Region:North America

Author(s):Shubham

Product Code:KRAA1783

Pages:85

Published On:August 2025

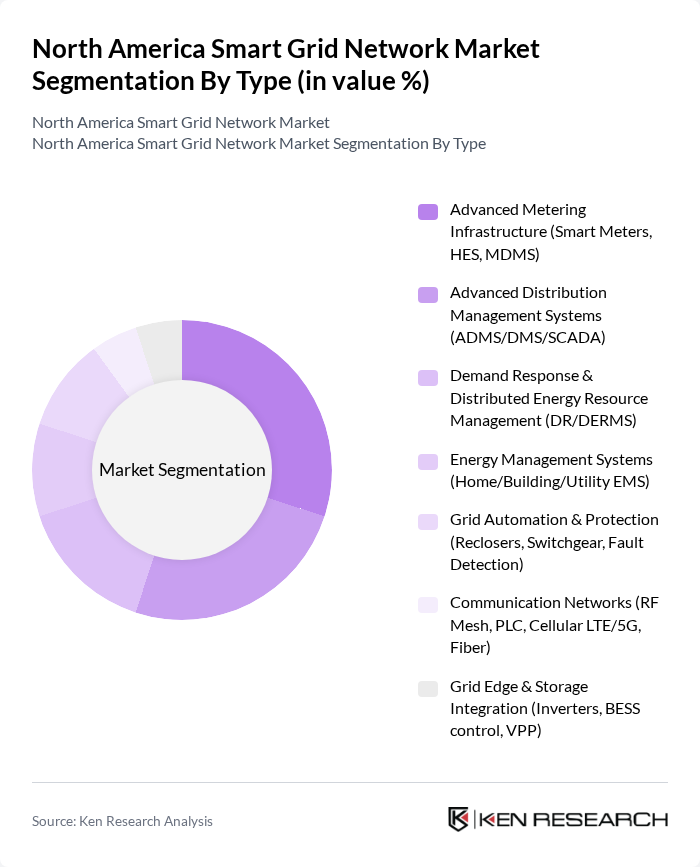

By Type:The market is segmented into various types, including Advanced Metering Infrastructure, Advanced Distribution Management Systems, Demand Response & Distributed Energy Resource Management, Energy Management Systems, Grid Automation & Protection, Communication Networks, and Grid Edge & Storage Integration. Each of these segments plays a crucial role in enhancing the efficiency and reliability of the power grid.

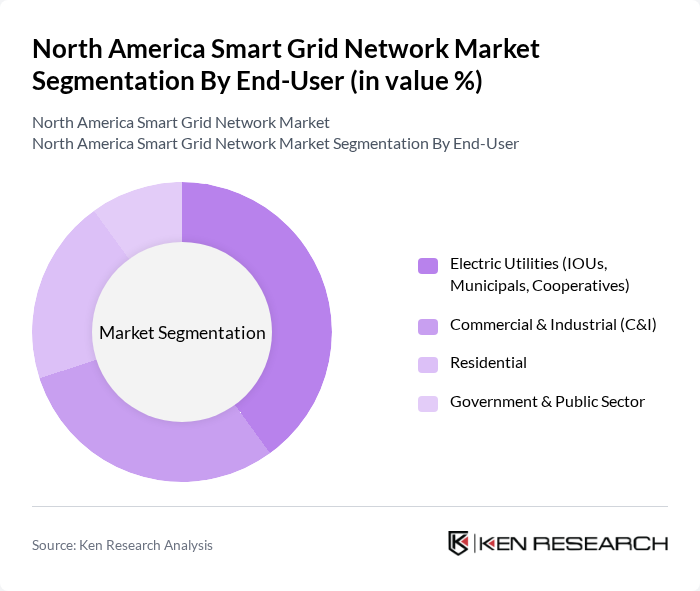

By End-User:The end-user segmentation includes Electric Utilities, Commercial & Industrial, Residential, and Government & Public Sector. Each segment has unique requirements and contributes differently to the overall market dynamics.

The North America Smart Grid Network Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, General Electric Company, Schneider Electric SE, ABB Ltd., Itron, Inc., Honeywell International Inc., Cisco Systems, Inc., Landis+Gyr AG, Eaton Corporation plc, Oracle Corporation, Mitsubishi Electric Corporation, Enel X North America, Inc., S&C Electric Company, Trilliant Networks, Inc., Aclara Technologies LLC (a Hubbell company) contribute to innovation, geographic expansion, and service delivery in this space.

The North America smart grid network market is poised for significant evolution, driven by technological advancements and increasing regulatory support. The integration of renewable energy sources and electric vehicles will necessitate further enhancements in grid infrastructure. Additionally, the focus on sustainability will push utilities to adopt innovative solutions. As consumer demand for energy efficiency rises, smart grid technologies will play a crucial role in optimizing energy distribution and management, ensuring a resilient and efficient energy future.

| Segment | Sub-Segments |

|---|---|

| By Type | Advanced Metering Infrastructure (Smart Meters, HES, MDMS) Advanced Distribution Management Systems (ADMS/DMS/SCADA) Demand Response & Distributed Energy Resource Management (DR/DERMS) Energy Management Systems (Home/Building/Utility EMS) Grid Automation & Protection (Reclosers, Switchgear, Fault Detection) Communication Networks (RF Mesh, PLC, Cellular LTE/5G, Fiber) Grid Edge & Storage Integration (Inverters, BESS control, VPP) |

| By End-User | Electric Utilities (IOUs, Municipals, Cooperatives) Commercial & Industrial (C&I) Residential Government & Public Sector |

| By Application | Transmission (WAMS/PMU, Synchrophasors, Substation Automation) Distribution (Feeder Automation, FLISR, Volt/VAR Optimization) Consumption & Retail (AMI Analytics, TOU, Billing & CIS) Integration of DER & EV (Interconnection, Charging Load Management) |

| By Investment Source | Utility Capital Expenditure (Rate-Based) Federal & State Funding/Grants Public-Private Partnerships (PPP) Private Investments & ESCO Models |

| By Policy Support | Incentives & Grants (IIJA, IRA, State Programs) Performance-Based Regulation & Decoupling Renewable/Clean Energy Standards & Interconnection Rules |

| By Distribution Mode | Direct to Utility/Enterprise Sales System Integrators & EPCs Channel Partners/Distributors Online & OEM Partnerships |

| By Component | Hardware Software Services Cybersecurity & Network Management |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Companies | 120 | Energy Managers, Grid Operations Directors |

| Smart Meter Manufacturers | 90 | Product Development Managers, Sales Executives |

| Energy Policy Makers | 60 | Regulatory Affairs Specialists, Government Officials |

| Commercial Energy Consumers | 70 | Facility Managers, Sustainability Coordinators |

| Technology Solution Providers | 80 | CTOs, Business Development Managers |

The North America Smart Grid Network Market is valued at approximately USD 15 billion, driven by the increasing demand for energy efficiency, integration of renewable energy sources, and advancements in communication technologies.