Region:Middle East

Author(s):Dev

Product Code:KRAD5311

Pages:97

Published On:December 2025

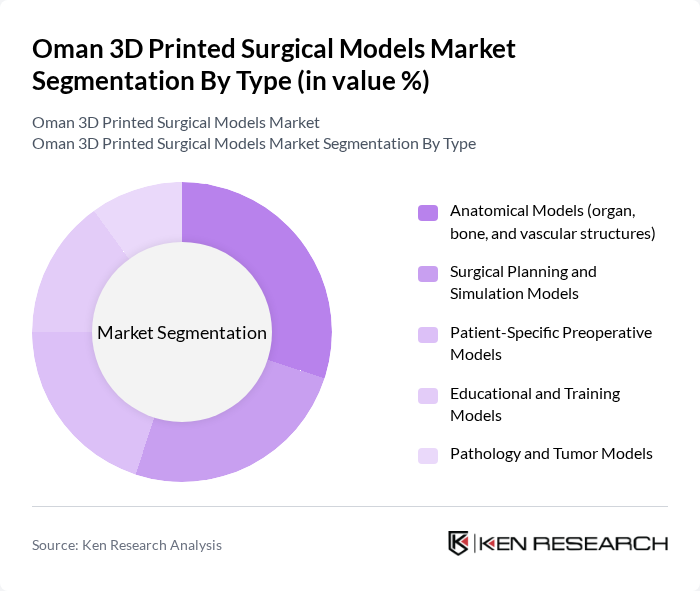

By Type:The market is segmented into various types of 3D printed surgical models, including anatomical models, surgical planning and simulation models, patient-specific preoperative models, educational and training models, and pathology and tumor models. These categories are consistent with global practice, where anatomical and patient-specific models are widely used for complex procedures and preoperative planning. Among these, anatomical models are gaining traction due to their critical role in enhancing surgical accuracy, communication with patients and families, and multidisciplinary team planning.

By End-User:The end-user segmentation includes tertiary care hospitals and university hospitals, specialized surgical and orthopedic centers, medical and dental schools, research & innovation centers and simulation labs, and private clinics. This structure aligns with global demand patterns, where hospitals and academic centers are the primary users of 3D printed surgical models for preoperative planning, complex case management, and resident training. Tertiary care hospitals are leading this segment due to their advanced facilities, higher case complexity and patient volumes, and greater access to imaging and 3D printing capabilities, which necessitate the use of 3D printed models for high-risk and anatomically challenging procedures.

The Oman 3D Printed Surgical Models Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3D Systems, Inc., Stratasys Ltd., Materialise NV, Stryker Corporation, Medtronic plc, Siemens Healthineers AG, GE HealthCare Technologies Inc., Formlabs Inc., Renishaw plc, EOS GmbH Electro Optical Systems, HP Inc., UltiMaker B.V., EnvisionTEC GmbH (now ETEC, a Desktop Metal company), Axial3D Ltd, Ricoh 3D for Healthcare contribute to innovation, geographic expansion, and service delivery in this space, leveraging technologies such as fused deposition modeling, stereolithography, and selective laser sintering to produce high-fidelity anatomical and patient-specific models for surgical planning and education.

The future of the Oman 3D printed surgical models market appears promising, driven by technological advancements and increasing healthcare investments. As the healthcare sector continues to evolve, the integration of artificial intelligence and machine learning in surgical modeling is expected to enhance precision and efficiency. Furthermore, the growing trend of minimally invasive surgeries will likely boost the demand for customized surgical models, leading to improved patient outcomes and reduced recovery times.

| Segment | Sub-Segments |

|---|---|

| By Type | Anatomical Models (organ, bone, and vascular structures) Surgical Planning and Simulation Models Patient-Specific Preoperative Models Educational and Training Models Pathology and Tumor Models |

| By End-User | Tertiary Care Hospitals and University Hospitals Specialized Surgical and Orthopedic Centers Medical and Dental Schools Research & Innovation Centers and Simulation Labs Private Clinics and Others |

| By Application | Orthopedic and Trauma Surgery Cardiovascular and Thoracic Surgery Neurosurgery and Spine Surgery Maxillofacial, ENT, and Dental Surgery Oncologic and Reconstructive Surgery |

| By Material | Photopolymer Resins (SLA/DLP) Thermoplastics (PLA, ABS, PETG, etc.) Metal and Metal-Like Materials Biocompatible and Medical-Grade Materials Multi?Material and Composite Materials |

| By Technology | Stereolithography (SLA) Fused Deposition Modeling (FDM) Selective Laser Sintering (SLS) Digital Light Processing (DLP) PolyJet and Material Jetting |

| By Distribution Channel | Direct Contracts with Hospitals and Health Systems Tender-Based Procurement via Government and Public Entities Local Distributors and System Integrators Regional 3D Printing Service Bureaus Online and Cloud-Based Planning Platforms |

| By Region | Muscat Governorate Dhofar (Salalah) Al Batinah (including Sohar) Ad Dakhiliyah (including Nizwa) Other Governorates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgery Models | 100 | Orthopedic Surgeons, Hospital Administrators |

| Cardiac Surgery Models | 80 | Cardiologists, Surgical Team Leaders |

| Dental Surgery Models | 70 | Dentists, Dental Technicians |

| Oncology Surgery Models | 60 | Oncologists, Medical Device Buyers |

| General Surgery Models | 90 | General Surgeons, Clinical Research Coordinators |

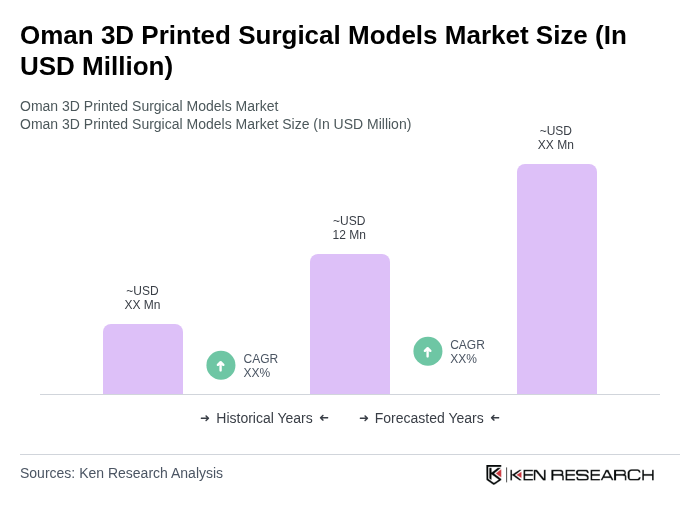

The Oman 3D Printed Surgical Models Market is valued at approximately USD 12 million, reflecting growth driven by advancements in 3D printing technology and increasing demand for personalized medical solutions in healthcare facilities.