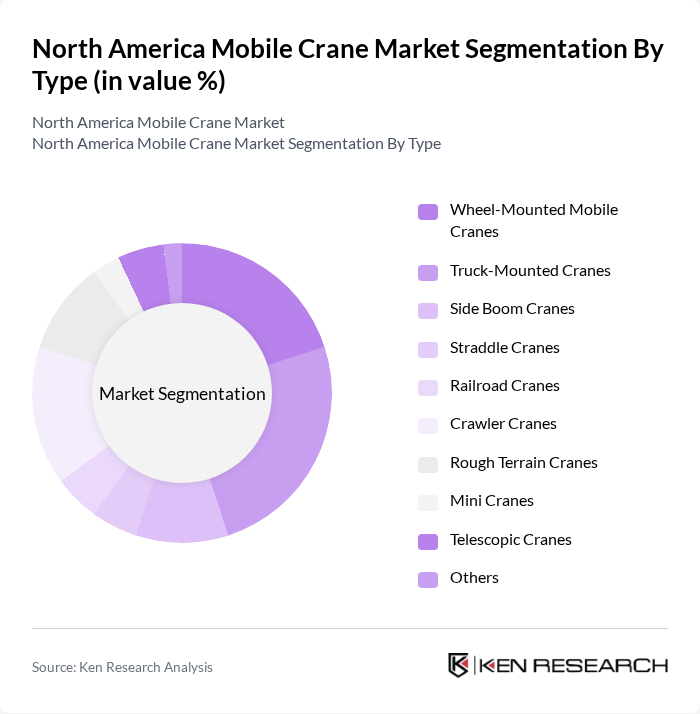

By Type:The mobile crane market is segmented into Wheel-Mounted Mobile Cranes, Truck-Mounted Cranes, Side Boom Cranes, Straddle Cranes, Railroad Cranes, Crawler Cranes, Rough Terrain Cranes, Mini Cranes, Telescopic Cranes, and Others. Each type is tailored for specific lifting and transport applications across construction, industrial, and infrastructure projects, with advanced models increasingly integrating automation, telematics, and environmentally friendly features .

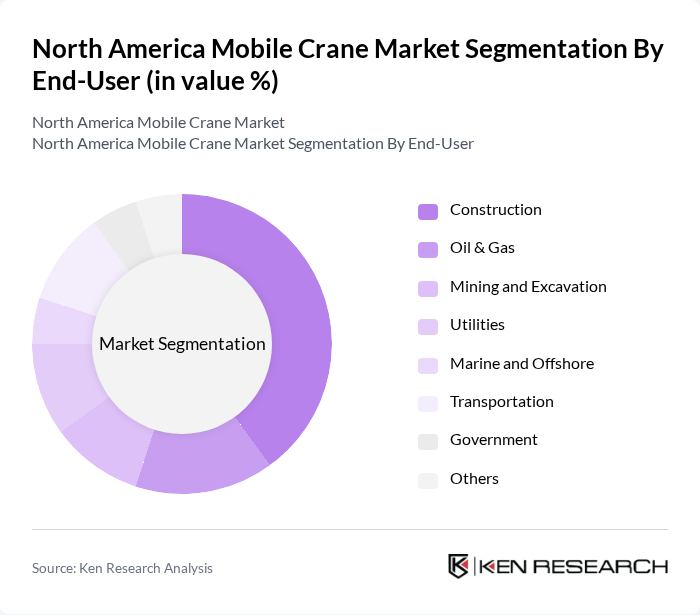

By End-User:The mobile crane market is segmented by end-user industries, including Construction, Oil & Gas, Mining and Excavation, Utilities, Marine and Offshore, Transportation, Government, and Others. The construction sector remains the largest consumer, driven by ongoing urban development and infrastructure upgrades. Oil & Gas, mining, and utilities also represent significant demand centers, leveraging mobile cranes for complex lifting and installation tasks in challenging environments .

The North America Mobile Crane Market is characterized by a dynamic mix of regional and international players. Leading participants such as Manitowoc Company, Inc., Terex Corporation, Liebherr Group, Tadano Ltd., SANY Group, XCMG Group, JLG Industries, Inc., Altec Industries, Inc., Link-Belt Cranes, LLC, Zoomlion Heavy Industry Science & Technology Co., Ltd., Konecranes Plc, Broderson Manufacturing Corp., National Crane, Manitex International, Inc., Elliott Equipment Company contribute to innovation, geographic expansion, and service delivery in this space.

The North American mobile crane market is poised for transformative growth, driven by increasing infrastructure investments and technological advancements. As urbanization accelerates, the demand for efficient lifting solutions will rise, particularly in renewable energy and construction sectors. Companies are expected to adopt smart technologies, enhancing operational efficiency and safety. Furthermore, the trend towards sustainability will likely influence equipment design and operational practices, aligning with environmental regulations and consumer preferences for eco-friendly solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Wheel-Mounted Mobile Cranes Truck-Mounted Cranes Side Boom Cranes Straddle Cranes Railroad Cranes Crawler Cranes Rough Terrain Cranes Mini Cranes Telescopic Cranes Others |

| By End-User | Construction Oil & Gas Mining and Excavation Utilities Marine and Offshore Transportation Government Others |

| By Application | Lifting Hoisting Material Handling Demolition Installation Others |

| By Sales Channel | Direct Sales Distributors Online Sales Rental Services Others |

| By Distribution Mode | Retail Wholesale E-commerce Direct Delivery Others |

| By Price Range | Low-End Cranes Mid-Range Cranes High-End Cranes |

| By Region | United States Canada Mexico Rest of North America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Mobile Crane Usage | 100 | Project Managers, Site Supervisors |

| Heavy Equipment Rental Companies | 60 | Rental Fleet Managers, Business Development Executives |

| Infrastructure Development Projects | 50 | Contractors, Civil Engineers |

| Safety Compliance in Crane Operations | 40 | Safety Officers, Compliance Managers |

| Technological Adoption in Crane Operations | 40 | Innovation Managers, Equipment Engineers |

The North America Mobile Crane Market is valued at approximately USD 19.6 billion, driven by increased construction and infrastructure projects, along with advancements in crane technology that enhance operational efficiency and safety.