Region:Middle East

Author(s):Shubham

Product Code:KRAD5476

Pages:98

Published On:December 2025

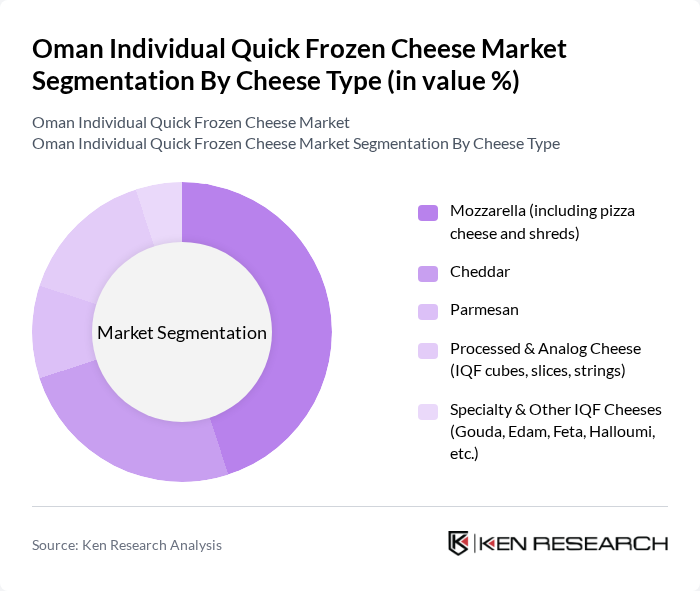

By Cheese Type:The cheese type segmentation includes various categories such as Mozzarella, Cheddar, Parmesan, Processed & Analog Cheese, and Specialty & Other IQF Cheeses. Among these, Mozzarella is the leading sub-segment, primarily due to its extensive use in pizzas and other fast-food items and its dominance in IQF formats globally. The growing trend of pizza consumption in Oman, supported by international pizza chains and local pizzerias, has significantly boosted the demand for Mozzarella cheese, making it a staple in both households and foodservice establishments. Cheddar and processed cheeses also hold substantial market shares, driven by their versatility in burgers, sandwiches, baked snacks, and industrial food processing, while Parmesan and other hard cheeses are mainly used as value-added toppings in foodservice and retail.

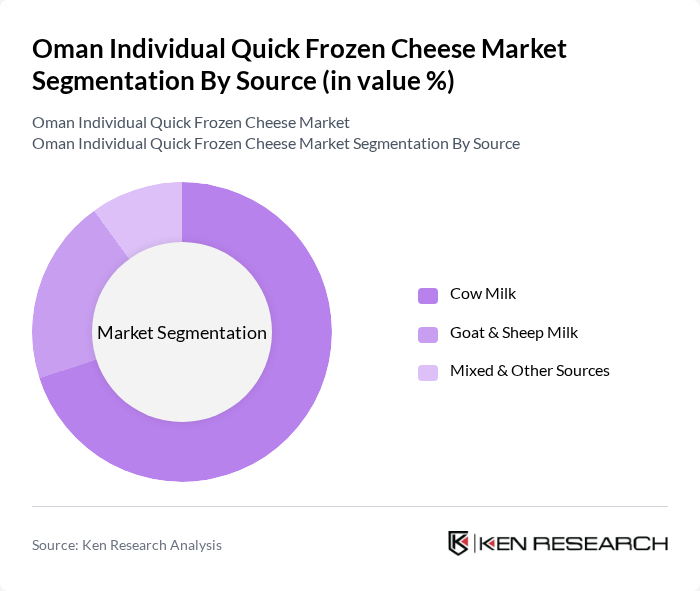

By Source:The source segmentation includes Cow Milk, Goat & Sheep Milk, and Mixed & Other Sources. Cow milk is the predominant source for IQF cheese production in Oman, accounting for the majority of the market share, consistent with global IQF cheese supply where cow-milk mozzarella, cheddar, and processed cheeses dominate. This is largely due to the availability, established supply chains, and cost-effectiveness of cow milk compared to other sources. Goat and sheep milk are gaining traction, particularly among health-conscious consumers and those seeking specialty cheeses such as feta and certain regional varieties, but they still represent a smaller portion of the market. The trend towards premium, clean-label, and regionally sourced dairy products, along with demand from high-end foodservice operators, is also influencing consumer preferences in this segment.

