Oman Fertility Supplements Market Overview

- The Oman Fertility Supplements Market is valued at USD 18 million, based on a five-year historical analysis and triangulation with the broader vitamins and minerals segment and prenatal vitamin supplement market in Oman. This growth is primarily driven by increasing awareness of fertility issues, rising disposable incomes, and a growing trend towards natural and organic products at both global and regional levels. The demand for fertility supplements has surged as more couples seek assistance in conception and adopt self-care solutions alongside clinical fertility treatments, leading to a robust market environment.

- Key cities such as Muscat and Salalah dominate the market due to their higher population density, concentration of private and public fertility clinics, and better access to pharmacies and modern retail channels. The urban population in these areas is more likely to invest in health and wellness products, including fertility and prenatal supplements, driven by changing lifestyles, delayed parenthood, and increased health consciousness among working-age adults.

- In 2023, the Omani authorities continued to apply a structured framework under which all dietary and fertility supplements imported or marketed in the country must be registered and approved by the Directorate General of Pharmaceutical Affairs and Drug Control under the Ministry of Health, in line with the Pharmacy and Drug Control Law promulgated by Royal Decree No. 41/96 and its implementing regulations. This framework covers product registration, labeling, quality and safety documentation, and licensing of importers and pharmacies, which supports product safety, efficacy claims review, and more responsible marketing practices in the fertility supplements segment.

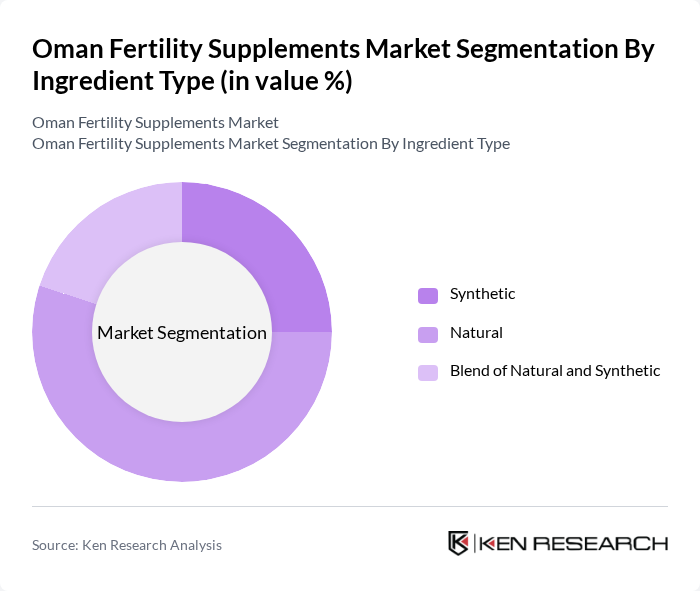

Oman Fertility Supplements Market Segmentation

By Ingredient Type:The market is segmented into three main ingredient types: Synthetic, Natural, and Blend of Natural and Synthetic, in line with global fertility supplements segmentation. The Natural segment is currently dominating the market due to increasing consumer preference for plant-based, herbal, and micronutrient-rich formulations that are perceived as cleaner-label and holistic. Consumers are becoming more health-conscious and are inclined towards supplements that are perceived as safer and more effective for long-term use, particularly those containing vitamins, minerals, antioxidants, omega-3s, and botanicals associated with reproductive health. This trend is further supported by the growing body of global research highlighting the role of nutrients such as folate, vitamin D, CoQ10, zinc, selenium, and myo-inositol in supporting fertility outcomes, which influences product positioning and ingredient choice in Oman.

By Product Type:The product types include Capsules, Tablets, Soft Gels, Powders, and Liquids and Gummies, consistent with the global fertility supplements product mix. Capsules are leading the market segment due to their convenience, accurate dosing, better stability for multi-ingredient formulas, and higher consumer acceptance in the fertility and prenatal space. The trend towards personalized health solutions and doctor-formulated fertility protocols has also led to an increase in the availability of specialized capsule products targeting issues such as ovulatory disorders, sperm quality, and egg health, further driving their popularity.

