Region:Middle East

Author(s):Rebecca

Product Code:KRAC4709

Pages:90

Published On:October 2025

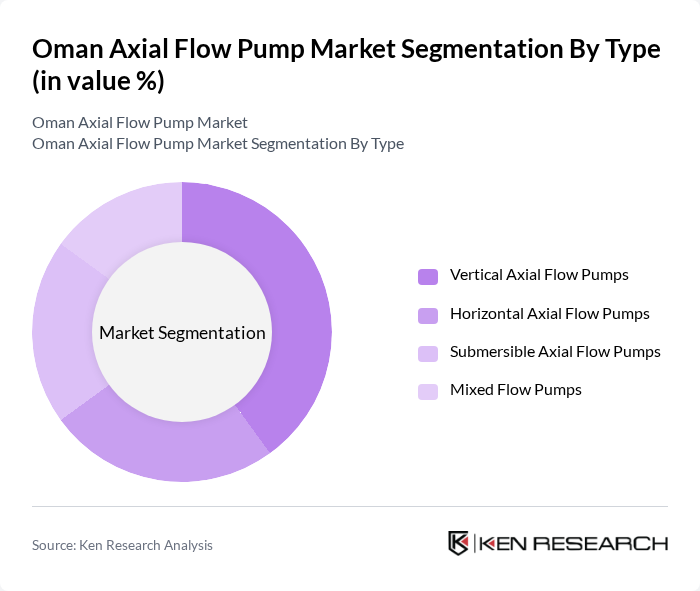

By Type:The market is segmented into vertical, horizontal, submersible, and mixed flow pumps. Each type serves specific applications and industries, catering to diverse customer needs. Among these, vertical axial flow pumps remain the most popular due to their high efficiency in handling large volumes of water, making them ideal for municipal water supply, flood control, and industrial processing. Horizontal axial flow pumps are preferred for irrigation and drainage projects where installation flexibility is required. Submersible axial flow pumps are increasingly adopted in fisheries and aquaculture, while mixed flow pumps address specialized requirements in power and mining sectors .

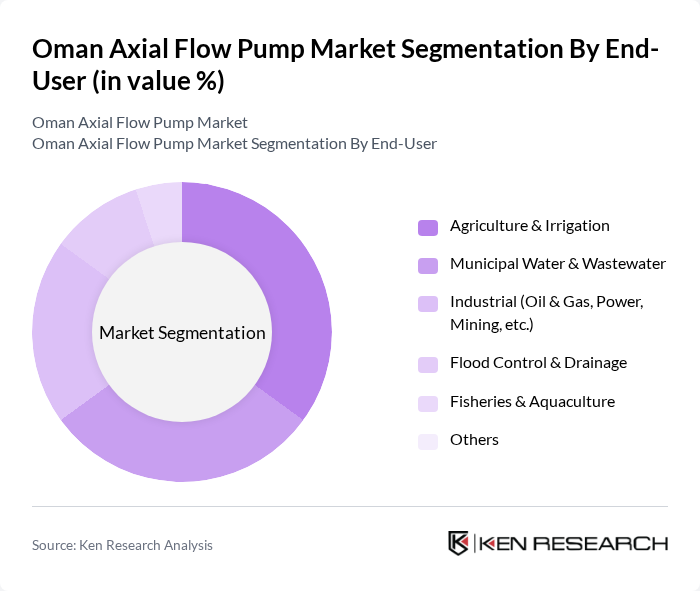

By End-User:The end-user segmentation includes agriculture & irrigation, municipal water & wastewater, industrial applications (oil & gas, power, mining), flood control & drainage, fisheries & aquaculture, and others. The agriculture and irrigation sector is the leading end-user, driven by the need for efficient water management in farming practices, especially in arid regions like Oman. Municipal water and wastewater utilities are the second-largest segment, reflecting ongoing investments in water infrastructure and compliance with new efficiency regulations. Industrial applications, including oil & gas and mining, continue to expand due to rising energy demand and process water requirements. Flood control and drainage remain critical for urban resilience, while fisheries and aquaculture are supported by government initiatives to diversify the economy .

The Oman Axial Flow Pump Market is characterized by a dynamic mix of regional and international players. Leading participants such as Xylem Inc., Grundfos Holding A/S, KSB SE & Co. KGaA, Flowserve Corporation, Sulzer Ltd., Pentair plc, Ebara Corporation, ITT Goulds Pumps, Wilo SE, The Weir Group PLC, Franklin Electric Co., Inc., Tsurumi Manufacturing Co., Ltd., HOMA Pumpenfabrik GmbH, Kirloskar Brothers Limited, Torishima Pump Mfg. Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman axial flow pump market appears promising, driven by increasing investments in water management and industrial expansion. As the government continues to prioritize infrastructure development, the demand for energy-efficient and automated pumping solutions is expected to rise. Additionally, the integration of IoT technologies in pump monitoring will enhance operational efficiency, paving the way for smarter water management practices. This trend will likely attract new players and innovations in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Vertical Axial Flow Pumps Horizontal Axial Flow Pumps Submersible Axial Flow Pumps Mixed Flow Pumps |

| By End-User | Agriculture & Irrigation Municipal Water & Wastewater Industrial (Oil & Gas, Power, Mining, etc.) Flood Control & Drainage Fisheries & Aquaculture Others |

| By Application | Irrigation Drainage Flood Control Water Supply Cooling Water Circulation Others |

| By Distribution Channel | Direct Sales Distributors/Dealers EPC Contractors Online Sales Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Component | Motor Impeller Shaft Casing Seals & Bearings Others |

| By Technology | Conventional Technology Smart/Automated Technology Energy-Efficient Technology Hybrid Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Irrigation Systems | 60 | Agronomists, Farm Managers |

| Municipal Water Supply | 50 | Water Resource Managers, City Planners |

| Industrial Applications | 40 | Plant Engineers, Operations Managers |

| Construction Projects | 40 | Project Managers, Site Engineers |

| Environmental Agencies | 40 | Environmental Scientists, Policy Makers |

The Oman Axial Flow Pump Market is valued at approximately USD 145 million, reflecting growth driven by increasing demand in agriculture, municipal water supply, and industrial applications, alongside a focus on energy-efficient technologies and infrastructure development.