Region:North America

Author(s):Rebecca

Product Code:KRAA2150

Pages:84

Published On:August 2025

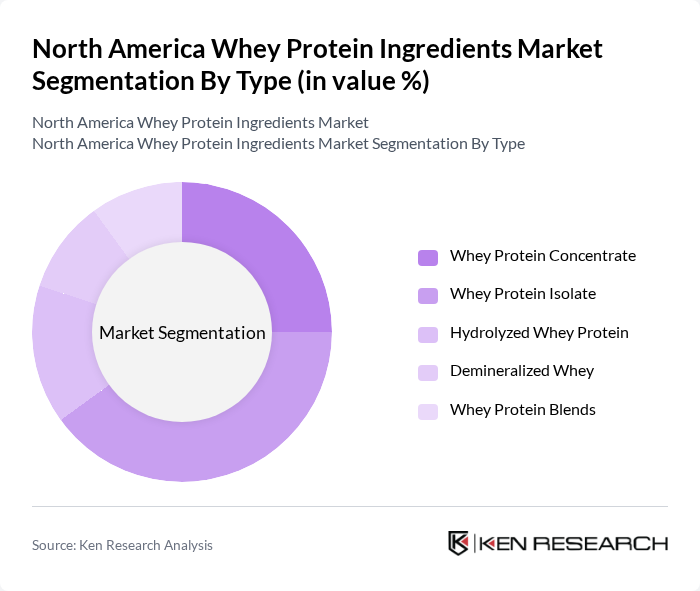

By Type:The market is segmented into various types of whey protein ingredients, including Whey Protein Concentrate, Whey Protein Isolate, Hydrolyzed Whey Protein, Demineralized Whey, and Whey Protein Blends. Among these, Whey Protein Isolate is currently dominating the market due to its high protein content and low fat and lactose levels, making it a preferred choice for fitness enthusiasts and those with dietary restrictions. The increasing trend of clean label products, product formulation innovation, and the demand for high-quality protein sources are further propelling the growth of this subsegment.

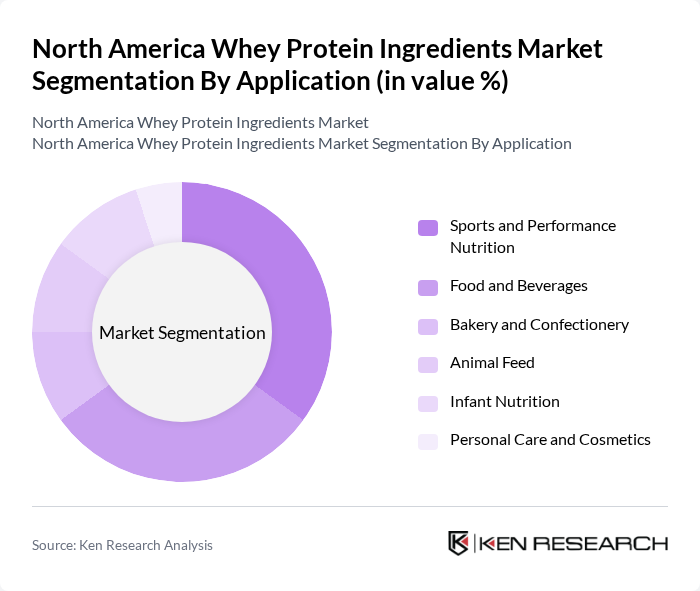

By Application:The applications of whey protein ingredients are diverse, including Sports and Performance Nutrition, Food and Beverages, Bakery and Confectionery, Animal Feed, Infant Nutrition, and Personal Care and Cosmetics. The Sports and Performance Nutrition segment is leading the market, driven by the increasing number of fitness enthusiasts and athletes seeking high-quality protein supplements to enhance performance and recovery. The growing trend of protein fortification in food and beverages, along with the expansion of functional foods and personalized nutrition, is also contributing to the expansion of this segment.

The North America Whey Protein Ingredients Market is characterized by a dynamic mix of regional and international players. Leading participants such as Glanbia Nutritionals, Arla Foods Ingredients, Fonterra Co-operative Group Limited, FrieslandCampina Ingredients, Groupe Lactalis, Optimum Nutrition (ON), Dymatize Enterprises LLC, MusclePharm Corporation, NOW Foods, NutraBio Labs, Isagenix International LLC, Quest Nutrition LLC, Bodybuilding.com LLC, ProMix Nutrition, BPI Sports contribute to innovation, geographic expansion, and service delivery in this space.

The North American whey protein ingredients market is poised for continued growth, driven by evolving consumer preferences towards health and wellness. Innovations in product formulations, such as the introduction of flavored whey proteins and functional blends, are expected to attract a broader audience. Additionally, the rise of e-commerce platforms will facilitate easier access to whey protein products, enhancing market penetration. As sustainability becomes a priority, companies focusing on eco-friendly sourcing will likely gain a competitive edge in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Whey Protein Concentrate Whey Protein Isolate Hydrolyzed Whey Protein Demineralized Whey Whey Protein Blends |

| By Application | Sports and Performance Nutrition Food and Beverages Bakery and Confectionery Animal Feed Infant Nutrition Personal Care and Cosmetics |

| By End-User | Supplements (including Sports Nutrition, Elderly Nutrition, Medical Nutrition) Food and Beverage Manufacturers Animal Feed Producers Personal Care and Cosmetics Companies |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales (B2B) |

| By Region | United States Canada Mexico |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Bulk Packaging Retail Packaging Single-Serve Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health and Fitness Enthusiasts | 100 | Personal Trainers, Gym Owners |

| Whey Protein Manufacturers | 60 | Production Managers, Quality Assurance Managers |

| Retailers of Nutritional Supplements | 50 | Store Managers, Category Buyers |

| Nutritionists and Dietitians | 40 | Registered Dietitians, Health Coaches |

| Consumers of Whey Protein Products | 80 | Fitness Enthusiasts, Health-Conscious Individuals |

The North America Whey Protein Ingredients Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by health awareness, the functional food sector, and the sports nutrition industry.