North America Soft Drinks Packaging Market Overview

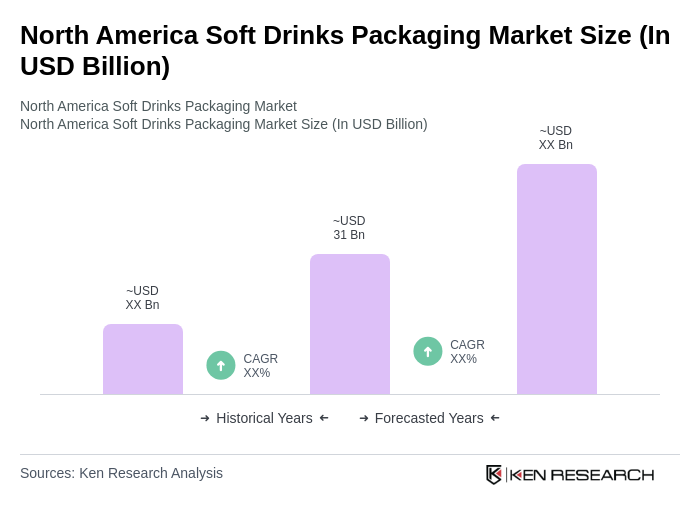

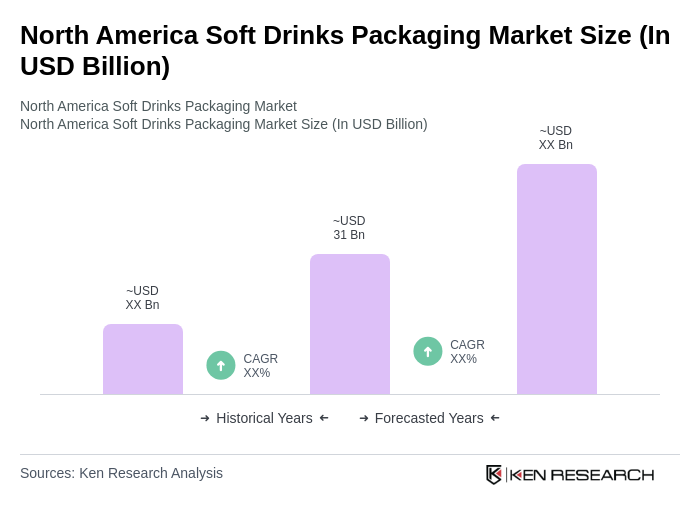

- The North America Soft Drinks Packaging Market is valued at USD 31 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for convenient and portable beverage formats, the rise of health-conscious consumers seeking functional and low-sugar beverage options, and ongoing innovations in sustainable packaging solutions. The market has seen a significant shift towards eco-friendly and recyclable materials, which has further propelled its expansion .

- The United States dominates the North American soft drinks packaging market due to its large consumer base, advanced manufacturing capabilities, and the strong presence of major beverage companies. Canada and Mexico also contribute significantly, with growing urban populations and increasing disposable incomes driving demand for packaged soft drinks. The trend towards on-the-go consumption and the expansion of retail channels have further solidified the market's growth in these regions .

- The Save Our Seas 2.0 Act, enacted by the United States Congress in 2020, mandates enhanced plastic waste reduction measures and requires beverage manufacturers to increase the use of recycled materials in packaging. The Act, administered by the Environmental Protection Agency, sets operational requirements for recycling infrastructure and encourages the use of recycled content in beverage containers, supporting the industry’s transition to more sustainable packaging solutions .

North America Soft Drinks Packaging Market Segmentation

By Packaging Material:The packaging material segment includes plastic, paper and paperboard, glass, metal, and other materials. Plastic remains the most widely used due to its lightweight, durability, and cost-effectiveness. However, there is a growing trend towards paper and paperboard as consumers and brands prioritize sustainability. Glass and metal are also significant, especially for premium and specialty products, with glass favored for its recyclability and premium image, and metal (especially aluminum) gaining traction for its high recyclability and growing use in canned beverages .

