Region:Middle East

Author(s):Dev

Product Code:KRAD5097

Pages:97

Published On:December 2025

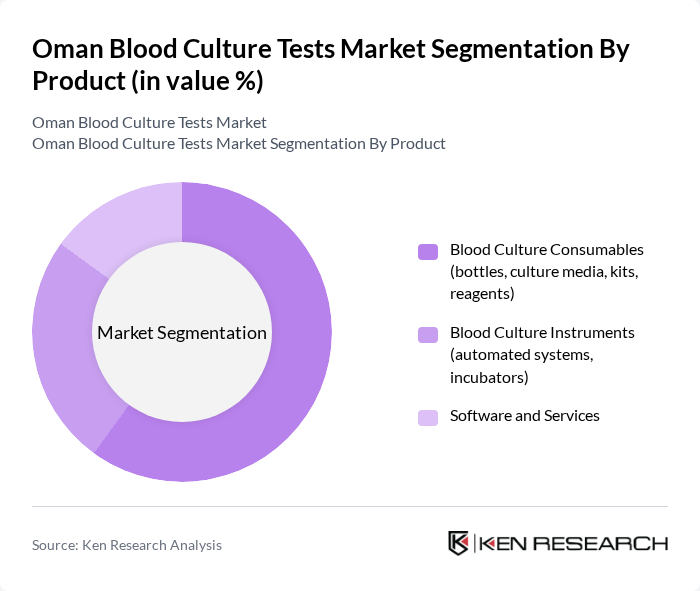

By Product:The product segmentation includes various components essential for blood culture testing. The subsegments are Blood Culture Consumables (bottles, culture media, kits, reagents), Blood Culture Instruments (automated systems, incubators), and Software and Services. Among these, Blood Culture Consumables are expected to dominate the market due to their essential role in the testing process and the continuous need for replenishment in laboratories, in line with global trends where consumables constitute the largest share of blood culture test spending.

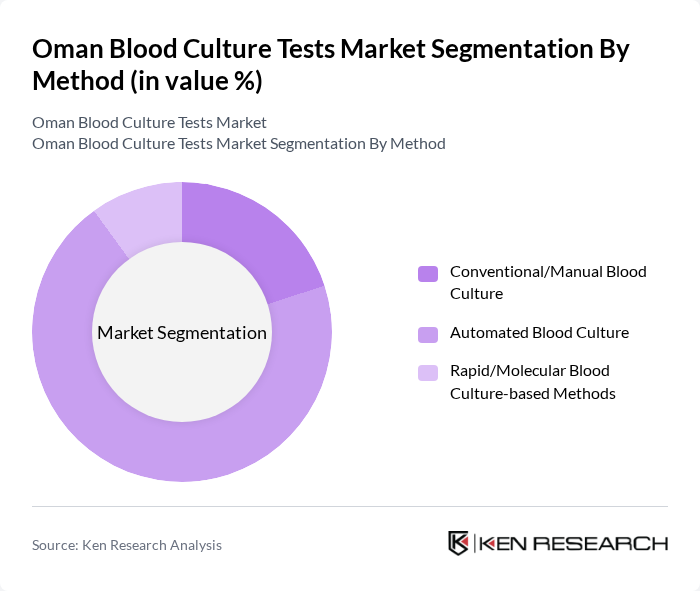

By Method:The method segmentation encompasses Conventional/Manual Blood Culture, Automated Blood Culture, and Rapid/Molecular Blood Culture-based Methods. The Automated Blood Culture method is leading the market in larger hospitals and centralized laboratories due to its efficiency, reduced turnaround time, continuous monitoring capability, and higher reproducibility compared to purely manual methods, in line with the increasing global adoption of automation in microbiology labs. Rapid/molecular methods are gaining gradual traction as adjunct tools for faster pathogen identification and antimicrobial stewardship, although they currently represent a smaller share of routine testing volumes.

The Oman Blood Culture Tests Market is characterized by a dynamic mix of regional and international players. Leading participants such as bioMérieux SA, Becton, Dickinson and Company (BD), Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd (Roche Diagnostics), Abbott Laboratories, Danaher Corporation (Beckman Coulter, Cepheid), Siemens Healthineers AG, Mindray Medical International Limited, Grifols, S.A., Sysmex Corporation, EIKEN CHEMICAL CO., LTD., Bruker Corporation, QuidelOrtho Corporation, OXOID (part of Thermo Fisher Scientific), Local and Regional Distributors (e.g., Apex Medical, National Medical Supplies, Tranzcare Oman) contribute to innovation, geographic expansion, and service delivery in this space, reflecting the broader global competitive landscape of blood culture tests where these companies are key suppliers of automated culture systems, consumables, and associated diagnostics.

The future of the blood culture tests market in Oman appears promising, driven by ongoing investments in healthcare infrastructure and technological advancements. With the government aiming to increase healthcare spending to OMR 1.2 billion in future, there will be enhanced capabilities for diagnostic testing. Additionally, the integration of artificial intelligence in diagnostic processes is expected to streamline operations and improve accuracy, further propelling market growth. The focus on personalized medicine will also shape future developments in testing methodologies.

| Segment | Sub-Segments |

|---|---|

| By Product | Blood Culture Consumables (bottles, culture media, kits, reagents) Blood Culture Instruments (automated systems, incubators) Software and Services |

| By Method | Conventional/Manual Blood Culture Automated Blood Culture Rapid/Molecular Blood Culture-based Methods |

| By Technology | Culture-based Techniques Molecular Diagnostics (PCR and syndromic panels) Proteomic and Other Emerging Technologies |

| By Application | Bacteremia and Sepsis Diagnosis Fungal Bloodstream Infections Antimicrobial Stewardship and Antibiotic Susceptibility Testing Support Others |

| By End-User | Public Hospitals (MOH and Government Hospitals) Private Hospitals and Clinics Independent Diagnostic Laboratories Academic and Research Institutions Others |

| By Distribution Channel | Direct Tender Sales to Hospitals and MOH Local Distributors and Agents Direct Sales by Multinational Manufacturers Online and E-procurement Portals |

| By Region | Muscat Governorate Dhofar Governorate Al Batinah (North & South) Interior & Other Governorates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Blood Culture Testing | 90 | Laboratory Managers, Infectious Disease Specialists |

| Private Laboratory Services | 80 | Clinical Pathologists, Operations Managers |

| Healthcare Policy Makers | 50 | Health Ministry Officials, Public Health Advisors |

| Diagnostic Equipment Suppliers | 70 | Sales Representatives, Product Managers |

| Research Institutions and Universities | 60 | Microbiology Researchers, Academic Professors |

The Oman Blood Culture Tests Market is valued at approximately USD 40 million, reflecting a five-year historical analysis and triangulation from global and regional estimates. This growth is driven by the rising prevalence of bloodstream infections and advancements in diagnostic technologies.