Region:Middle East

Author(s):Dev

Product Code:KRAA9611

Pages:92

Published On:November 2025

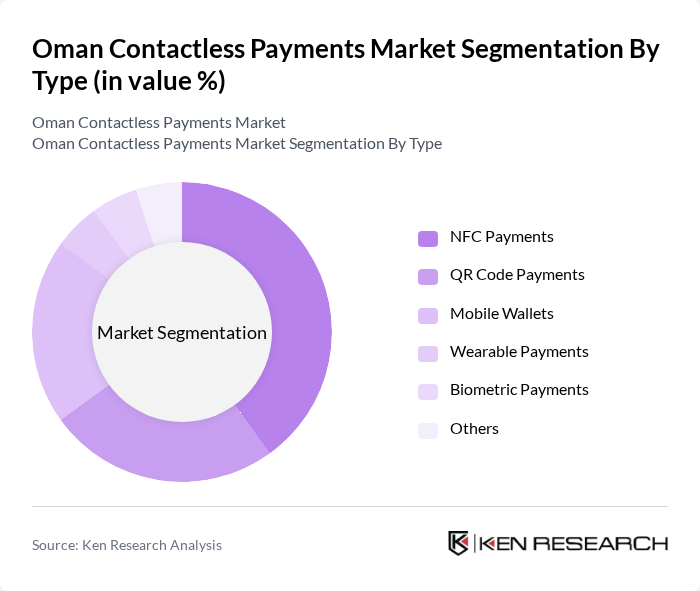

By Type:The market is segmented into various types of contactless payment methods, including NFC Payments, QR Code Payments, Mobile Wallets, Wearable Payments, Biometric Payments, and Others. Among these, NFC Payments are currently leading the market due to their widespread acceptance and ease of use in retail environments. Mobile Wallets are also gaining traction as consumers increasingly prefer the convenience of managing multiple payment options through their smartphones. The growing trend of digital wallets is reshaping consumer behavior, with a significant shift towards contactless transactions for everyday purchases.

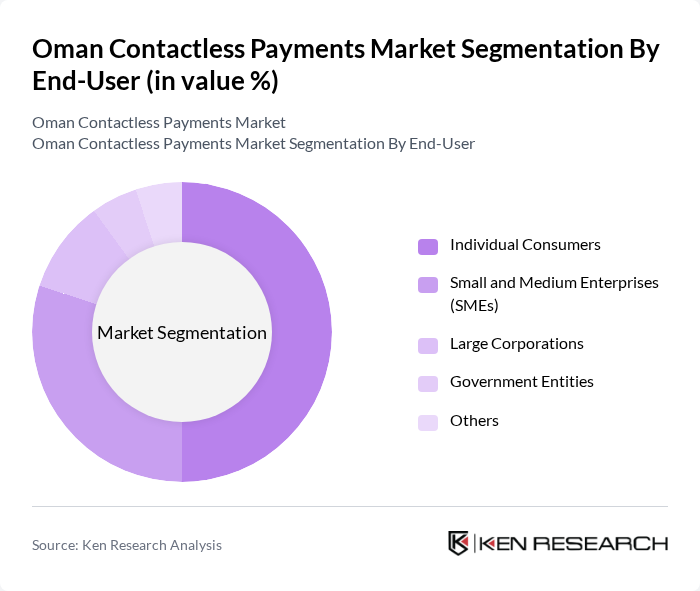

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Government Entities, and Others. Individual Consumers dominate the market, driven by the increasing preference for contactless payments for daily transactions. SMEs are also rapidly adopting these technologies to enhance customer experience and streamline operations. The growing trend of digitalization among businesses is further propelling the adoption of contactless payment solutions across various sectors.

The Oman Contactless Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bank Muscat, National Bank of Oman, Sohar International, Bank Dhofar, Oman Arab Bank, Ahli Bank, HSBC Bank Oman, Ooredoo Oman, Thawani Technologies, Fatora, PayFort (Amazon Payment Services), Visa, Mastercard, Apple Pay, Samsung Pay contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman contactless payments market appears promising, driven by technological advancements and evolving consumer preferences. As biometric authentication methods gain traction, security concerns may diminish, encouraging wider adoption. Additionally, the integration of artificial intelligence in payment processing is expected to enhance transaction efficiency and user experience. With ongoing government support and increasing digital literacy, the market is poised for significant growth, paving the way for a more cashless society in Oman.

| Segment | Sub-Segments |

|---|---|

| By Type | NFC Payments QR Code Payments Mobile Wallets Wearable Payments Biometric Payments Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities Others |

| By Merchant Type | Large Enterprises Small and Medium Enterprises Online Merchants Government Service Providers Others |

| By Payment Method | Contactless Cards Mobile Payments In-App Payments Wearable Device Payments Others |

| By Industry Vertical | Retail and E-commerce Transportation and Logistics Hospitality and Tourism Healthcare Entertainment and Leisure Others |

| By Consumer Demographics | Age Group Income Level Urban vs Rural Others |

| By Technology Adoption | Early Adopters Mainstream Users Late Adopters Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Adoption | 100 | Store Managers, Payment System Administrators |

| Banking Sector Insights | 80 | Product Managers, Digital Banking Executives |

| Consumer Behavior Analysis | 120 | General Consumers, Tech-Savvy Users |

| Fintech Innovations | 60 | Startup Founders, Technology Officers |

| Government Regulatory Impact | 40 | Policy Makers, Regulatory Affairs Specialists |

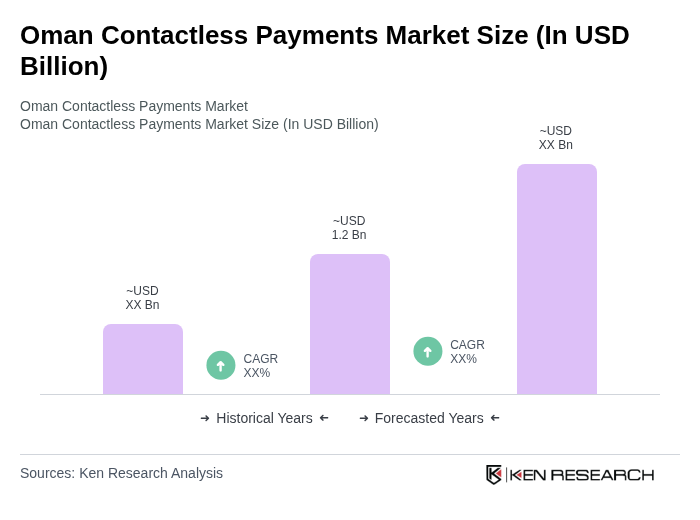

The Oman Contactless Payments Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital payment solutions and a shift towards cashless transactions, particularly accelerated by the COVID-19 pandemic.