Region:Middle East

Author(s):Rebecca

Product Code:KRAB8383

Pages:91

Published On:October 2025

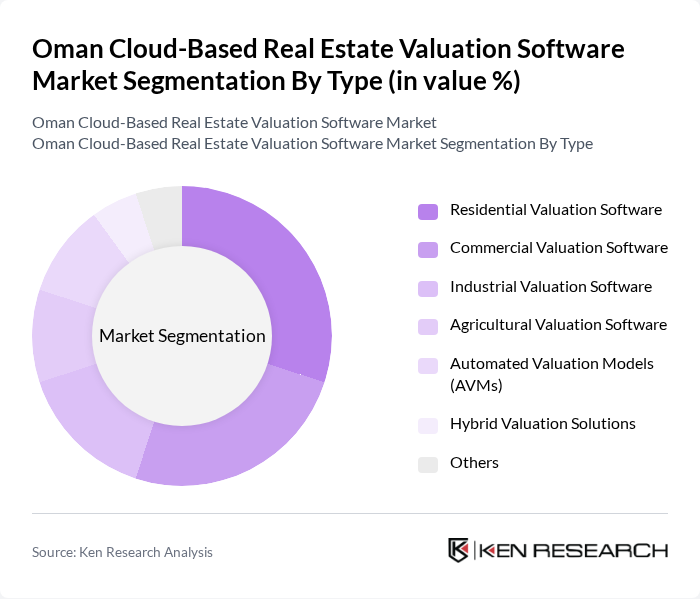

By Type:The market is segmented into various types of valuation software, including Residential Valuation Software, Commercial Valuation Software, Industrial Valuation Software, Agricultural Valuation Software, Automated Valuation Models (AVMs), Hybrid Valuation Solutions, and Others. Each of these sub-segments caters to specific needs within the real estate sector, with varying degrees of demand based on market trends and consumer preferences.

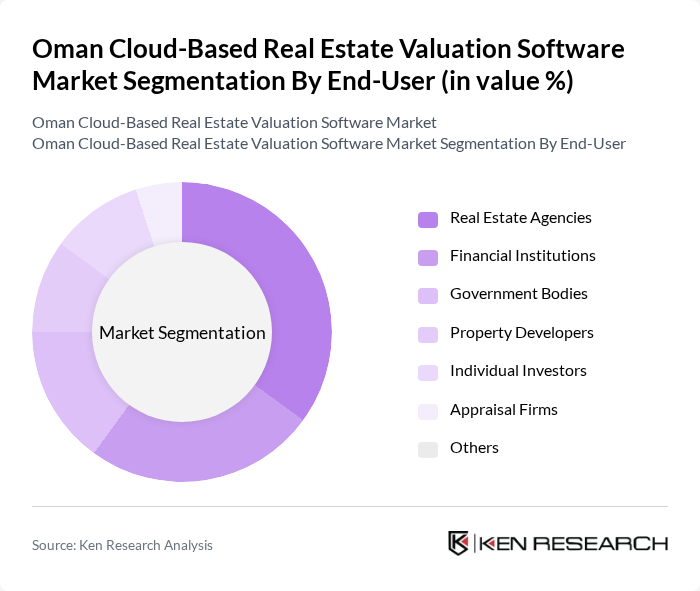

By End-User:The end-user segmentation includes Real Estate Agencies, Financial Institutions, Government Bodies, Property Developers, Individual Investors, Appraisal Firms, and Others. Each of these segments plays a crucial role in the demand for cloud-based valuation software, with varying needs and preferences influencing their choice of solutions.

The Oman Cloud-Based Real Estate Valuation Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as PropertyGuru, REA Group, Zillow, CoreLogic, and Colliers International contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman cloud-based real estate valuation software market appears promising, driven by technological advancements and increasing demand for efficiency. The integration of artificial intelligence and machine learning is expected to enhance valuation accuracy and speed, while the expansion into underserved markets will provide new growth avenues. Additionally, partnerships with real estate agencies will facilitate broader adoption, ensuring that the market remains dynamic and responsive to evolving consumer needs and regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Valuation Software Commercial Valuation Software Industrial Valuation Software Agricultural Valuation Software Automated Valuation Models (AVMs) Hybrid Valuation Solutions Others |

| By End-User | Real Estate Agencies Financial Institutions Government Bodies Property Developers Individual Investors Appraisal Firms Others |

| By Application | Residential Property Valuation Commercial Property Valuation Investment Analysis Risk Assessment Portfolio Management Tax Assessment Others |

| By Sales Channel | Direct Sales Online Platforms Distributors Partnerships with Real Estate Firms Others |

| By Distribution Mode | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions Others |

| By Pricing Model | Subscription-Based Pricing One-Time License Fee Pay-Per-Use Model Freemium Model Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Valuation | 100 | Real Estate Appraisers, Property Managers |

| Commercial Real Estate Transactions | 80 | Commercial Brokers, Investment Analysts |

| Cloud Software Adoption in Real Estate | 70 | IT Managers, Software Developers |

| Market Trends in Real Estate Valuation | 90 | Market Researchers, Real Estate Analysts |

| End-User Experience with Valuation Software | 60 | Real Estate Agents, Property Investors |

The Oman Cloud-Based Real Estate Valuation Software Market is valued at approximately USD 45 million, reflecting a significant growth trend driven by the increasing adoption of digital solutions and the demand for accurate property valuations in the real estate sector.