Region:North America

Author(s):Shubham

Product Code:KRAB0747

Pages:98

Published On:August 2025

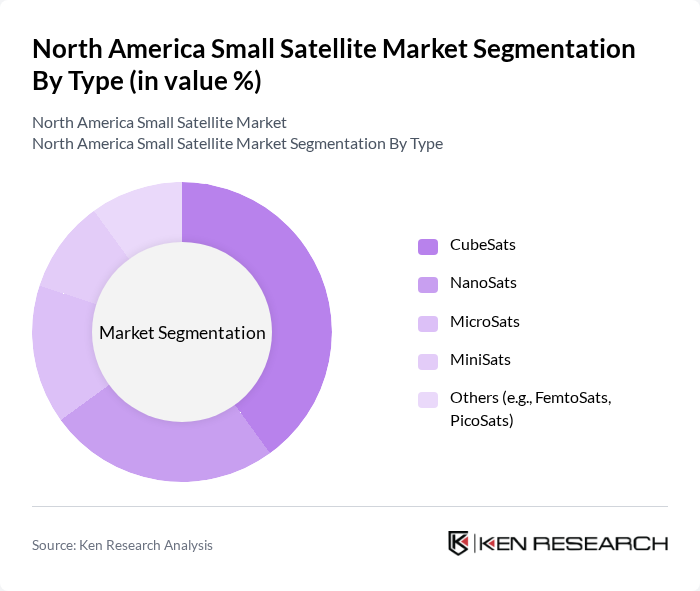

By Type:The small satellite market can be segmented into CubeSats, NanoSats, MicroSats, MiniSats, and others such as FemtoSats and PicoSats. Among these, CubeSats have emerged as the dominant sub-segment due to their compact size, standardized form factor, and cost-effectiveness, making them ideal for educational, research, and commercial applications. The increasing adoption of CubeSats for earth observation, remote sensing, and communication—especially in large-scale constellation deployments—has significantly contributed to their market leadership .

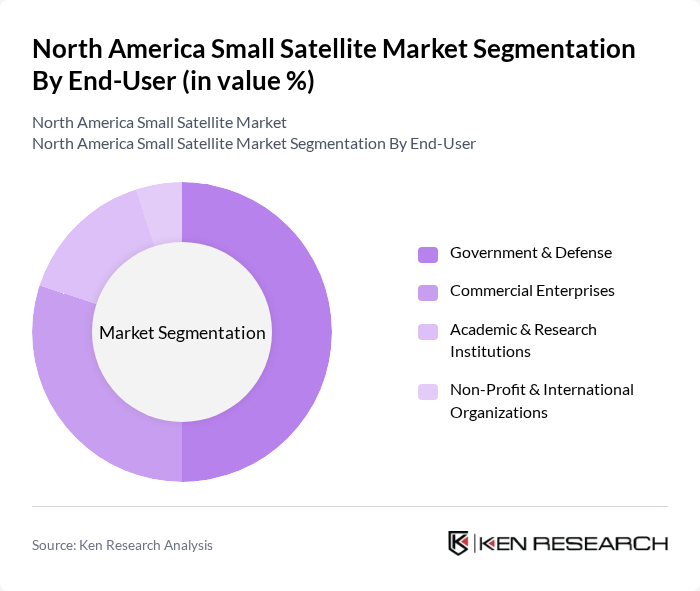

By End-User:The small satellite market is segmented by end-users, including Government & Defense, Commercial Enterprises, Academic & Research Institutions, and Non-Profit & International Organizations. The Government & Defense sector is the leading end-user, driven by the increasing need for surveillance, reconnaissance, secure communications, and real-time earth observation. Heightened focus on national security, disaster response, and intelligence gathering has propelled government investments in small satellite technologies, while commercial enterprises are rapidly expanding their use for connectivity, remote sensing, and IoT applications .

