Region:North America

Author(s):Rebecca

Product Code:KRAA0343

Pages:86

Published On:August 2025

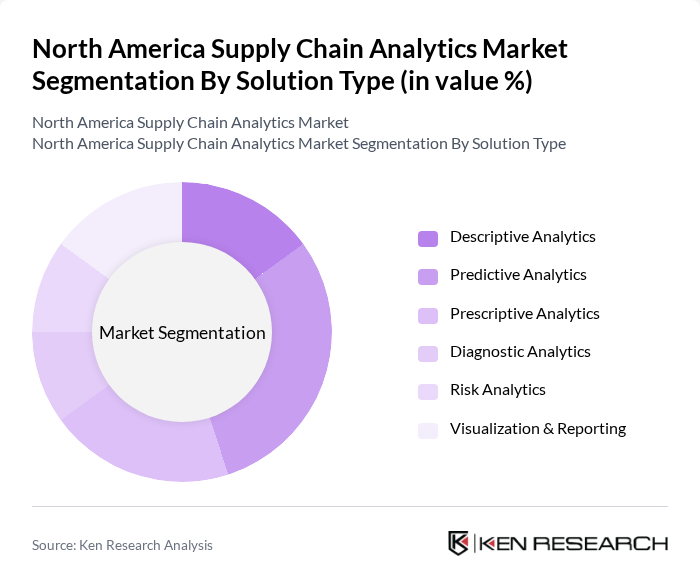

By Solution Type:The solution type segmentation includes various analytics methodologies that cater to different aspects of supply chain management. The subsegments are Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Diagnostic Analytics, Risk Analytics, and Visualization & Reporting. Among these, Predictive Analytics is currently leading the market due to its ability to forecast demand, optimize inventory levels, and proactively manage supply chain disruptions. Businesses increasingly rely on predictive models to enhance efficiency and reduce costs, especially in volatile market conditions .

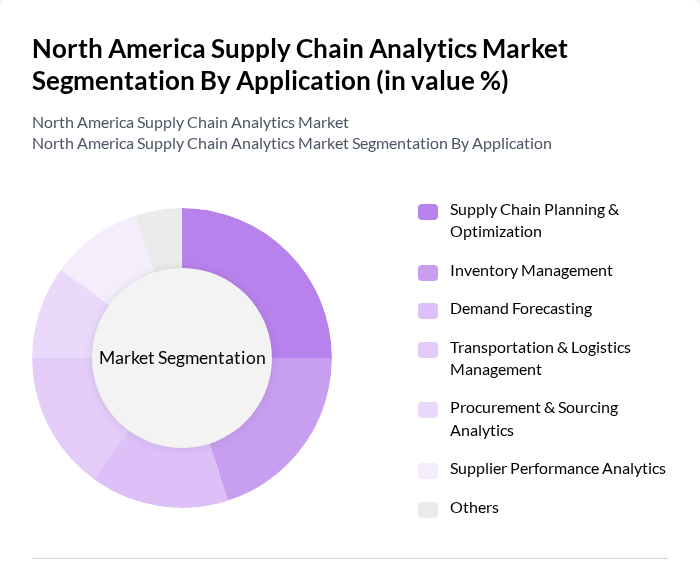

By Application:The application segmentation encompasses various functions within supply chain management, including Supply Chain Planning & Optimization, Inventory Management, Demand Forecasting, Transportation & Logistics Management, Procurement & Sourcing Analytics, Supplier Performance Analytics, and Others. Supply Chain Planning & Optimization is the leading application area, driven by the need for organizations to streamline operations, improve resource allocation, and enhance overall supply chain efficiency. The increasing complexity of supply networks and the demand for real-time decision-making are further accelerating adoption in this segment .

The North America Supply Chain Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Microsoft Corporation, Blue Yonder (formerly JDA Software), Kinaxis Inc., Tableau Software (Salesforce, Inc.), QlikTech International AB, SAS Institute Inc., Infor, Coupa Software, Manhattan Associates, Llamasoft (Coupa Software), TIBCO Software, Oracle NetSuite contribute to innovation, geographic expansion, and service delivery in this space.

The North American supply chain analytics market is poised for significant transformation as businesses increasingly embrace digitalization and automation. In future, the integration of advanced technologies such as AI and IoT will enhance predictive capabilities, enabling companies to anticipate market changes and respond proactively. Furthermore, the emphasis on sustainability will drive innovations in analytics, allowing organizations to optimize resource use and reduce environmental impact. As these trends evolve, the market will likely witness a shift towards more collaborative and transparent supply chain practices.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Diagnostic Analytics Risk Analytics Visualization & Reporting |

| By Application | Supply Chain Planning & Optimization Inventory Management Demand Forecasting Transportation & Logistics Management Procurement & Sourcing Analytics Supplier Performance Analytics Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By End-User Industry | Retail & E-commerce Manufacturing Transportation & Logistics Healthcare & Pharmaceuticals Automotive Food & Beverage Consumer Goods Others |

| By Country | United States Canada Mexico |

| By Policy Support | Government Incentives Tax Benefits Grants and Funding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Analytics | 100 | Supply Chain Managers, Data Analysts |

| Manufacturing Process Optimization | 80 | Operations Directors, Production Managers |

| Healthcare Logistics Management | 60 | Logistics Coordinators, Compliance Officers |

| Transportation and Freight Analytics | 90 | Fleet Managers, Transportation Analysts |

| Technology Adoption in Supply Chains | 50 | IT Managers, Digital Transformation Leads |

The North America Supply Chain Analytics Market is valued at approximately USD 9.4 billion, reflecting significant growth driven by the need for operational efficiency and the adoption of advanced technologies like AI and big data in supply chain processes.