Region:Middle East

Author(s):Rebecca

Product Code:KRAA9346

Pages:91

Published On:November 2025

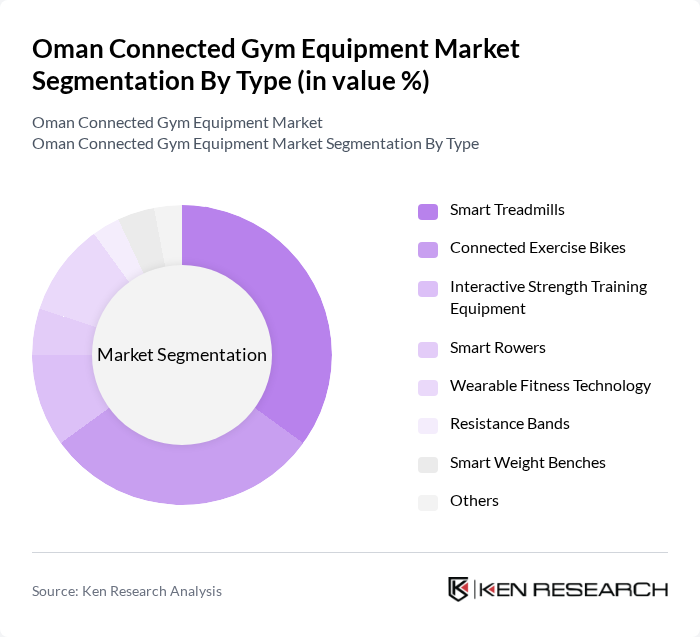

By Type:The market is segmented into Smart Treadmills, Connected Exercise Bikes, Interactive Strength Training Equipment, Smart Rowers, Wearable Fitness Technology, Resistance Bands, Smart Weight Benches, and Others. Smart Treadmills and Connected Exercise Bikes lead the market, driven by their popularity among residential and commercial users. The surge in home workouts, accelerated by digital fitness platforms and app integration, has significantly increased demand for equipment offering connectivity, real-time feedback, and personalized training features .

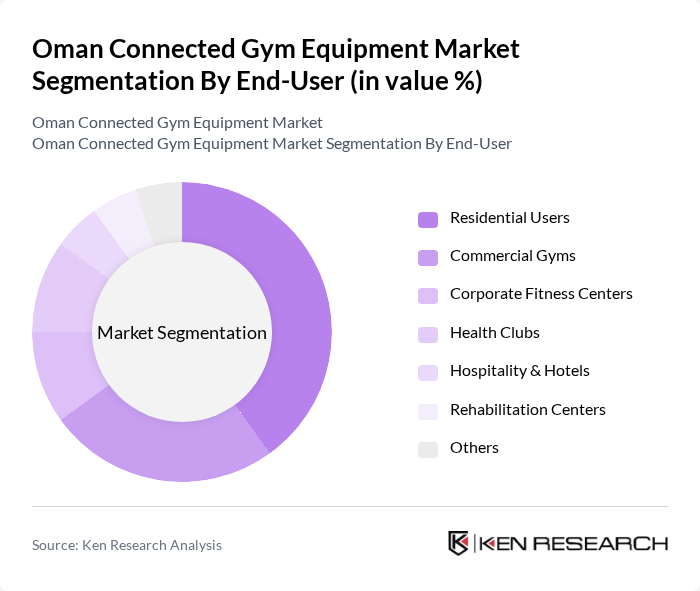

By End-User:The end-user segmentation includes Residential Users, Commercial Gyms, Corporate Fitness Centers, Health Clubs, Hospitality & Hotels, Rehabilitation Centers, and Others. Residential Users currently dominate the market, propelled by the increasing adoption of home fitness solutions and digital workout platforms. The COVID-19 pandemic has further accelerated this trend, with consumers preferring connected gym equipment that enables remote coaching, personalized routines, and integration with fitness apps for enhanced convenience and safety .

The Oman Connected Gym Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Technogym, Peloton, Life Fitness, NordicTrack (ICON Health & Fitness), Bowflex (Nautilus, Inc.), Echelon Fitness, ProForm (ICON Health & Fitness), Cybex International, Precor (Peloton Interactive, Inc.), Matrix Fitness (Johnson Health Tech), Octane Fitness (Nautilus, Inc.), Sole Fitness, Schwinn Fitness (Nautilus, Inc.), True Fitness, Star Trac (Core Health & Fitness) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman connected gym equipment market appears promising, driven by increasing health consciousness and technological advancements. As the government continues to promote fitness initiatives, the market is likely to see a rise in consumer engagement. Additionally, the integration of AI and virtual fitness solutions will enhance user experiences, making workouts more personalized and effective. This evolving landscape suggests a robust growth trajectory, with opportunities for innovation and collaboration within the fitness industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Treadmills Connected Exercise Bikes Interactive Strength Training Equipment Smart Rowers Wearable Fitness Technology Resistance Bands Smart Weight Benches Others |

| By End-User | Residential Users Commercial Gyms Corporate Fitness Centers Health Clubs Hospitality & Hotels Rehabilitation Centers Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Fitness Equipment Distributors Others |

| By Price Range | Budget-Friendly Equipment Mid-Range Equipment Premium Equipment Others |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Driven Consumers Others |

| By Technological Features | AI-Enabled Equipment App-Connected Devices Virtual Coaching Features Biometric Sensors Integration NFC/RFID Connectivity Cloud-Based Data Analytics Others |

| By User Demographics | Age Group (18-25, 26-35, 36-50, 51+) Gender (Male, Female) Fitness Level (Beginner, Intermediate, Advanced) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Gym Equipment Purchases | 60 | Gym Owners, Fitness Center Managers |

| Home Fitness Equipment Adoption | 50 | Home Gym Users, Fitness Enthusiasts |

| Corporate Wellness Programs | 40 | HR Managers, Corporate Wellness Coordinators |

| Connected Fitness Technology Trends | 45 | Fitness Tech Developers, Product Managers |

| Consumer Preferences in Fitness Equipment | 55 | Personal Trainers, Fitness Influencers |

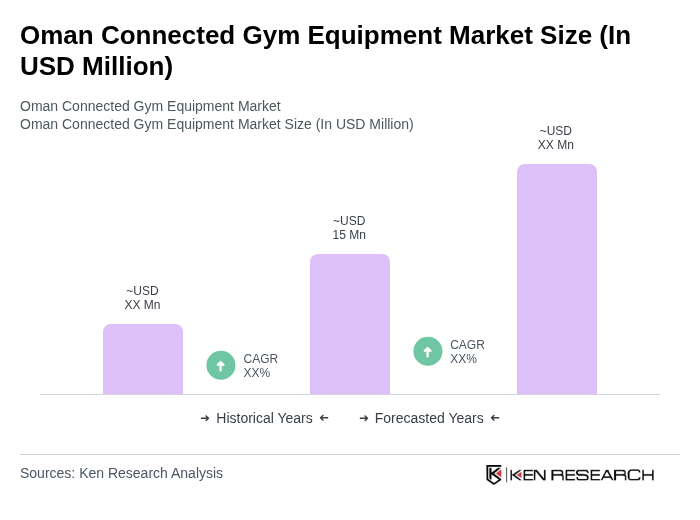

The Oman Connected Gym Equipment Market is valued at approximately USD 15 million, reflecting its share within the broader fitness equipment and services market, which is experiencing significant growth due to rising health consciousness and increased disposable incomes.