Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7004

Pages:89

Published On:October 2025

Market.png)

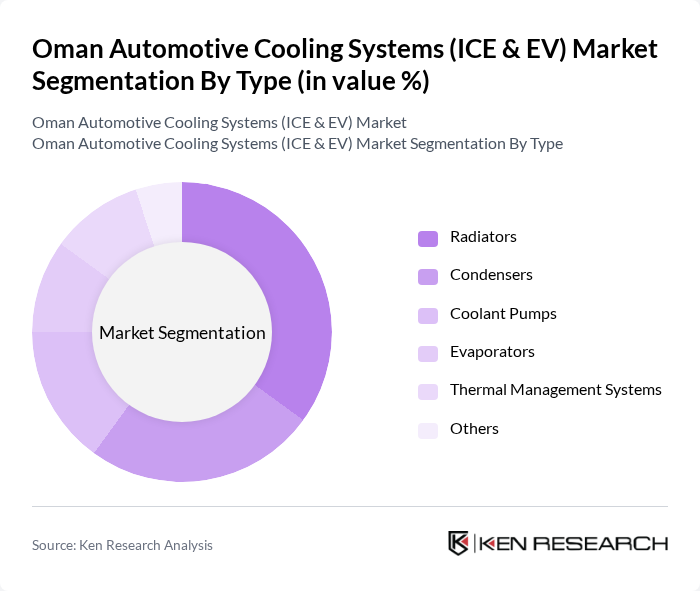

By Type:The market is segmented into various types of cooling systems, including radiators, condensers, coolant pumps, evaporators, thermal management systems, and others. Each of these components plays a crucial role in maintaining optimal engine temperatures and enhancing vehicle performance. Among these, radiators and thermal management systems are particularly significant due to their essential functions in both ICE and EV applications.

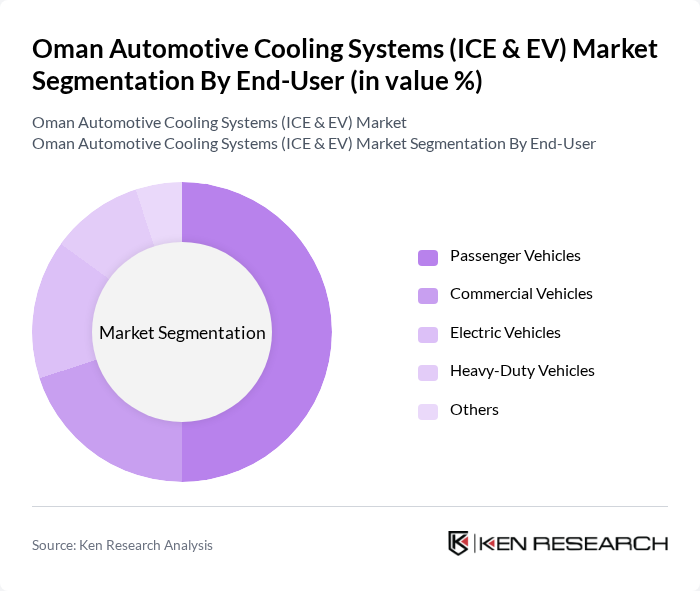

By End-User:The end-user segmentation includes passenger vehicles, commercial vehicles, electric vehicles, heavy-duty vehicles, and others. The passenger vehicle segment dominates the market due to the high volume of sales and the increasing consumer preference for personal transportation. Additionally, the rise in electric vehicle adoption is gradually shifting the focus towards specialized cooling systems designed for EVs.

The Oman Automotive Cooling Systems (ICE & EV) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mahindra & Mahindra Ltd., Tata Motors Ltd., Al-Futtaim Group, Nissan Motor Co., Ltd., Toyota Motor Corporation, Ford Motor Company, General Motors Company, Hyundai Motor Company, Kia Corporation, BMW AG, Mercedes-Benz AG, Volkswagen AG, Honda Motor Co., Ltd., Mitsubishi Motors Corporation, BYD Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive cooling systems market in Oman appears promising, driven by increasing investments in EV infrastructure and a growing emphasis on sustainability. As the government continues to implement supportive policies, the market is likely to witness a surge in the adoption of innovative cooling technologies. Additionally, the integration of smart technologies and IoT in cooling systems will enhance efficiency and performance, positioning Oman as a regional leader in automotive cooling solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Radiators Condensers Coolant Pumps Evaporators Thermal Management Systems Others |

| By End-User | Passenger Vehicles Commercial Vehicles Electric Vehicles Heavy-Duty Vehicles Others |

| By Component | Mechanical Components Electronic Components Software Components Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Retail Distribution Wholesale Distribution Direct-to-Consumer Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Application | Automotive Manufacturing Aftermarket Services Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 100 | Product Development Managers, Engineering Leads |

| Cooling System Suppliers | 80 | Sales Directors, Technical Support Engineers |

| Fleet Operators | 70 | Fleet Managers, Maintenance Supervisors |

| Regulatory Bodies | 50 | Policy Makers, Environmental Analysts |

| Automotive Aftermarket Retailers | 60 | Store Managers, Product Buyers |

The Oman Automotive Cooling Systems market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient cooling solutions in both internal combustion engine (ICE) and electric vehicles (EVs).