Region:Middle East

Author(s):Shubham

Product Code:KRAA8813

Pages:90

Published On:November 2025

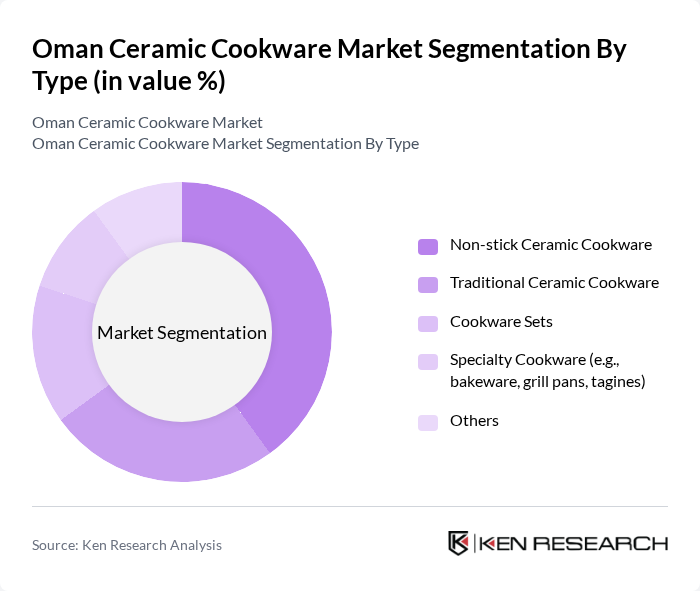

By Type:The ceramic cookware market in Oman is segmented into Non-stick Ceramic Cookware, Traditional Ceramic Cookware, Cookware Sets, Specialty Cookware (such as bakeware, grill pans, tagines), and Others. Non-stick Ceramic Cookware leads the segment, favored for its convenience, easy cleaning, and health benefits associated with PFOA-free coatings. Consumers increasingly prefer non-stick options due to their suitability for low-oil cooking and modern lifestyles. Traditional Ceramic Cookware retains a substantial share, appealing to those who value authentic cooking experiences and artisanal craftsmanship.

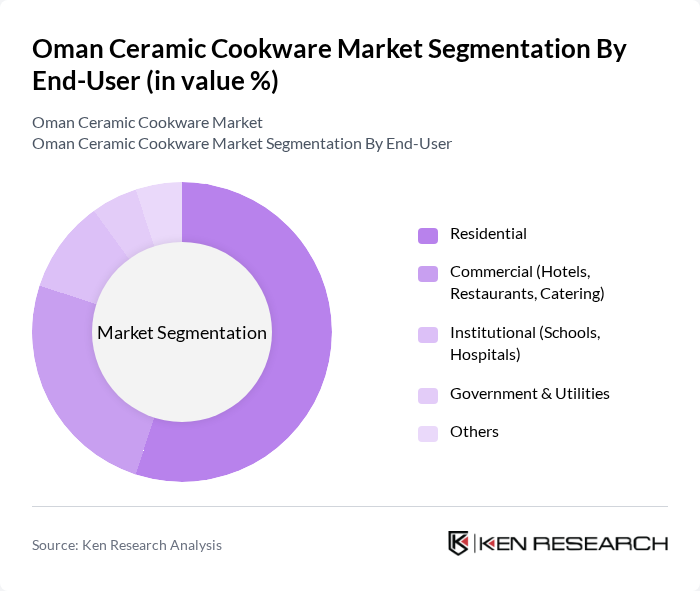

By End-User:The market is segmented by end-user into Residential, Commercial (Hotels, Restaurants, Catering), Institutional (Schools, Hospitals), Government & Utilities, and Others. The Residential segment dominates, driven by the rising number of households, increased home cooking, and consumer investment in high-quality cookware for everyday use. The Commercial segment is also expanding, as hospitality and catering businesses seek durable, health-conscious, and eco-friendly cooking solutions.

The Oman Ceramic Cookware Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tefal, GreenPan, Cuisinart, Scanpan, Pyrex, Le Creuset, Rachael Ray, Ozeri, CeraPan, Cook N Home, Bialetti, Staub, Emile Henry, Healthy Legend Cookware, GreenLife contribute to innovation, geographic expansion, and service delivery in this space.

The Oman ceramic cookware market is poised for significant growth, driven by increasing consumer awareness of health and sustainability. As disposable incomes rise, consumers are likely to invest more in high-quality cookware. Additionally, the expansion of e-commerce platforms will facilitate greater access to ceramic products. Innovations in product design and eco-friendly materials will further enhance market appeal, positioning ceramic cookware as a preferred choice among health-conscious consumers in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Non-stick Ceramic Cookware Traditional Ceramic Cookware Cookware Sets Specialty Cookware (e.g., bakeware, grill pans, tagines) Others |

| By End-User | Residential Commercial (Hotels, Restaurants, Catering) Institutional (Schools, Hospitals) Government & Utilities Others |

| By Distribution Channel | Online Retail (e-commerce platforms, brand websites) Supermarkets/Hypermarkets Specialty Stores (kitchenware, homeware stores) Direct Sales (distributors, B2B) Others |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Material Composition | Pure Ceramic Ceramic-coated (aluminum, stainless steel base) Composite Materials Others |

| By Brand Positioning | Established International Brands Regional/Middle East Brands Private Labels Others |

| By Consumer Demographics | Age Group (18-30, 31-45, 46-60, 60+) Income Level (Low, Middle, High) Lifestyle Preferences (Health-conscious, Eco-friendly, Modern/Traditional) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Cookware | 120 | Home Cooks, Culinary Enthusiasts |

| Retail Insights on Ceramic Cookware | 90 | Store Managers, Retail Buyers |

| Manufacturing Perspectives | 60 | Production Managers, Quality Control Experts |

| Distribution Channel Analysis | 50 | Logistics Coordinators, Supply Chain Managers |

| Market Trends and Innovations | 40 | Industry Analysts, Product Development Managers |

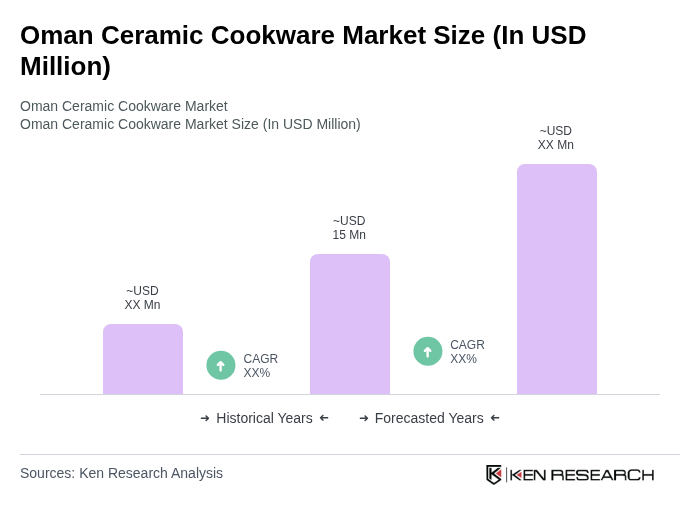

The Oman Ceramic Cookware Market is valued at approximately USD 15 million, reflecting a growing consumer preference for healthier cooking options and an increasing demand for premium kitchenware among Omani households.