Region:Middle East

Author(s):Shubham

Product Code:KRAD3451

Pages:86

Published On:November 2025

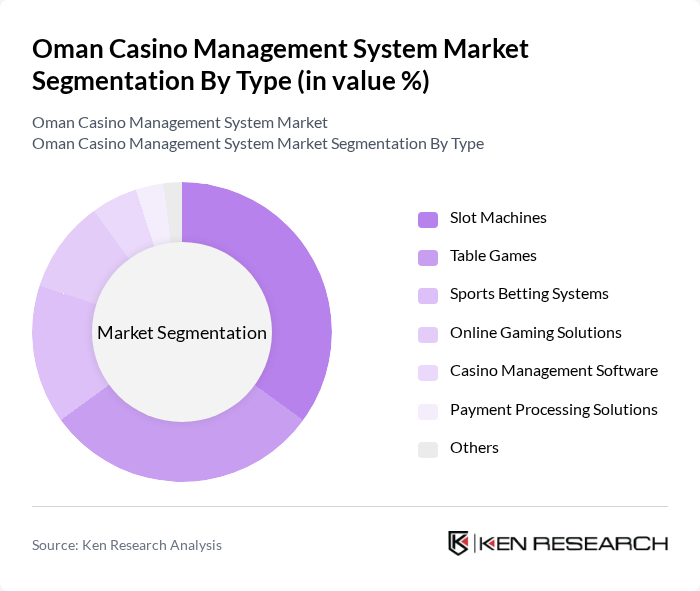

By Type:The market is segmented into various types, including Slot Machines, Table Games, Sports Betting Systems, Online Gaming Solutions, Casino Management Software, Payment Processing Solutions, and Others. Among these, Slot Machines and Table Games are the most popular, driven by consumer preferences for traditional gaming experiences. The rise of online gaming solutions has also gained traction, especially post-pandemic, as more players seek convenience and accessibility.

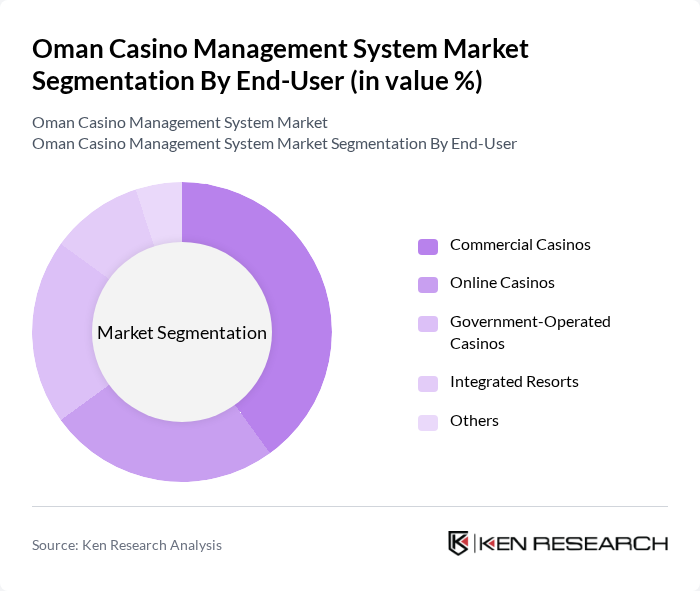

By End-User:The end-user segmentation includes Commercial Casinos, Online Casinos, Government-Operated Casinos, Integrated Resorts, and Others. Commercial Casinos dominate the market due to their established presence and the variety of gaming options they offer. Integrated Resorts are also gaining popularity as they provide a comprehensive entertainment experience, attracting a diverse clientele.

The Oman Casino Management System market is characterized by a dynamic mix of regional and international players. Leading participants such as International Game Technology (IGT), Scientific Games Corporation, Aristocrat Technologies, Everi Holdings Inc., Novomatic AG, Konami Gaming, Inc., Playtech PLC, Betsoft Gaming, Microgaming, NetEnt, Red Tiger Gaming, Ezugi, Yggdrasil Gaming, GAN PLC, 888 Holdings PLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman casino management system market appears promising, driven by increasing tourism and technological innovations. As the government continues to enhance regulatory frameworks, the market is likely to attract more international investments. Additionally, the integration of advanced technologies will cater to evolving consumer preferences, particularly among younger demographics. The focus on creating a vibrant entertainment ecosystem will further solidify Oman’s position as a competitive player in the regional gaming industry, fostering sustainable growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Slot Machines Table Games Sports Betting Systems Online Gaming Solutions Casino Management Software Payment Processing Solutions Others |

| By End-User | Commercial Casinos Online Casinos Government-Operated Casinos Integrated Resorts Others |

| By Market Segment | High-Stakes Gaming Mid-Stakes Gaming Low-Stakes Gaming Others |

| By Payment Method | Credit/Debit Cards E-Wallets Cash Transactions Cryptocurrency Others |

| By Customer Demographics | Age Groups Gender Income Levels Others |

| By Geographic Presence | Urban Areas Rural Areas Tourist Destinations Others |

| By Marketing Channel | Online Marketing Offline Marketing Partnerships and Collaborations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Casino Operators | 100 | General Managers, Operations Directors |

| Technology Providers | 75 | Product Managers, Sales Executives |

| Regulatory Authorities | 50 | Compliance Officers, Policy Makers |

| Tourism Sector Stakeholders | 60 | Tourism Board Officials, Hotel Managers |

| Market Analysts | 40 | Industry Analysts, Economic Researchers |

The Oman Casino Management System market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increased interest in gaming, tourism, and foreign investments in the region.