Region:Middle East

Author(s):Dev

Product Code:KRAA8353

Pages:92

Published On:November 2025

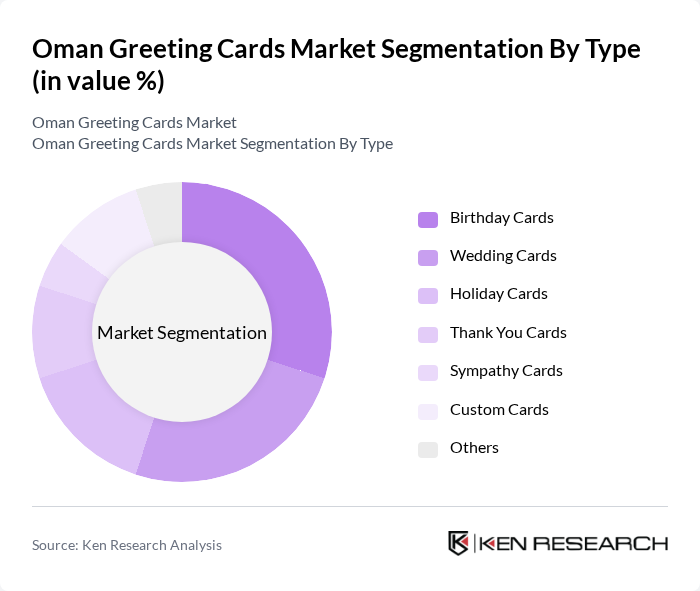

By Type:The greeting cards market is segmented into Birthday Cards, Wedding Cards, Holiday Cards, Thank You Cards, Sympathy Cards, Custom Cards, and Others. Birthday Cards and Wedding Cards are particularly popular due to their frequent use in personal and family celebrations. Demand for Custom Cards is increasing as consumers seek personalized options reflecting unique sentiments and cultural motifs .

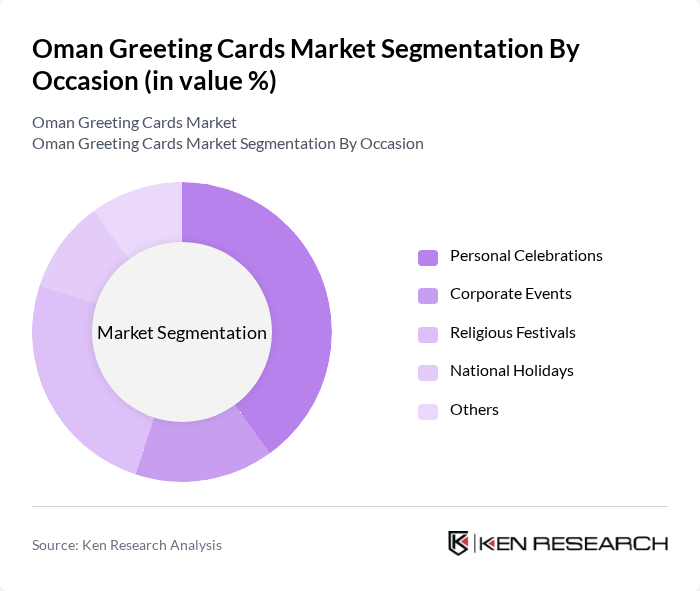

By Occasion:The market is also segmented by occasion, including Personal Celebrations, Corporate Events, Religious Festivals (Eid, Ramadan, National Day, etc.), National Holidays, and Others. Personal Celebrations dominate the market, reflecting the cultural importance of birthdays, weddings, and family milestones. Religious Festivals are a significant driver of sales, with cards exchanged among family and friends during these events .

The Oman Greeting Cards Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Greeting Cards Co., Al Noor Cards, Muscat Greetings, Creative Cards Oman, Omani Card Makers, Gulf Greetings LLC, Al Harthy Cards, Majan Cards, Oman Art Cards, Al Fawaz Cards, Dar Al Hekma Cards, Al Jazeera Cards, Al Muna Cards, Al Shams Cards, Oman Creative Designs, Hallmark Cards (Oman distributor), and American Greetings (Oman distributor) contribute to innovation, geographic expansion, and service delivery in this space .

The Oman greeting cards market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As personalization and sustainability become increasingly important, manufacturers are likely to innovate their offerings. The integration of augmented reality features in cards and the expansion of online sales channels will further enhance consumer engagement. Additionally, the cultural significance of greeting cards in Oman will continue to support market resilience, ensuring a steady demand for both traditional and modern card solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Birthday Cards Wedding Cards Holiday Cards Thank You Cards Sympathy Cards Custom Cards Others |

| By Occasion | Personal Celebrations Corporate Events Religious Festivals (Eid, Ramadan, National Day, etc.) National Holidays Others |

| By Distribution Channel | Online Retail (e.g., Namshi, Noon, Amazon.ae, local e-commerce) Supermarkets and Hypermarkets (e.g., Lulu Hypermarket, Carrefour Oman) Specialty Stores (stationery and card shops) Gift Shops Others |

| By Material | Paper Cards Eco-friendly Cards (recycled, FSC-certified, biodegradable) Recycled Cards Others |

| By Design | Traditional Omani Designs (calligraphy, local motifs) Modern Designs Artistic Designs (collaborations with Omani artists) Others |

| By Target Audience | Children Adults Corporates Tourists/Expatriates Others |

| By Price Range | Budget Cards Mid-range Cards Premium Cards (handmade, luxury finishes) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Greeting Card Sales | 100 | Store Managers, Retail Buyers |

| Online Greeting Card Purchases | 60 | eCommerce Managers, Digital Marketing Specialists |

| Consumer Preferences for Card Designs | 90 | General Consumers, Graphic Designers |

| Corporate Greeting Card Usage | 50 | Corporate Gifting Managers, HR Representatives |

| Seasonal Greeting Card Trends | 40 | Marketing Managers, Trend Analysts |

The Oman Greeting Cards Market is valued at approximately USD 38 million, reflecting a steady demand driven by cultural traditions, consumer spending on personalized gifts, and the growth of e-commerce platforms facilitating card purchases.