Region:Middle East

Author(s):Shubham

Product Code:KRAD5566

Pages:89

Published On:December 2025

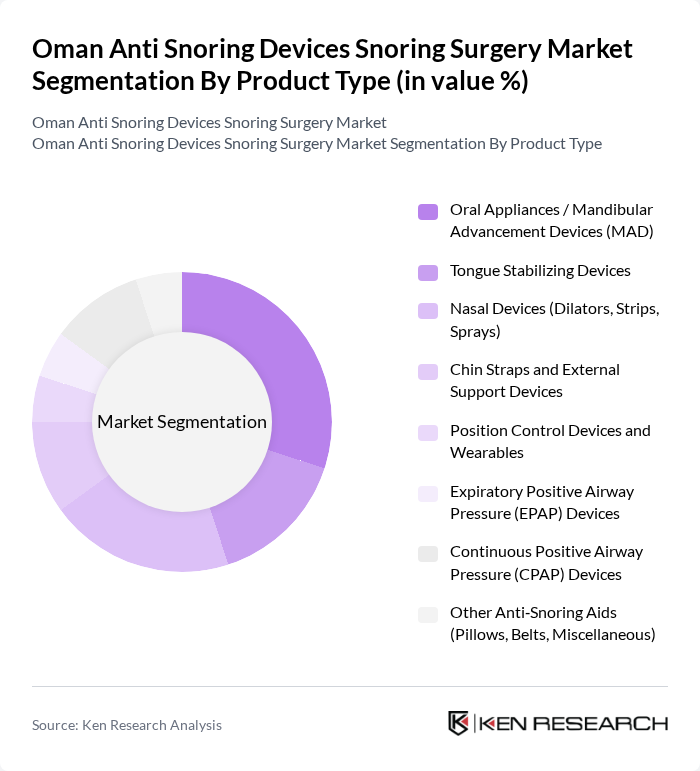

By Product Type:The product type segmentation includes various devices designed to alleviate snoring. The market is characterized by a diverse range of products catering to different needs and preferences, with oral appliances and nasal devices generally accounting for the largest shares in anti?snoring device revenues in Gulf markets.

The Oral Appliances / Mandibular Advancement Devices (MAD) segment is currently dominating the market due to their effectiveness in repositioning the jaw to keep the airway open during sleep and strong clinical evidence supporting their role in mild to moderate obstructive sleep apnea and primary snoring. These devices are favored by both patients and healthcare providers for their non-invasive nature and ease of use. The increasing awareness of sleep apnea and its associated health risks, such as cardiovascular disease and daytime functional impairment, has led to a surge in demand for these devices, making them a preferred choice among consumers. Additionally, the growing trend of personalized healthcare solutions and dentist?fitted oral appliances has further propelled the adoption of MADs, as they can be custom-fitted to individual patients and increasingly integrated with digital titration and telemonitoring features.

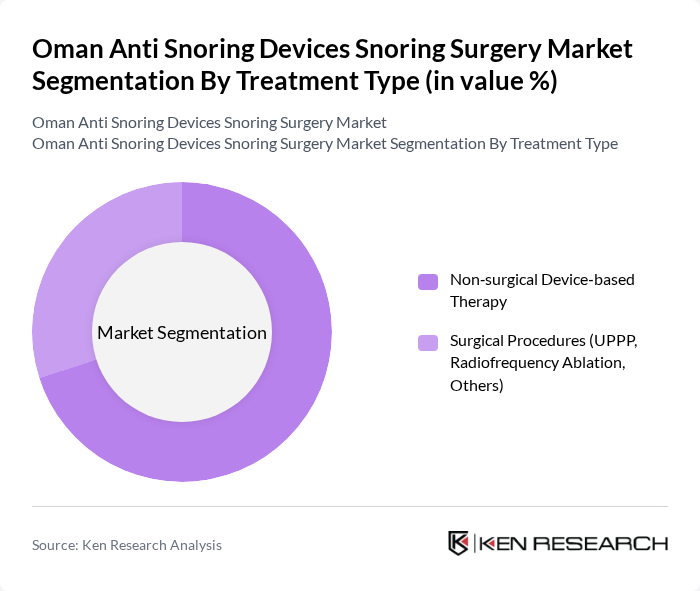

By Treatment Type:This segmentation focuses on the methods used to treat snoring, which can be broadly categorized into non-surgical and surgical options. Each treatment type addresses different levels of severity and patient preferences, with global and regional data showing higher utilization of device?based therapies relative to invasive procedures for primary snoring and many obstructive sleep apnea cases.