Oman Fertility Supplements Market Competitive Landscape

The Oman Fertility Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vitabiotics Ltd. (Wellman & Wellwoman Conception), Bayer AG (Elevit & Menevit), GNC Holdings LLC, Pfizer Inc. (Centrum & Prenatal Lines), Ritual, NOW Foods, Orthomol pharmazeutische Vertriebs GmbH, Fairhaven Health LLC, Nordic Naturals, TTK Healthcare Ltd., Abbott Laboratories (Oman), New Chapter, Inc., Swisse Wellness Pty Ltd., Solgar Inc., Herbalife Nutrition Ltd. contribute to innovation, geographic expansion, and service delivery in this space, supported by a broader regional shift towards over-the-counter fertility and prenatal nutrition solutions.

Oman Fertility Supplements Market Industry Analysis

Growth Drivers

- Increasing Awareness of Fertility Health:The awareness of fertility health in Oman has significantly increased, with over 60% of couples actively seeking information on fertility-related issues. This trend is supported by the rise in health campaigns and educational programs, which have seen a 40% increase in participation since 2020. The Ministry of Health reported that 1 in 6 couples in Oman face infertility, driving demand for fertility supplements as couples seek solutions to enhance reproductive health.

- Rising Infertility Rates:Infertility rates in Oman have escalated, with approximately 15% of couples experiencing difficulties in conceiving, according to the World Health Organization. This statistic reflects a broader trend observed in the Middle East, where lifestyle changes and environmental factors contribute to reproductive health issues. The increasing prevalence of infertility has led to a heightened demand for fertility supplements, as couples look for effective ways to improve their chances of conception.

- Growth in Disposable Income:The average disposable income in Oman is projected to reach OMR 1,260 per capita in future, reflecting a 5% increase from the previous period. This rise in disposable income allows consumers to invest more in health and wellness products, including fertility supplements. As more individuals prioritize their reproductive health, the market for fertility supplements is expected to expand, driven by consumers' willingness to spend on quality health products that promise better outcomes.

Market Challenges

- High Competition Among Brands:The Oman fertility supplements market is characterized by intense competition, with over 50 brands vying for market share. This saturation makes it challenging for new entrants to establish themselves. Established brands dominate the market, holding approximately 70% of the total market share. This competitive landscape pressures pricing strategies and marketing efforts, making it difficult for smaller companies to gain traction and visibility.

- Regulatory Hurdles:The regulatory environment for fertility supplements in Oman is stringent, with the Ministry of Health enforcing strict guidelines on product approval and labeling. Companies must navigate complex approval processes, which can take up to 12 months. Additionally, compliance with advertising regulations poses challenges, as misleading claims can lead to penalties. These hurdles can delay product launches and increase operational costs, impacting market entry strategies for new players.

Oman Fertility Supplements Market Future Outlook

The future of the Oman fertility supplements market appears promising, driven by increasing consumer awareness and a growing focus on holistic health. As more individuals prioritize reproductive health, the demand for innovative and effective supplements is expected to rise. Additionally, the integration of technology in marketing and distribution channels will enhance accessibility, allowing brands to reach a broader audience. This evolving landscape presents opportunities for growth and innovation in product offerings tailored to consumer needs.

Market Opportunities

- Development of Organic and Natural Supplements:There is a growing consumer preference for organic and natural fertility supplements, with the market for such products expected to grow by 20% annually. This trend is driven by health-conscious consumers seeking safer alternatives. Companies that invest in developing organic formulations can tap into this lucrative segment, catering to the increasing demand for clean-label products.

- Collaborations with Healthcare Providers:Collaborating with healthcare providers can enhance brand credibility and consumer trust. Approximately 30% of consumers prefer recommendations from healthcare professionals when choosing supplements. By partnering with clinics and fertility specialists, brands can effectively reach target audiences, improve product visibility, and drive sales through trusted endorsements, ultimately expanding their market presence.