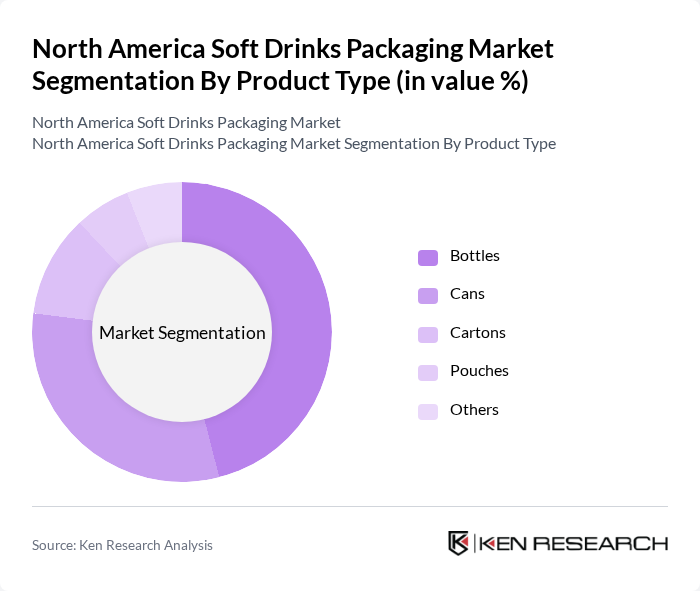

By Product Type:The product type segmentation includes bottles, cans, cartons, pouches, and others. Bottles are the leading sub-segment, driven by consumer preference for convenience and portability, particularly in PET and glass formats. Cans are also popular, especially for carbonated and energy beverages, while cartons and pouches are gaining traction in the juice, functional, and non-carbonated drink segments. The diversity in product types continues to cater to evolving consumer needs and sustainability preferences .

North America Soft Drinks Packaging Market Competitive Landscape

The North America Soft Drinks Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Coca-Cola Company, PepsiCo, Inc., Nestlé S.A., Keurig Dr Pepper Inc., Monster Beverage Corporation, Red Bull GmbH, Refresco Group N.V., Berry Global, Inc., Ball Corporation, Crown Holdings, Inc., Amcor plc, Ardagh Group S.A., O-I Glass, Inc., Tetra Pak International S.A., Silgan Holdings Inc. contribute to innovation, geographic expansion, and service delivery in this space.

North America Soft Drinks Packaging Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Convenience Packaging:The North American soft drinks packaging market is experiencing a surge in demand for convenience packaging, driven by busy lifestyles. In future, the convenience packaging segment is projected to account for approximately $16 billion, reflecting a 7% increase from the previous year. This growth is supported by the rise in on-the-go consumption, with 62% of consumers preferring single-serve options, as reported by the Beverage Marketing Corporation.

- Rising Health Consciousness and Demand for Healthier Options:Health consciousness among consumers is reshaping the soft drinks packaging landscape. In future, the market for healthier beverage options is expected to reach $22 billion, with a notable 20% increase in demand for low-calorie and organic drinks. This trend is supported by a 12% rise in sales of health-oriented beverages, as consumers increasingly seek products with transparent labeling and natural ingredients, according to the International Bottled Water Association.

- Innovations in Sustainable Packaging Materials:The shift towards sustainability is a key driver in the soft drinks packaging market. In future, the sustainable packaging segment is anticipated to grow to $15 billion, reflecting a 25% increase from the previous year. This growth is fueled by innovations such as plant-based plastics and recyclable materials, with 45% of consumers willing to pay more for eco-friendly packaging, as highlighted by a recent report from the Sustainable Packaging Coalition.

Market Challenges

- Stringent Regulations on Packaging Materials:The North American soft drinks packaging market faces significant challenges due to stringent regulations on packaging materials. In future, compliance costs are expected to rise by 18%, impacting profit margins for manufacturers. Regulations concerning BPA and other harmful substances are becoming increasingly strict, with the FDA enforcing new guidelines that require extensive testing and certification, leading to delays in product launches and increased operational costs.

- Fluctuating Raw Material Prices:The volatility in raw material prices poses a considerable challenge for the soft drinks packaging industry. In future, the cost of key materials such as aluminum and plastics is projected to increase by 12%, driven by supply chain disruptions and geopolitical tensions. This fluctuation can lead to unpredictable pricing for manufacturers, affecting their ability to maintain competitive pricing and profitability, as reported by the Commodity Research Bureau.

North America Soft Drinks Packaging Market Future Outlook

The North American soft drinks packaging market is poised for transformative growth, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, companies are expected to invest heavily in eco-friendly materials and innovative packaging solutions. Additionally, the rise of e-commerce will further influence packaging design, emphasizing convenience and personalization. In future, the market is likely to see a significant shift towards smart packaging technologies, enhancing consumer engagement and product traceability, thereby reshaping the competitive landscape.

Market Opportunities

- Expansion of Plant-Based and Biodegradable Packaging:The demand for plant-based and biodegradable packaging solutions is set to rise significantly, with an expected market value of $6 billion in future. This growth is driven by consumer preferences for sustainable products, as 75% of consumers express a willingness to choose biodegradable options, according to a recent survey by the Green Packaging Association.

- Increasing Demand for Personalized Packaging Solutions:Personalized packaging is becoming a key differentiator in the soft drinks market. In future, the personalized packaging segment is projected to reach $4 billion, fueled by consumer desire for unique and customized experiences. This trend is supported by advancements in digital printing technologies, allowing brands to create tailored packaging that resonates with individual consumer preferences, as reported by the Custom Packaging Institute.