Region:North America

Author(s):Shubham

Product Code:KRAA0923

Pages:99

Published On:August 2025

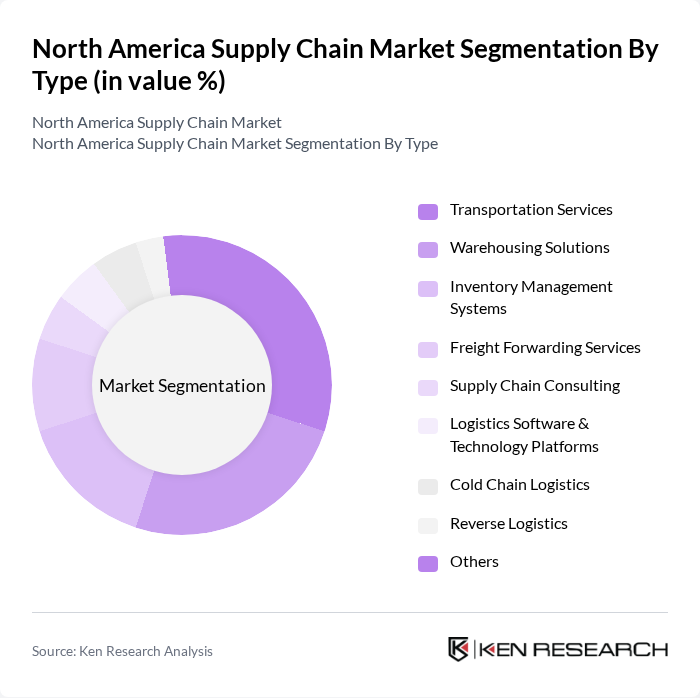

By Type:The North America Supply Chain Market can be segmented into Transportation Services, Warehousing Solutions, Inventory Management Systems, Freight Forwarding Services, Supply Chain Consulting, Logistics Software & Technology Platforms, Cold Chain Logistics, Reverse Logistics, and Others. Each segment plays a crucial role in the overall supply chain ecosystem, addressing distinct operational needs and customer demands. Transportation Services remain the largest segment, driven by the scale of freight movement and the need for timely delivery. Warehousing Solutions are increasingly adopting automation and robotics to improve efficiency, while Logistics Software & Technology Platforms are seeing rapid growth due to the integration of AI, IoT, and real-time analytics .

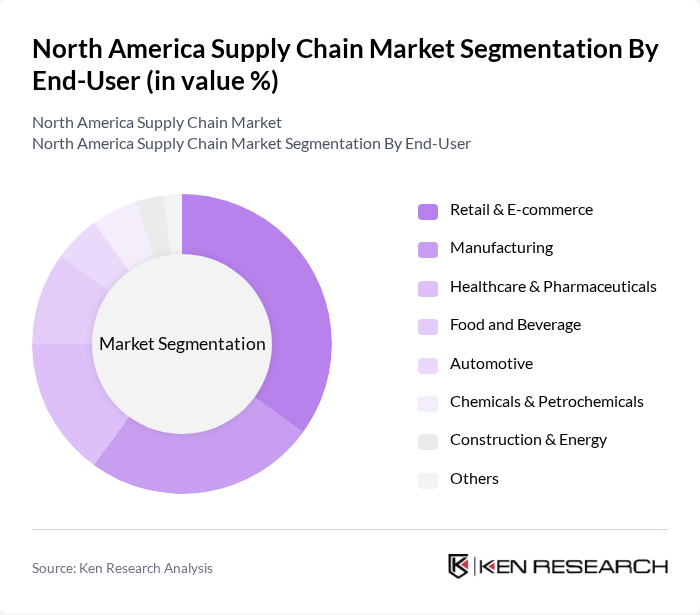

By End-User:The market is also segmented by end-user industries, including Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Food and Beverage, Automotive, Chemicals & Petrochemicals, Construction & Energy, and Others. Retail & E-commerce continues to drive the largest share, reflecting the surge in online shopping and the need for rapid fulfillment. Manufacturing and Healthcare & Pharmaceuticals segments are also significant, with the latter seeing increased demand for cold chain and specialized logistics solutions .

The North America Supply Chain Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, XPO Logistics, C.H. Robinson, UPS Supply Chain Solutions, FedEx Logistics, J.B. Hunt Transport Services, Kuehne + Nagel, Ryder Supply Chain Solutions, Geodis, DB Schenker, Penske Logistics, CEVA Logistics, Schneider National, TQL (Total Quality Logistics), APL Logistics, Averitt Express, Expeditors International of Washington, Manhattan Associates, Oracle (Supply Chain Software), and SAP (Supply Chain Software) contribute to innovation, geographic expansion, and service delivery in this space.

The North American supply chain market is poised for transformative growth, driven by technological innovations and evolving consumer expectations. As companies increasingly adopt AI and automation, operational efficiencies will improve, enabling faster response times. Additionally, the focus on sustainability will lead to the development of greener logistics solutions. The integration of blockchain technology will enhance transparency and traceability, fostering trust among stakeholders. Overall, these trends will shape a more resilient and adaptive supply chain landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Services Warehousing Solutions Inventory Management Systems Freight Forwarding Services Supply Chain Consulting Logistics Software & Technology Platforms Cold Chain Logistics Reverse Logistics Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Food and Beverage Automotive Chemicals & Petrochemicals Construction & Energy Others |

| By Distribution Mode | Road Rail Air Sea Intermodal Hyperlocal/On-Demand Others |

| By Sales Channel | Direct Sales Online Sales Distributors Retail Outlets Others |

| By Application | Order Fulfillment Demand Planning Supply Chain Visibility & Analytics Risk Management & Resilience Sustainability & Green Logistics Others |

| By Investment Source | Private Investment Public Funding Venture Capital Government Grants Others |

| By Policy Support | Tax Incentives Subsidies for Green Logistics Infrastructure Development Programs Trade Facilitation Policies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Management | 100 | Supply Chain Managers, Logistics Coordinators |

| Manufacturing Logistics Optimization | 80 | Operations Directors, Production Managers |

| E-commerce Fulfillment Strategies | 70 | eCommerce Operations Managers, Warehouse Supervisors |

| Transportation and Freight Management | 60 | Logistics Analysts, Freight Managers |

| Supply Chain Sustainability Initiatives | 40 | Sustainability Managers, Corporate Social Responsibility Officers |

The North America Supply Chain Market is valued at approximately USD 1.5 trillion, reflecting significant growth driven by the demand for efficient logistics solutions, technological advancements, and the rise of e-commerce.