Region:North America

Author(s):Geetanshi

Product Code:KRAB0052

Pages:94

Published On:August 2025

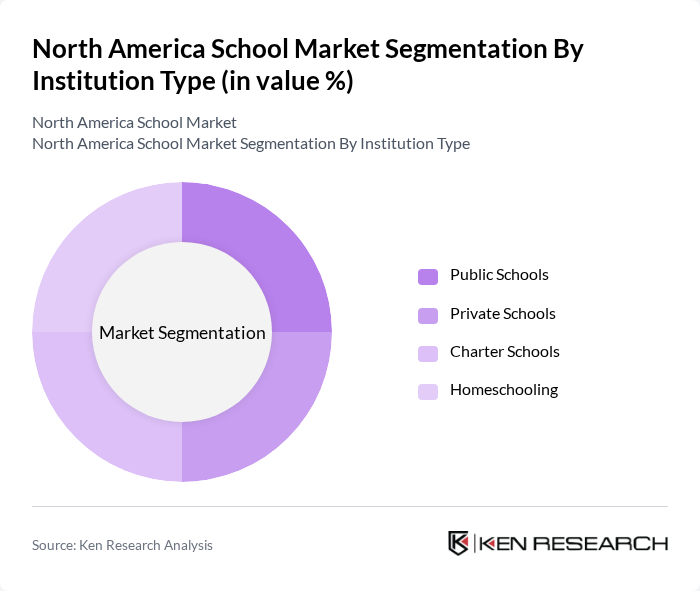

By Institution Type:The North America School Market is segmented into public schools, private schools, charter schools, and homeschooling. Public schools remain the dominant segment due to their accessibility and government funding, serving the majority of K-12 students in the region. Private schools and charter schools continue to grow, driven by demand for specialized curricula and flexible learning environments. Homeschooling has seen increased adoption, particularly during and after the pandemic, as families seek personalized education and digital resources .

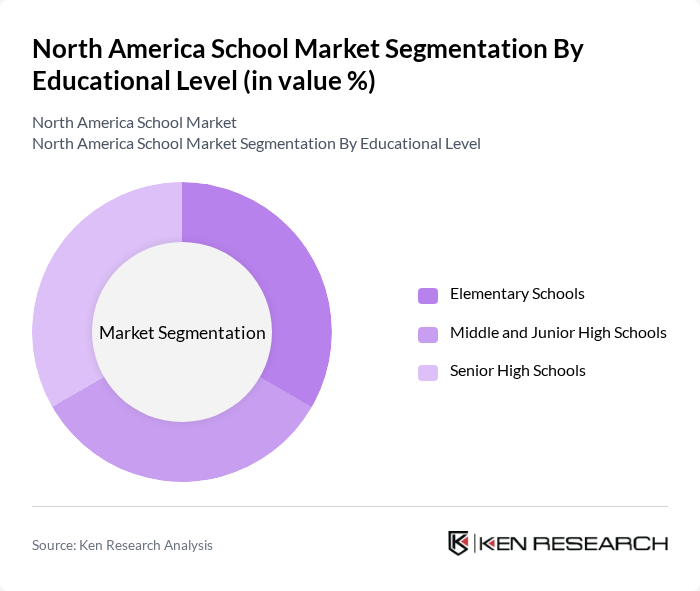

By Educational Level:The market is also segmented by educational levels, including elementary schools, middle and junior high schools, and senior high schools. Elementary schools account for the largest share, reflecting the foundational nature of early education and the high enrollment in primary grades. Middle and junior high schools represent the next largest segment, focusing on transitional education, while senior high schools are critical for preparing students for higher education and career readiness. There is a growing emphasis on early childhood and foundational education, further supporting the expansion of elementary school offerings .

The North America School Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pearson Education, McGraw Hill, Houghton Mifflin Harcourt, Scholastic Corporation, Cengage Group, Discovery Education, Edmentum, Stride, Inc. (formerly K12 Inc.), Blackboard Inc., DreamBox Learning, ClassDojo, Seesaw Learning, Inc., Nearpod, Instructure (Canvas LMS), and Kahoot! contribute to innovation, geographic expansion, and service delivery in this space .

The North American school market is poised for transformative changes driven by technological integration and evolving educational needs. As schools increasingly adopt hybrid learning models, the demand for digital resources and training will rise. Additionally, the focus on mental health and well-being in educational settings is expected to grow, prompting schools to invest in comprehensive support systems. These trends will shape the future landscape, fostering innovation and enhancing student engagement across the region.

| Segment | Sub-Segments |

|---|---|

| By Institution Type | Public Schools Private Schools Charter Schools Homeschooling |

| By Educational Level | Elementary Schools Middle and Junior High Schools Senior High Schools |

| By Product/Service | Textbooks & Print Materials Digital Learning Tools & Educational Software Classroom Supplies & Furniture Extracurricular & Supplemental Materials |

| By Subject Area | Mathematics Science Language Arts Social Studies STEM/STEAM |

| By Sales Channel | Direct Institutional Sales Online Retail & E-commerce Distributors & Wholesalers Educational Conferences & Events |

| By Geography | United States Canada Mexico |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 School Administrators | 100 | Superintendents, Principals, District Officials |

| Higher Education Institutions | 80 | Deans, Department Heads, Admissions Officers |

| Educational Technology Providers | 40 | Product Managers, Sales Directors, Tech Support Leads |

| Parents of School-Aged Children | 120 | Parents, Guardians, PTA Members |

| Students in K-12 and Higher Education | 90 | High School Students, College Undergraduates |

The North America School Market is valued at approximately USD 44 billion, reflecting a significant growth trend driven by increasing enrollment rates, the adoption of digital learning tools, and a focus on STEM and STEAM education within the K-12 sector.