Region:Middle East

Author(s):Shubham

Product Code:KRAD3458

Pages:86

Published On:November 2025

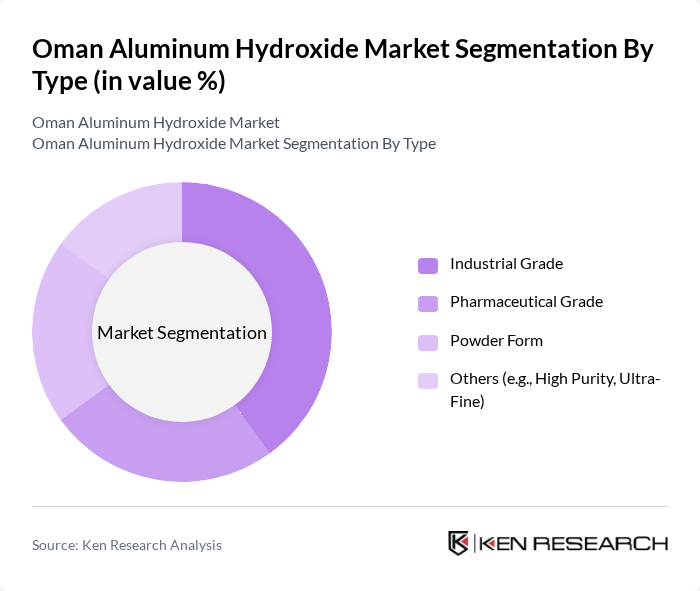

By Type:The market is segmented into Industrial Grade, Pharmaceutical Grade, Powder Form, and Others (e.g., High Purity, Ultra-Fine). Industrial grade is widely used in flame retardants and water treatment, pharmaceutical grade is essential for antacid and vaccine adjuvant applications, powder form is preferred for its compatibility in plastics and polymers, and other types cover specialized high-purity and ultra-fine variants for advanced industrial uses.

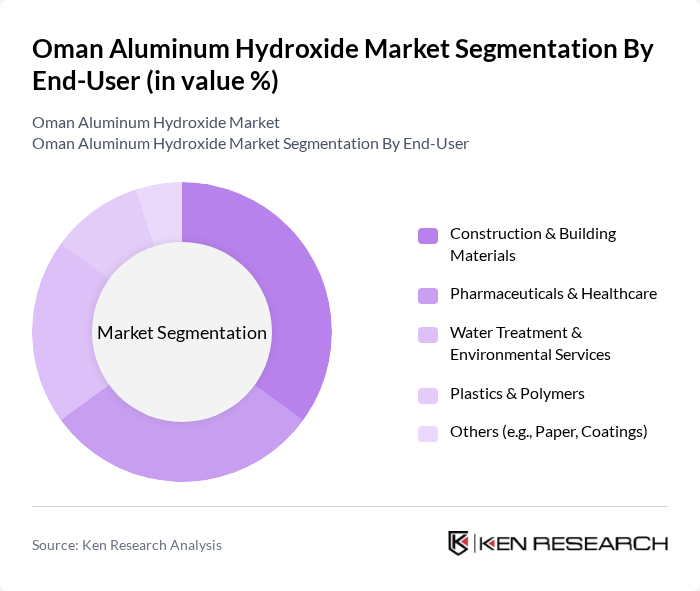

By End-User:The end-user segmentation includes Construction & Building Materials, Pharmaceuticals & Healthcare, Water Treatment & Environmental Services, Plastics & Polymers, and Others (e.g., Paper, Coatings). Construction & building materials utilize aluminum hydroxide primarily as a flame retardant, pharmaceuticals & healthcare use it for antacids and vaccine adjuvants, water treatment leverages its coagulation properties, plastics & polymers benefit from its flame-retardant and filler roles, while other sectors apply it in specialty coatings and paper processing.

The Oman Aluminum Hydroxide Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sohar Aluminium LLC, Oman Aluminium Processing Industries LLC, Huber Engineered Materials, Sumitomo Chemical Co., Ltd., Hindalco Industries Limited, Almatis, MAL Hungarian Aluminium, Aluminum Corporation of China Ltd (Chalco), Rusal, Emirates Global Aluminium, Sibelco, Donau Chemie AG, LKAB Minerals AB, Alteo, Nashtec LLC contribute to innovation, geographic expansion, and service delivery in this space.

The Oman aluminum hydroxide market is poised for significant growth, driven by increasing demand across various sectors, including construction and pharmaceuticals. As the government continues to invest in infrastructure and healthcare, the market is expected to benefit from enhanced consumption. Additionally, the trend towards sustainable practices and eco-friendly products will likely shape future developments, encouraging innovation and investment in cleaner production methods, ultimately fostering a more resilient market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade Pharmaceutical Grade Powder Form Others (e.g., High Purity, Ultra-Fine) |

| By End-User | Construction & Building Materials Pharmaceuticals & Healthcare Water Treatment & Environmental Services Plastics & Polymers Others (e.g., Paper, Coatings) |

| By Application | Flame Retardants Fillers in Plastics & Rubber Antacid Formulations Water Purification Agents Others (e.g., Catalyst, Pigments) |

| By Source | Bauxite-Derived Recycled Aluminum Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Muscat Salalah Sohar Others |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | Product Managers, Quality Assurance Officers |

| Water Treatment Facilities | 80 | Operations Managers, Environmental Engineers |

| Cosmetic Industry Usage | 70 | Formulation Chemists, Brand Managers |

| Industrial Applications | 90 | Procurement Managers, Production Supervisors |

| Research Institutions | 50 | Research Scientists, Laboratory Managers |

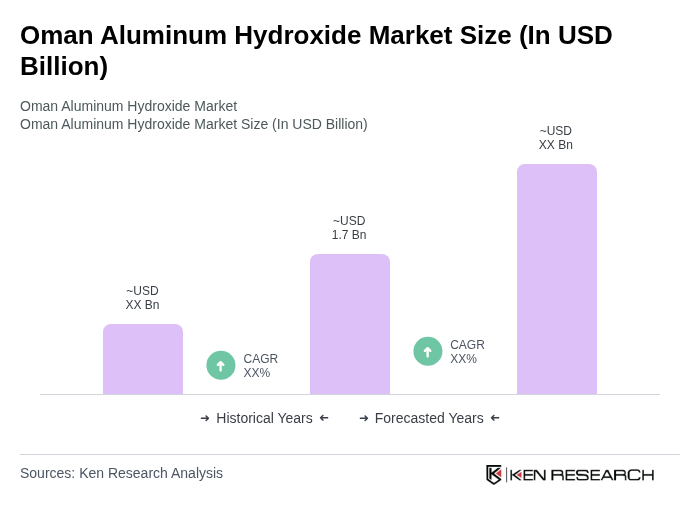

The Oman Aluminum Hydroxide Market is valued at approximately USD 1.7 billion, reflecting a robust growth trajectory driven by increasing demand across various sectors, including construction, pharmaceuticals, and water treatment.