Region:North America

Author(s):Dev

Product Code:KRAB0650

Pages:96

Published On:August 2025

Market.png)

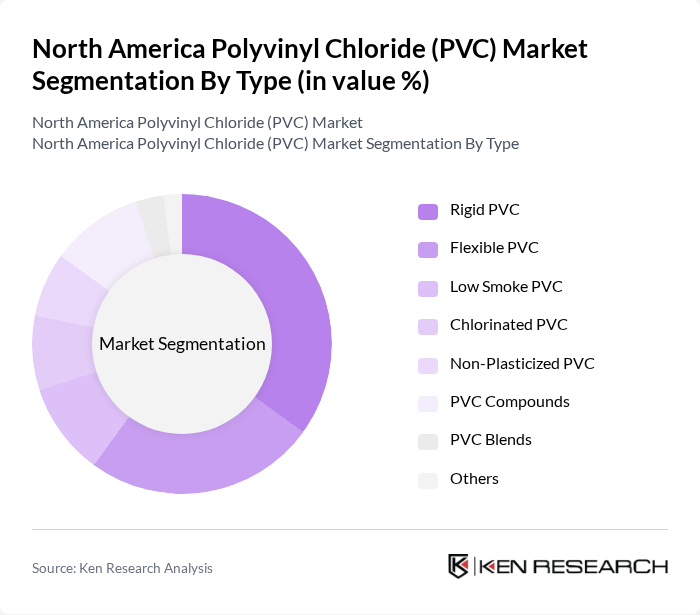

By Type:The PVC market is segmented into various types, including Rigid PVC, Flexible PVC, Low Smoke PVC, Chlorinated PVC, Non-Plasticized PVC, PVC Compounds, PVC Blends, and Others. Rigid PVC is widely used in construction for pipes, window profiles, and fittings due to its high strength, weather resistance, and durability. Flexible PVC is favored in applications requiring flexibility, such as electrical cables, flooring, and automotive interiors. The demand for Low Smoke PVC is increasing in construction and automotive sectors due to its enhanced fire safety and low emission characteristics. Chlorinated PVC is utilized in applications requiring high chemical resistance, such as industrial piping. Non-Plasticized PVC is increasingly used in the healthcare sector for medical devices and pharmaceutical packaging. PVC Compounds and Blends are tailored for diverse applications, offering improved performance, processability, and versatility .

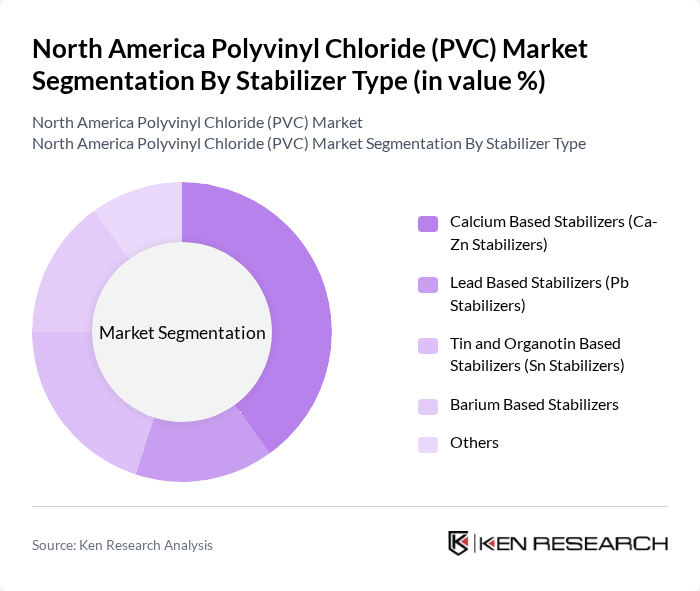

By Stabilizer Type:The market is also segmented by stabilizer type, including Calcium Based Stabilizers (Ca-Zn Stabilizers), Lead Based Stabilizers (Pb Stabilizers), Tin and Organotin Based Stabilizers (Sn Stabilizers), Barium Based Stabilizers, and Others. Calcium-based stabilizers are increasingly preferred due to their environmental benefits and compliance with evolving regulatory standards. Lead-based stabilizers are being rapidly phased out due to health and environmental concerns, while tin-based stabilizers are used in specialized applications such as food contact and potable water pipes. Barium-based stabilizers are utilized for their cost-effectiveness and performance in certain flexible PVC applications. The transition toward safer alternatives is driving innovation in stabilizer formulations and supporting the adoption of sustainable PVC products .

The North America Polyvinyl Chloride (PVC) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Westlake Corporation, OxyVinyls, LP (Occidental Petroleum Corporation), Shintech Inc. (Shin-Etsu Chemical Co., Ltd.), Formosa Plastics Corporation, U.S.A., The Chemours Company, INEOS Group Holdings S.A., Solvay S.A., BASF SE, DuPont de Nemours, Inc., LG Chem Ltd., Evonik Industries AG, SABIC, Reliance Industries Limited, A. Schulman, Inc. (now part of LyondellBasell Industries), Kraton Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The North American PVC market is poised for growth, driven by increasing demand in construction and a shift towards sustainable practices. As the construction sector continues to expand, particularly in urban areas, the need for durable and eco-friendly materials will rise. Additionally, advancements in recycling technologies and the integration of smart building solutions are expected to create new avenues for PVC applications. These trends indicate a promising future for the PVC market, with opportunities for innovation and sustainability at the forefront.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid PVC Flexible PVC Low Smoke PVC Chlorinated PVC Non-Plasticized PVC PVC Compounds PVC Blends Others |

| By Stabilizer Type | Calcium Based Stabilizers (Ca-Zn Stabilizers) Lead Based Stabilizers (Pb Stabilizers) Tin and Organotin Based Stabilizers (Sn Stabilizers) Barium Based Stabilizers Others |

| By Application | Pipes and Fittings Films and Sheets Wires and Cables Bottles Profiles, Hoses, and Tubings Coatings Others |

| By End-User | Building and Construction Automotive Electrical & Electronics Packaging Healthcare Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Region | United States Canada Mexico Others |

| By Price Range | Low Medium High |

| By Product Form | Granules Sheets Films Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry PVC Usage | 120 | Project Managers, Procurement Officers |

| Automotive PVC Applications | 90 | Product Development Engineers, Supply Chain Managers |

| Healthcare PVC Products | 60 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Consumer Goods Packaging | 50 | Marketing Managers, Product Managers |

| Recycling and Sustainability Initiatives | 40 | Sustainability Officers, Environmental Compliance Managers |

The North America Polyvinyl Chloride (PVC) Market is valued at approximately USD 13.5 billion, driven by demand in construction, automotive, and packaging industries, as well as the increasing adoption of sustainable materials.