Region:North America

Author(s):Rebecca

Product Code:KRAD0252

Pages:93

Published On:August 2025

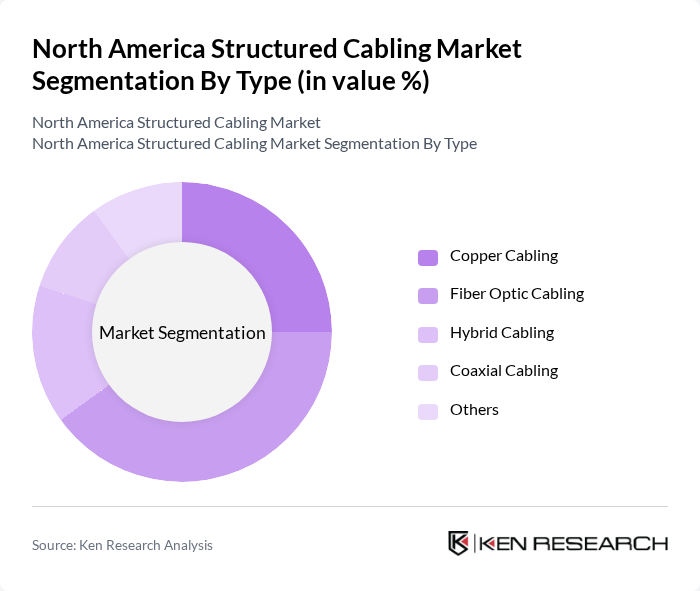

By Type:

The structured cabling market is segmented into various types, including Copper Cabling, Fiber Optic Cabling, Hybrid Cabling, Coaxial Cabling, and Others. Among these,Fiber Optic Cablingis dominating the market due to its superior bandwidth capabilities and increasing adoption in data centers and telecommunications. The shift towards high-speed internet and the growing demand for data transmission are driving the preference for fiber optics over traditional copper solutions. Additionally, advancements in fiber optic technology have made it more accessible and cost-effective, further solidifying its market leadership .

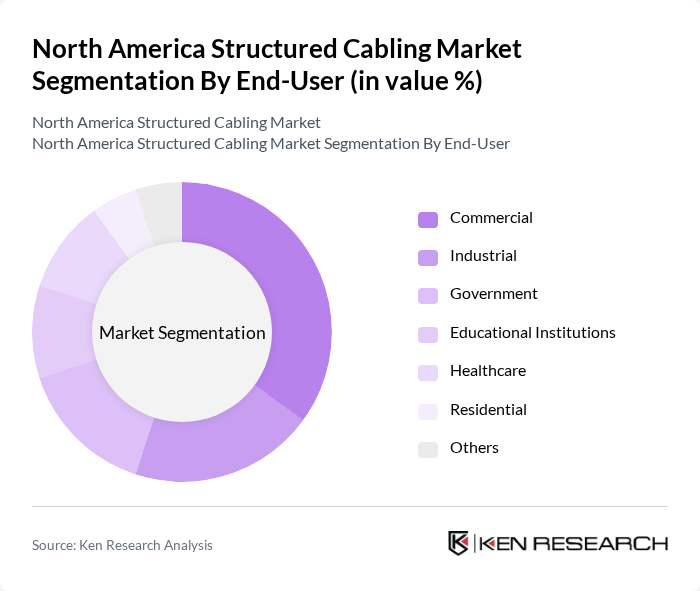

By End-User:

The end-user segmentation includes Commercial, Industrial, Government, Educational Institutions, Healthcare, Residential, and Others. TheCommercial sectoris the leading segment, driven by the rapid expansion of office spaces and the increasing need for efficient communication systems. Businesses are investing heavily in structured cabling to support their IT infrastructure, enhance connectivity, and improve operational efficiency. The rise of remote work and digital transformation initiatives has further accelerated the demand for robust cabling solutions in commercial environments .

The North America Structured Cabling Market is characterized by a dynamic mix of regional and international players. Leading participants such as CommScope Holding Company, Inc., Belden Inc., Legrand S.A., Corning Incorporated, Panduit Corporation, Schneider Electric SE, TE Connectivity Ltd., Nexans S.A., The Siemon Company, Molex LLC, R&M (Reichle & De-Massari AG), 3M Company, Anixter International Inc., AFL Telecommunications LLC, Cisco Systems, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The North American structured cabling market is poised for significant transformation, driven by technological advancements and evolving consumer needs. As businesses increasingly adopt smart technologies and IoT applications, the demand for efficient and scalable cabling solutions will intensify. Additionally, the ongoing rollout of 5G technology is expected to create new opportunities for structured cabling systems, enhancing connectivity and performance. Companies that invest in innovative cabling solutions will likely gain a competitive edge in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Copper Cabling Fiber Optic Cabling Hybrid Cabling Coaxial Cabling Others |

| By End-User | Commercial Industrial Government Educational Institutions Healthcare Residential Others |

| By Component | Cables Connectors Patch Panels Racks and Enclosures Cable Management Systems Others |

| By Sales Channel | Direct Sales Distributors Online Sales System Integrators Others |

| By Distribution Mode | Wholesale Retail E-commerce Others |

| By Price Range | Low Medium High |

| By Application | Data Centers Telecommunications Commercial Buildings Industrial Facilities Residential Networks Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Installations | 100 | IT Managers, Network Engineers |

| Residential Cabling Solutions | 60 | Homeowners, Electrical Contractors |

| Industrial Networking Projects | 50 | Facility Managers, Operations Directors |

| Telecommunications Infrastructure | 80 | Telecom Engineers, Project Managers |

| Smart Building Technologies | 40 | Building Managers, Technology Consultants |

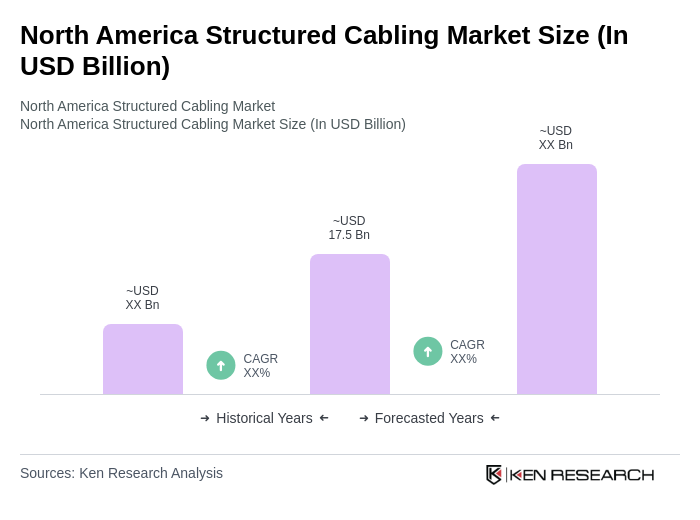

The North America Structured Cabling Market is valued at approximately USD 17.5 billion, reflecting a significant growth driven by the demand for high-speed data transmission, data center expansion, and the rise of smart buildings.