Region:Middle East

Author(s):Geetanshi

Product Code:KRAD8239

Pages:82

Published On:December 2025

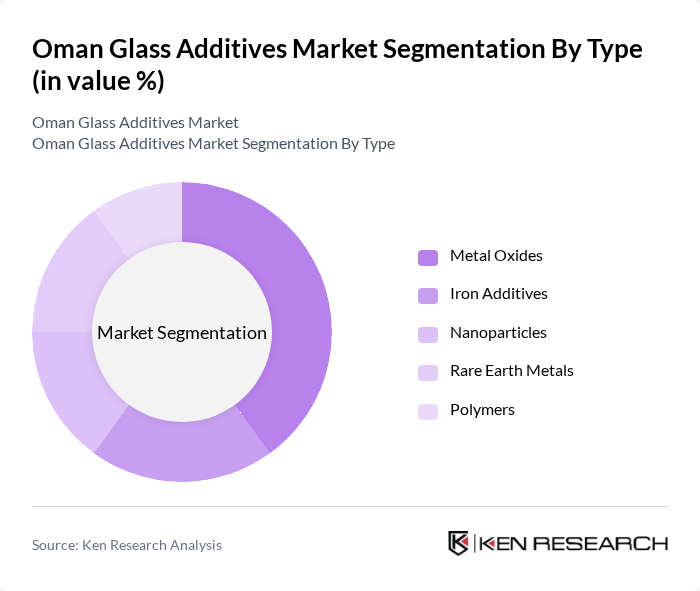

By Type:The market is segmented into various types of glass additives, including Metal Oxides, Iron Additives, Nanoparticles, Rare Earth Metals, and Polymers. Each of these subsegments plays a crucial role in enhancing the properties of glass products, such as durability, thermal resistance, and aesthetic appeal. Among these, Metal Oxides are particularly dominant due to their widespread application in improving the strength and clarity of glass, making them essential in the manufacturing process.

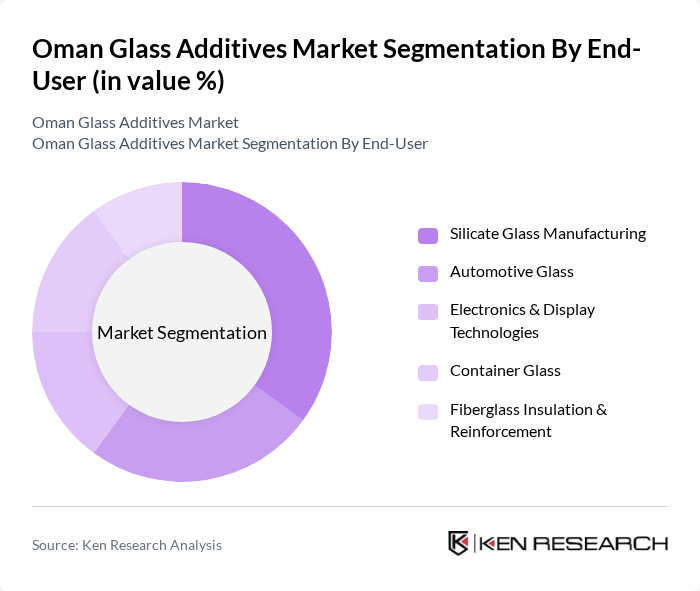

By End-User:The end-user segmentation includes Silicate Glass Manufacturing, Automotive Glass, Electronics & Display Technologies, Container Glass, and Fiberglass Insulation & Reinforcement. The Silicate Glass Manufacturing segment is leading the market due to the high demand for silicate glass in construction and architectural applications. This segment benefits from the growing construction industry in Oman, which is driving the need for high-quality glass products. Container glass applications are also expanding, supported by growth in beverage bottling and pharmaceutical vial production within emerging industrial zones.

The Oman Glass Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Glass Company SAOG, Gulf Glass Manufacturing Company K.S.C., Al Jazeera Glass Products LLC, National Glass Company SAOG, Al Anwar Ceramic Tiles Company SAOG, GlassPoint Solar Inc., Oman National Engineering & Investment Company SAOG, Al-Futtaim Engineering (Oman Branch), Al Mufeed Glass Factory LLC, Al Muna Glass LLC, Oman Glass Industries LLC, Saint-Gobain (Middle East), Guardian Glass (Middle East & Africa), AGC Glass (Asia & Middle East), and Isecam Flat Glass (Middle East) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman glass additives market is poised for significant growth, driven by increasing investments in infrastructure and a shift towards sustainable practices. As the construction sector expands, the demand for high-quality, eco-friendly glass products will rise. Additionally, technological advancements will facilitate the development of innovative glass solutions, enhancing energy efficiency and performance. The market is expected to adapt to these trends, positioning itself for a competitive edge in the regional landscape while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Metal Oxides Iron Additives Nanoparticles Rare Earth Metals Polymers |

| By End-User | Silicate Glass Manufacturing Automotive Glass Electronics & Display Technologies Container Glass Fiberglass Insulation & Reinforcement |

| By Application | Architectural Glass (Facades & Curtain Walls) Automotive Glass Optical Glass (Lenses & Prisms) Specialty Glass (Bioglass, Photochromic) Container & Packaging Glass |

| By Distribution Channel | Direct Sales (B2B) Distributors & Dealers Online Sales Specialty Retailers Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| By Product Form | Powder Granules Liquid Others |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Glass Additives | 100 | Project Managers, Procurement Officers |

| Automotive Glass Manufacturing | 80 | Production Supervisors, Quality Control Managers |

| Architectural Glass Applications | 70 | Architects, Design Engineers |

| Consumer Glass Products | 60 | Product Development Managers, Marketing Executives |

| Industrial Glass Solutions | 90 | Operations Managers, Supply Chain Analysts |

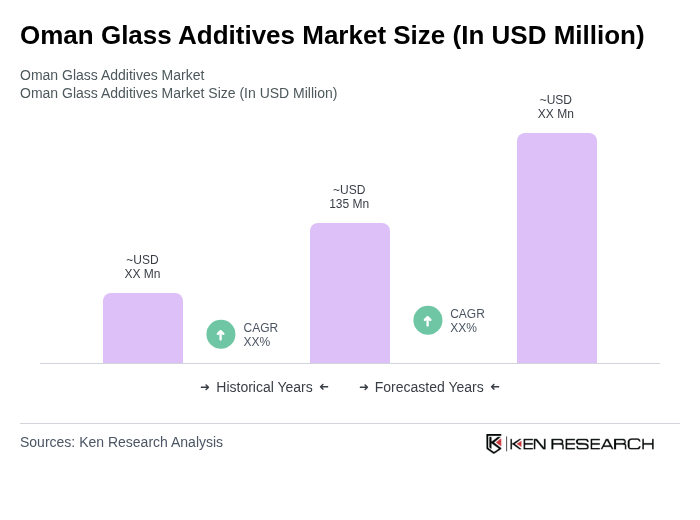

The Oman Glass Additives Market is valued at approximately USD 135 million, driven by the increasing demand for high-quality glass products across various sectors, including construction, automotive, and electronics.