Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2384

Pages:98

Published On:October 2025

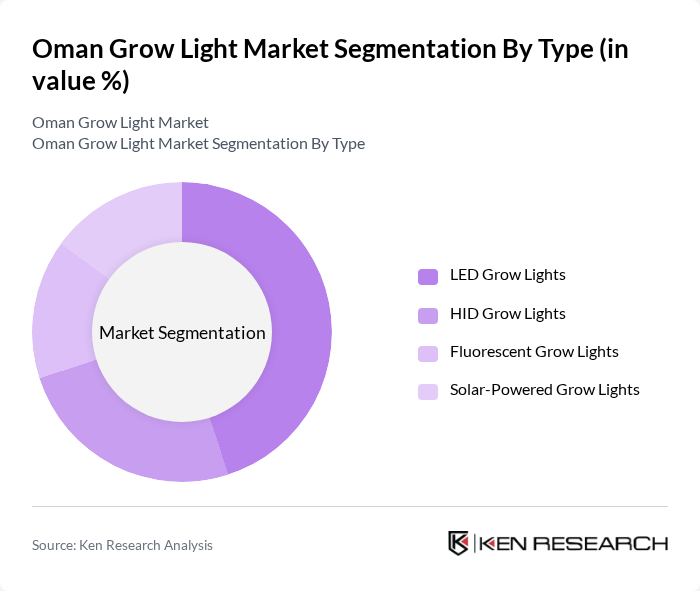

By Type:The market is segmented into LED Grow Lights, HID Grow Lights, Fluorescent Grow Lights, and Solar-Powered Grow Lights. LED Grow Lights are leading the market due to their superior energy efficiency, longer operational lifespan, and rapidly declining costs, making them the preferred choice for both commercial and residential users. The drive toward sustainable farming and regulatory support for energy-efficient solutions have further accelerated the adoption of LED technology, as it significantly reduces electricity consumption while providing optimal light spectra for plant growth .

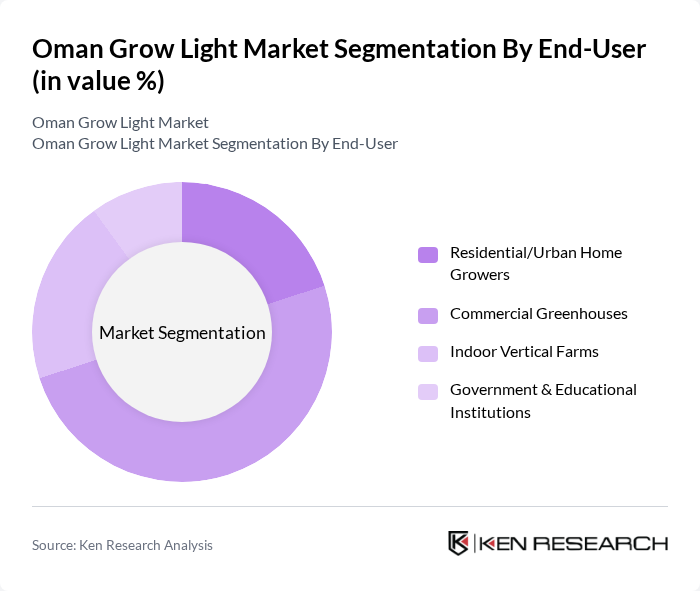

By End-User:The end-user segmentation includes Residential/Urban Home Growers, Commercial Greenhouses, Indoor Vertical Farms, and Government & Educational Institutions. Commercial Greenhouses dominate this segment, driven by the increasing need for year-round crop production and the ability to precisely control growing conditions. The trend toward local food production and the expansion of urban agriculture have led to a surge in greenhouse installations, making them a significant contributor to overall market growth .

The Oman Grow Light Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify (Philips Lighting), OSRAM GmbH, Heliospectra AB, Gavita International B.V., Black Dog LED, Horticulture Lighting Group, VIVOSUN, Mars Hydro, Samsung Electronics, EVERLIGHT Electronics Co., Ltd., Bridgelux, Inc., Savant Systems, Inc., Smart Global Holdings, Inc., AgroLED, and local Omani distributor Al Maha Agricultural Supplies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman grow light market appears promising, driven by increasing urbanization and a growing focus on food security. As the government continues to invest in agricultural technology, the integration of smart farming solutions is expected to rise. Additionally, the trend towards organic farming will likely enhance the demand for energy-efficient grow lights. With ongoing education and awareness campaigns, more farmers may transition to modern practices, fostering a sustainable agricultural landscape in Oman.

| Segment | Sub-Segments |

|---|---|

| By Type | LED Grow Lights HID Grow Lights Fluorescent Grow Lights Solar-Powered Grow Lights |

| By End-User | Residential/Urban Home Growers Commercial Greenhouses Indoor Vertical Farms Government & Educational Institutions |

| By Application | Hydroponics Greenhouses Indoor Gardens Vertical Farming |

| By Distribution Channel | Online Retail Specialty Agricultural Suppliers Direct B2B Sales Offline Retail |

| By Price Range | Budget Mid-Range Premium |

| By Component | Lighting Fixtures Control Systems Reflectors Sensors & IoT Modules |

| By Technology | Smart Lighting Systems Manual Lighting Automated Lighting Controls Energy-Efficient Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Greenhouse Operators | 100 | Greenhouse Managers, Agricultural Technicians |

| Retail Grow Light Distributors | 60 | Sales Managers, Product Specialists |

| Indoor Farming Startups | 40 | Founders, Operations Managers |

| Home Gardening Enthusiasts | 50 | Hobbyist Gardeners, Home Improvement Retailers |

| Agricultural Research Institutions | 45 | Research Scientists, Agronomists |

The Oman Grow Light Market is valued at approximately USD 18 million, reflecting the increasing adoption of indoor farming techniques and energy-efficient lighting solutions in the region.