The North America Small Satellite Market is characterized by a dynamic mix of regional and international players. Leading participants such as Planet Labs PBC, Spire Global, Inc., Rocket Lab USA, Inc., Northrop Grumman Corporation, Maxar Technologies Inc., Blue Canyon Technologies, LLC, Terran Orbital Corporation (Tyvak Nano-Satellite Systems, Inc.), Satellogic Inc., OneWeb Ltd., SES S.A., Airbus Defence and Space, The Boeing Company, Lockheed Martin Corporation, Inmarsat Global Limited, Surrey Satellite Technology Limited, Space Exploration Technologies Corp. (SpaceX), Raytheon Technologies (Millennium Space Systems), Telesat Canada, Starlink Canada (SpaceX) contribute to innovation, geographic expansion, and service delivery in this space.

The North American small satellite market is poised for significant evolution, driven by technological advancements and increasing applications across various sectors. The integration of artificial intelligence in satellite operations is expected to enhance data processing capabilities, leading to more efficient satellite management. Furthermore, the growing emphasis on sustainability will likely push companies to adopt eco-friendly practices in satellite manufacturing and operations, aligning with global environmental goals and attracting investment in innovative solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | CubeSats NanoSats MicroSats MiniSats Others (e.g., FemtoSats, PicoSats) |

| By End-User | Government & Defense Commercial Enterprises Academic & Research Institutions Non-Profit & International Organizations |

| By Application | Earth Observation & Remote Sensing Communication & Connectivity Scientific Research & Technology Demonstration Navigation & Surveillance |

| By Orbit Class | Low Earth Orbit (LEO) Medium Earth Orbit (MEO) Geostationary Orbit (GEO) |

| By Launch Method | Dedicated Launch Ride-Share Launch Secondary Payload Launch |

| By Payload Capacity | Less than 10 kg kg to 50 kg kg to 500 kg |

| By Distribution Channel | Direct Sales Online Sales Partnerships with Launch Providers |

| By Propulsion Type | Chemical Propulsion Electric Propulsion Hybrid Propulsion |

| By Policy Support | Government Grants Tax Incentives Research Funding Public-Private Partnerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Small Satellite Manufacturers | 100 | CEOs, Product Development Managers |

| Satellite Service Providers | 80 | Operations Managers, Business Development Executives |

| Aerospace Research Institutions | 60 | Lead Researchers, Program Directors |

| Government Space Agencies | 40 | Policy Makers, Project Managers |

| End-Users in Agriculture and Environmental Monitoring | 70 | Data Analysts, Project Coordinators |

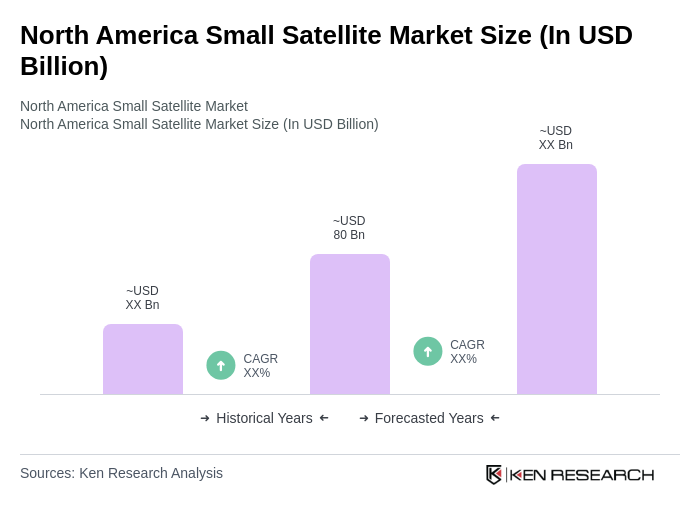

The North America Small Satellite Market is valued at approximately USD 80 billion, driven by advancements in satellite miniaturization, the proliferation of satellite constellations, and increasing demand for applications such as earth observation and communication across various sectors.