Region:North America

Author(s):Dev

Product Code:KRAB0673

Pages:94

Published On:August 2025

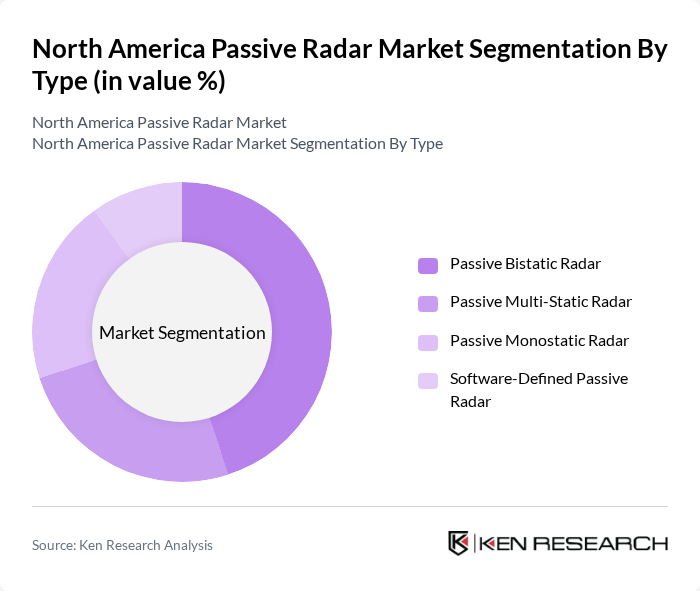

By Type:The market is segmented into four types: Passive Bistatic Radar, Passive Multi-Static Radar, Passive Monostatic Radar, and Software-Defined Passive Radar. Among these, Passive Bistatic Radar is currently leading the market due to its ability to utilize existing communication signals for detection, making it cost-effective and efficient. The increasing demand for surveillance in military and civil applications drives the adoption of this technology, while the other types are also gaining traction as they offer unique advantages in specific scenarios. Software-defined passive radar systems are gaining popularity due to their flexibility and adaptability, while multi-static systems are preferred for applications requiring enhanced coverage and accuracy.

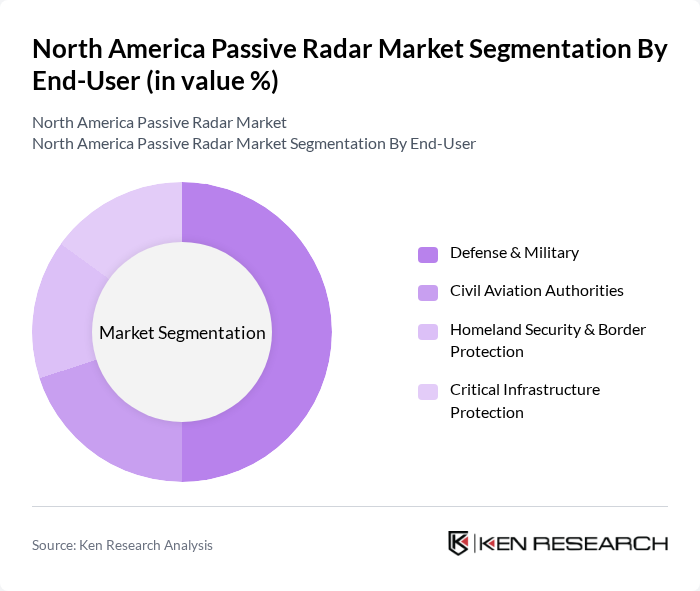

By End-User:The end-user segmentation includes Defense & Military, Civil Aviation Authorities, Homeland Security & Border Protection, and Critical Infrastructure Protection. The Defense & Military segment holds the largest share, driven by the increasing need for advanced surveillance systems and reconnaissance capabilities. The growing focus on national security and border protection initiatives further enhances the demand for passive radar systems in these sectors, while civil aviation authorities are also increasingly adopting these technologies for air traffic management. Critical infrastructure protection is emerging as a key application area, with passive radar systems being deployed for monitoring and securing energy, transportation, and communication networks.

The North America Passive Radar Market is characterized by a dynamic mix of regional and international players. Leading participants such as SRC, Inc., HENSOLDT AG, ERA a.s. (Omnipol Group), RTX Corporation (formerly Raytheon Technologies), Lockheed Martin Corporation, Leonardo S.p.A., Thales Group, Indra Sistemas, S.A., L3Harris Technologies, Inc., General Dynamics Corporation, Saab AB, Elbit Systems Ltd., BAE Systems plc, Raytheon BBN Technologies, Rockwell Collins, Inc. (Collins Aerospace) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the North American passive radar market appears promising, driven by technological advancements and increasing security demands. As organizations recognize the advantages of passive radar systems, including reduced operational costs and enhanced stealth capabilities, adoption rates are expected to rise. Furthermore, collaborations between government and private sectors will likely foster innovation, leading to the development of more sophisticated radar solutions that meet evolving security challenges in both defense and civilian applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Passive Bistatic Radar Passive Multi-Static Radar Passive Monostatic Radar Software-Defined Passive Radar |

| By End-User | Defense & Military Civil Aviation Authorities Homeland Security & Border Protection Critical Infrastructure Protection |

| By Application | Air Traffic Control & Management Military Surveillance & Reconnaissance Border & Coastal Surveillance Weather Monitoring |

| By Component | Antenna Systems Receivers & Signal Processors Software & Analytics Services (Integration, Maintenance) |

| By Sales Channel | Direct Government Contracts Defense Contractors/Integrators Distributors & VARs |

| By Distribution Mode | Domestic Distribution Cross-Border/Export Distribution |

| By Policy Support | Government R&D Funding Defense Modernization Programs Public-Private Partnerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Applications of Passive Radar | 120 | Defense Analysts, Military Procurement Officers |

| Civil Surveillance Systems | 90 | City Planners, Law Enforcement Officials |

| Commercial Use Cases | 60 | Security System Integrators, Facility Managers |

| Research and Development in Radar Technology | 50 | R&D Engineers, Technology Innovators |

| Market Trends and Future Outlook | 70 | Industry Experts, Market Analysts |

The North America Passive Radar Market is valued at approximately USD 1.5 billion, driven by advancements in radar technology and increasing demand for surveillance systems in defense and civil aviation sectors.