Region:North America

Author(s):Dev

Product Code:KRAB0322

Pages:98

Published On:August 2025

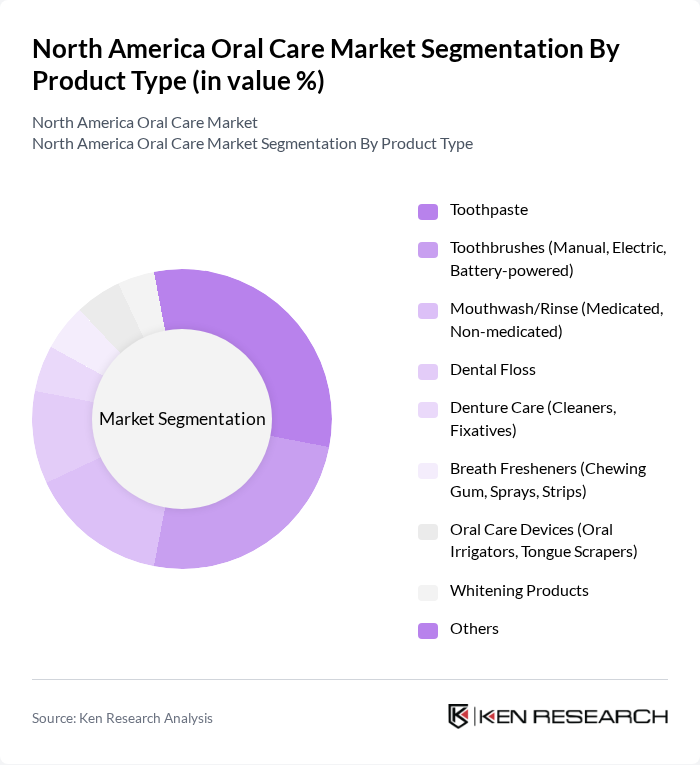

By Product Type:The oral care market is segmented into various product types, including toothpaste, toothbrushes (manual, electric, battery-powered), mouthwash/rinse (medicated, non-medicated), dental floss, denture care (cleaners, fixatives), breath fresheners (chewing gum, sprays, strips), oral care devices (oral irrigators, tongue scrapers), whitening products, and others. Among these, toothpaste is the leading sub-segment due to its essential role in daily oral hygiene routines, with consumers increasingly opting for specialized formulations that cater to specific dental needs. Toothpaste accounted for the largest revenue share among product types, reflecting strong consumer preference for products targeting sensitivity, whitening, and natural ingredients.

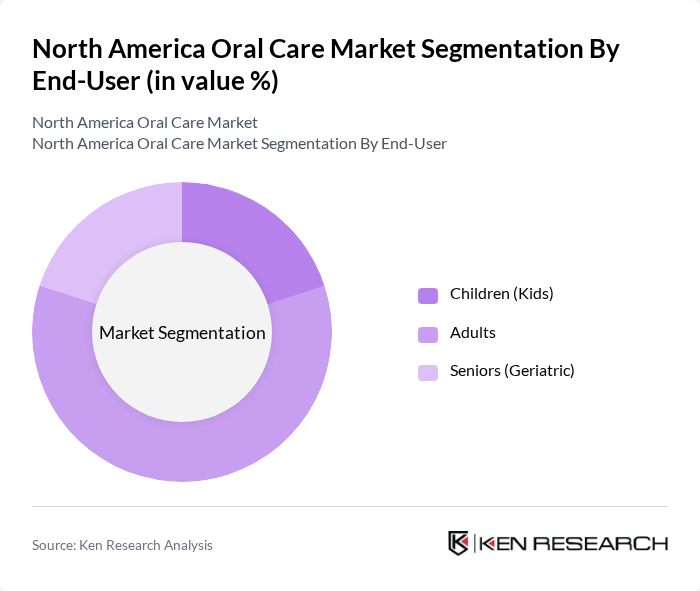

By End-User:The market is segmented by end-user demographics, including children (kids), adults, and seniors (geriatric). Adults represent the largest segment, driven by a growing focus on oral health and aesthetics. This demographic is increasingly investing in premium oral care products, including whitening solutions and advanced toothbrushes, reflecting a trend towards maintaining a healthy and attractive smile.

The North America Oral Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co., Colgate-Palmolive Company, Johnson & Johnson, Unilever PLC, GlaxoSmithKline PLC, Henkel AG & Co. KGaA, Church & Dwight Co., Inc., Kimberly-Clark Corporation, Oral-B (a subsidiary of Procter & Gamble), Crest (a brand of Procter & Gamble), Philips Sonicare (Koninklijke Philips N.V.), Tom's of Maine (a subsidiary of Colgate-Palmolive), Sensodyne (a brand of GlaxoSmithKline), Biotene (a brand of Haleon, formerly GSK), Listerine (a brand of Johnson & Johnson), Waterpik (a brand of Church & Dwight Co., Inc.), Hello Products LLC (a subsidiary of Colgate-Palmolive), Arm & Hammer (a brand of Church & Dwight Co., Inc.), CloSYS (Rowpar Pharmaceuticals Inc.), Dr. Fresh LLC contribute to innovation, geographic expansion, and service delivery in this space.

The North American oral care market is poised for transformative growth driven by evolving consumer preferences and technological advancements. As the demand for personalized oral care solutions rises, companies are increasingly investing in innovative product development. Additionally, the expansion of e-commerce platforms is expected to enhance product accessibility, allowing consumers to explore a wider range of options. Sustainability initiatives will also play a crucial role, as brands focus on eco-friendly packaging and natural ingredients to meet consumer expectations in the future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Toothpaste Toothbrushes (Manual, Electric, Battery-powered) Mouthwash/Rinse (Medicated, Non-medicated) Dental Floss Denture Care (Cleaners, Fixatives) Breath Fresheners (Chewing Gum, Sprays, Strips) Oral Care Devices (Oral Irrigators, Tongue Scrapers) Whitening Products Others |

| By End-User | Children (Kids) Adults Seniors (Geriatric) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Pharmacies and Drug Stores Online Retail Stores Other Distribution Channels |

| By Application | Home Dentistry (Dental Clinics, Professional Use) |

| By Product Formulation | Fluoride-based Non-fluoride Herbal |

| By Price Range | Premium Mid-range Economy |

| By Brand Loyalty | Established Brands New Entrants |

| By Packaging Type | Tube Bottle Box Others |

| By Country | United States Canada Mexico Rest of North America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Oral Care Product Usage | 150 | General Consumers, Age 18-65 |

| Dental Professional Insights | 80 | Dentists, Dental Hygienists |

| Retailer Perspectives on Oral Care | 60 | Pharmacy Managers, Grocery Store Buyers |

| Market Trends and Innovations | 50 | Product Development Managers, Marketing Executives |

| Consumer Attitudes towards Oral Health | 120 | Health-Conscious Consumers, Parents |

The North America Oral Care Market is valued at approximately USD 13.9 billion, reflecting a significant growth driven by increased consumer awareness of oral hygiene and rising dental care spending.