The Non?surgical Device?based Therapy segment is leading the market due to its accessibility and lower risk compared to surgical options. Patients often prefer these devices as they can be used at home without the need for invasive procedures, and global treatment patterns show strong adoption of CPAP systems, oral appliances, nasal dilators, and positional devices as first?line or adjunctive therapies. The increasing awareness of sleep disorders and the effectiveness of these devices in managing snoring have contributed to their popularity. Additionally, advancements in technology have led to the development of more comfortable and effective non-surgical solutions, including smart wearables with vibration feedback, app?connected MADs, and quieter CPAP devices, further driving their adoption among consumers.

The Oman Anti Snoring Devices Snoring Surgery Market is characterized by a dynamic mix of regional and international players. Leading participants such as ResMed Inc., Koninklijke Philips N.V. (Philips Respironics), SomnoMed Ltd, Fisher & Paykel Healthcare Corporation Limited, GSK plc (Breathe Right), Apnea Sciences Corporation, Tomed GmbH, Airway Management Inc., Oventus Medical Ltd, Inspire Medical Systems Inc., Local Distributors & Importers (e.g., Oman Medical Supplies & Services LLC), Major Hospital & Clinic Providers Offering Snoring Surgery in Oman (e.g., Royal Hospital, Sultan Qaboos University Hospital, Private ENT & Sleep Clinics), Regional GCC Players Active in Oman (e.g., UAE?based sleep solution providers), Online Pharmacy & E?commerce Platforms Supplying Anti?snoring Devices in Oman, Emerging Start?ups and Niche Anti?snoring Device Brands in the Middle East contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman anti-snoring devices market appears promising, driven by increasing consumer awareness and technological innovations. As healthcare spending continues to rise, projected to reach OMR 1.2 billion in future, more individuals are likely to invest in preventive healthcare solutions. Additionally, the integration of telemedicine is expected to facilitate remote consultations, making it easier for patients to access treatment options. This evolving landscape will likely enhance market growth and accessibility for anti-snoring devices.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Oral Appliances / Mandibular Advancement Devices (MAD) Tongue Stabilizing Devices Nasal Devices (Dilators, Strips, Sprays) Chin Straps and External Support Devices Position Control Devices and Wearables Expiratory Positive Airway Pressure (EPAP) Devices Continuous Positive Airway Pressure (CPAP) Devices Other Anti?Snoring Aids (Pillows, Belts, Miscellaneous) |

| By Treatment Type | Non?surgical Device?based Therapy Surgical Procedures (UPPP, Radiofrequency Ablation, Others) |

| By End?User | Hospitals Sleep Clinics and Specialized Centers Dental Clinics / ENT Clinics Home Care Settings Other Healthcare Facilities |

| By Patient Profile | Adults Elderly Pediatric & Adolescent Patients |

| By Severity of Snoring / Sleep?Disordered Breathing | Primary (Simple) Snoring Mild to Moderate Obstructive Sleep Apnea Severe Obstructive Sleep Apnea |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies & Drug Stores Online Pharmacies & E?commerce Platforms Direct Sales through Clinics / Manufacturers |

| By Region in Oman | Muscat Governorate Dhofar (Salalah) Al Batinah (including Sohar) Interior & Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Patients Using Anti-Snoring Devices | 140 | Individuals aged 30-60, diagnosed with sleep apnea or snoring issues |

| Healthcare Providers | 100 | Otolaryngologists, sleep specialists, and general practitioners |

| Surgeons Performing Snoring Surgery | 60 | ENT surgeons and maxillofacial surgeons with experience in sleep surgery |

| Medical Device Distributors | 50 | Sales representatives and distribution managers in the medical device sector |

| Patients Post-Surgery | 70 | Individuals who have undergone surgical treatment for snoring in the last 2 years |

The Oman Anti Snoring Devices Snoring Surgery Market is valued at approximately USD 14 million, reflecting a five-year historical analysis and benchmarking against the broader Middle East & Africa and GCC anti-snoring devices markets.