The Oman Individual Quick Frozen Cheese Market is characterized by a dynamic mix of regional and international players. Leading participants such as FrieslandCampina, Lactalis Group, Arla Foods, Fonterra Co-operative Group, Almarai Company, Savencia Fromage & Dairy, Bel Group, Al Kabeer Group, National Dairy Products Co. SAOC (Nadec Oman/Jubailah brand importer), A’Saffa Foods SAOG, Oman Food Investment Holding-related Dairy Importers, Regional Foodservice Distributors (Oman) Focused on IQF Cheese, Private Label IQF Cheese Packers Supplying Oman Modern Trade, Major Global IQF Cheese Exporters Supplying GCC (e.g., Leprino Foods), Leading Online & Cash-and-Carry Distributors Handling IQF Cheese in Oman contribute to innovation, geographic expansion, and service delivery in this space.

The Oman Individual Quick Frozen Cheese market is poised for significant growth, driven by evolving consumer preferences and an expanding food service sector. As health consciousness rises, consumers are increasingly seeking convenient yet nutritious food options. Innovations in freezing technology and sustainable packaging will likely enhance product appeal. Additionally, the potential for collaboration with local food manufacturers presents opportunities for market expansion, enabling the introduction of unique cheese products tailored to local tastes and preferences.

| Segment | Sub-Segments |

|---|---|

| By Cheese Type | Mozzarella (including pizza cheese and shreds) Cheddar Parmesan Processed & Analog Cheese (IQF cubes, slices, strings) Specialty & Other IQF Cheeses (Gouda, Edam, Feta, Halloumi, etc.) |

| By Source | Cow Milk Goat & Sheep Milk Mixed & Other Sources |

| By Application / End-User | Quick Service Restaurants (QSRs) & Fast-Casual (pizza, burgers, sandwiches) Full-Service Restaurants & Hotels Industrial Food Manufacturers (ready meals, snacks, bakery) Institutional Catering (airlines, hospitals, schools, camps) Household / Retail Consumers |

| By Distribution Channel | Foodservice Distributors & HoReCa Channels Cash & Carry / Wholesale Stores Supermarkets / Hypermarkets Specialized Frozen Food Distributors Online B2B & B2C Channels |

| By Packaging Format | Bulk Foodservice Packs (>2 kg bags / cartons) Medium Packs (500 g – 2 kg) Retail Packs (<500 g, zip / pillow / stand-up pouches) Private Label & Custom Packs |

| By Freezing / Processing Technology | Individual Quick Freezing (IQF – tunnel / belt systems) Blast Freezing Cryogenic Freezing Other Industrial Freezing Methods |

| By Region | Muscat Governorate Dhofar (including Salalah) Al Batinah (including Sohar) Ad Dakhiliyah (including Nizwa) Other Regions (Ash Sharqiyah, Al Dhahirah, Al Wusta, Musandam) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Cheese Outlets | 90 | Store Managers, Category Buyers |

| Food Service Providers | 70 | Restaurant Owners, Catering Managers |

| Cheese Manufacturers | 50 | Production Managers, Quality Control Officers |

| Distributors and Wholesalers | 60 | Logistics Coordinators, Sales Representatives |

| Consumers of Frozen Cheese Products | 140 | Household Decision Makers, Food Enthusiasts |

The Oman Individual Quick Frozen Cheese Market is valued at approximately USD 12 million, reflecting a growing demand for convenience foods and the increasing popularity of cheese-based dishes among consumers in the region.