Region:Middle East

Author(s):Dev

Product Code:KRAA8273

Pages:88

Published On:November 2025

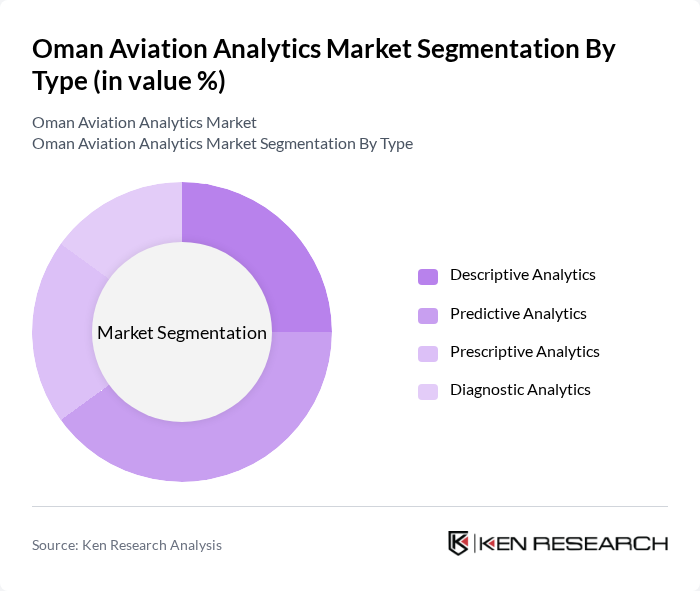

By Type:The market is segmented into four types of analytics: Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, and Diagnostic Analytics. Each type serves a unique purpose in the aviation sector, with Descriptive Analytics focusing on historical data analysis, Predictive Analytics forecasting future trends, Prescriptive Analytics recommending actions based on data, and Diagnostic Analytics identifying causes of past outcomes. Among these, Predictive Analytics is currently leading the market due to its ability to enhance operational efficiency and improve decision-making processes .

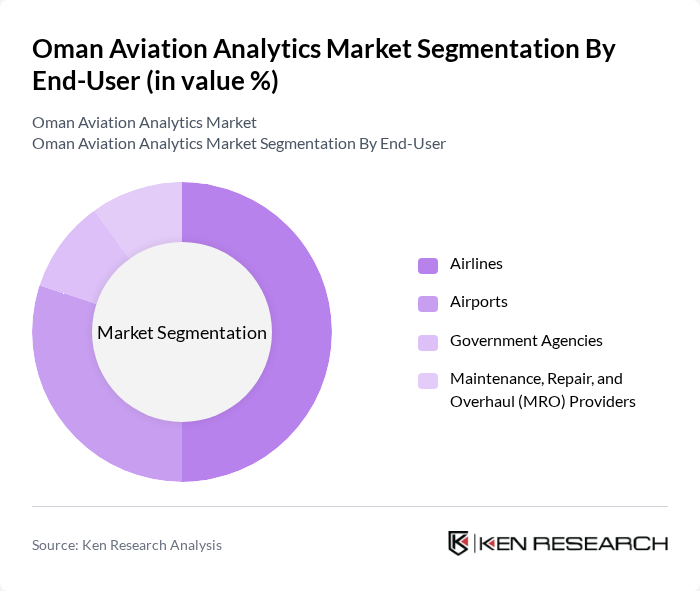

By End-User:The end-user segmentation includes Airlines, Airports, Government Agencies, and Maintenance, Repair, and Overhaul (MRO) Providers. Airlines are the dominant end-users, leveraging analytics for flight operations optimization, revenue management, and customer experience enhancement. Airports are increasingly adopting analytics to improve operational efficiency and passenger flow management, while government agencies utilize data for regulatory compliance and safety management. The MRO segment is also witnessing increased adoption of analytics for predictive maintenance and asset optimization .

The Oman Aviation Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Air, Muscat International Airport, Oman Aviation Services Co. S.A.O.G., Honeywell International Inc., IBM Corporation, SAP SE, Oracle Corporation, Boeing Company, Airbus S.A.S., Thales Group, Collins Aerospace, GE Aerospace, SITA, ADB SAFEGATE, Amadeus IT Group contribute to innovation, geographic expansion, and service delivery in this space.

The Oman aviation analytics market is poised for significant advancements, driven by technological innovations and increasing regulatory support. As the government emphasizes compliance with international aviation standards, the integration of AI and machine learning will enhance operational efficiencies. Furthermore, the focus on sustainability will encourage the adoption of eco-friendly practices, aligning with global trends. The market is expected to evolve, fostering a culture of data-driven decision-making that enhances safety and customer experience in the aviation sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Diagnostic Analytics |

| By End-User | Airlines Airports Government Agencies Maintenance, Repair, and Overhaul (MRO) Providers |

| By Application | Flight Operations Optimization Revenue Management Safety Management Fuel Management Customer Experience Analytics Inventory and Supply Chain Management |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Region | Muscat Salalah Sohar Duqm |

| By Data Source | Internal Data External Data Real-Time Data |

| By Service Type | Consulting Services Implementation Services Support and Maintenance Data Integration and Customization |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Airline Operational Analytics | 60 | Operations Managers, Data Analysts |

| Airport Performance Metrics | 50 | Airport Managers, IT Directors |

| Passenger Experience Analytics | 40 | Customer Experience Managers, Marketing Directors |

| Cargo and Freight Analytics | 40 | Cargo Managers, Logistics Coordinators |

| Regulatory Compliance Analytics | 40 | Compliance Officers, Risk Management Executives |

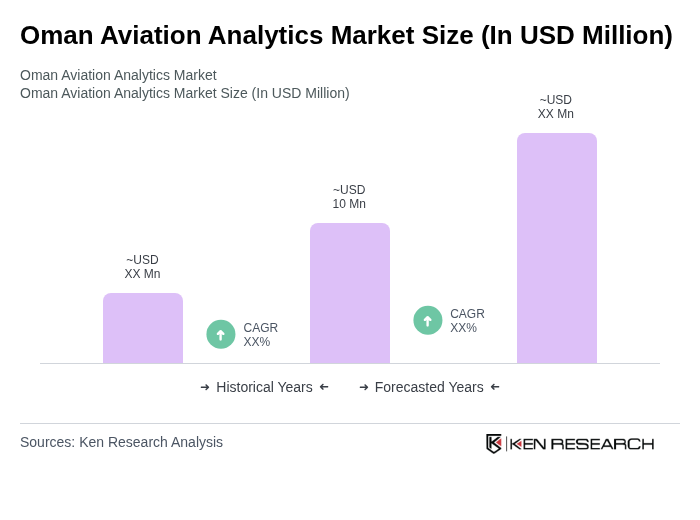

The Oman Aviation Analytics Market is valued at approximately USD 10 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for data-driven decision-making in the aviation sector, enhancing operational efficiency and customer experience.