Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7185

Pages:96

Published On:December 2025

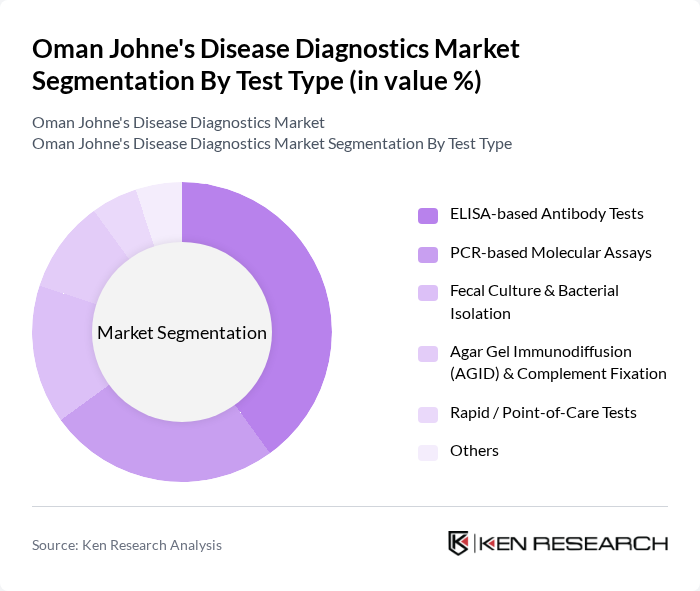

By Test Type:The diagnostics market is segmented into various test types, including ELISA-based antibody tests, PCR-based molecular assays, fecal culture and bacterial isolation, agar gel immunodiffusion (AGID) and complement fixation, rapid/point-of-care tests, and others. At the global level, ELISA-based antibody tests account for the largest share in Johne’s disease diagnostics owing to their balance of sensitivity, specificity, throughput, and cost-effectiveness for herd-level screening. In Oman, ELISA-based antibody tests are similarly the most widely used in routine surveillance and herd screening programs because they are relatively affordable, compatible with central veterinary laboratories, and allow testing of large sample numbers, making them a preferred choice for veterinarians and livestock producers. The increasing adoption of these tests is driven by their ability to provide quick and reasonably accurate results for subclinical infections, which is essential for effective disease management and culling decisions in dairy and beef herds.

By Animal Type:This segment includes dairy cattle, beef cattle, small ruminants (sheep and goats), camels, and others. Globally, the cattle segment accounts for the dominant share of Johne’s disease diagnostics revenue, reflecting the high economic impact of the disease in dairy and beef production systems. In Oman, dairy cattle represent the largest segment due to their economic importance in the country’s dairy and fresh milk supply chain, particularly in organized farms and integrated agri?businesses. The increasing focus on improving dairy yields, reducing involuntary culling, and maintaining disease-free herds drives the demand for effective diagnostic solutions. Additionally, growing awareness among farmers and farm managers about the impact of Johne's disease on milk production, fertility, and long-term herd performance further enhances the market for diagnostics in dairy cattle, while emerging commercial fattening operations and small?ruminant and camel herds are gradually increasing their use of testing in high?value breeding and export-oriented systems.

The Oman Johne's Disease Diagnostics Market is characterized by a dynamic mix of regional and international players. At the global level, leading participants in Johne’s disease diagnostics include IDEXX Laboratories, Inc., Zoetis Inc., Thermo Fisher Scientific Inc., PBD Biotech Ltd, IDvet, VMRD, Inc., INDICAL BIOSCIENCE GmbH, MV Diagnostics Ltd (SureFarm), Tetracore, Inc., QIAGEN N.V., Neogen Corporation, and Bio-Rad Laboratories, Inc., many of which offer ELISA kits, PCR assays, and ancillary reagents for Mycobacterium avium subspecies paratuberculosis detection. In Oman, these companies typically serve the market through regional distributors and veterinary supply channels, supporting local laboratories and veterinary practices with imported test kits and instruments, while veterinary reference laboratories act as key implementation partners.

The future of the Oman Johne's Disease diagnostics market appears promising, driven by technological advancements and increased awareness of animal health. As the government intensifies its disease control programs, the integration of digital technologies in diagnostics is expected to enhance efficiency. Furthermore, the growing focus on preventive healthcare will likely lead to increased investments in veterinary research, fostering innovation and improving diagnostic capabilities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Test Type | ELISA-based Antibody Tests PCR-based Molecular Assays Fecal Culture & Bacterial Isolation Agar Gel Immunodiffusion (AGID) & Complement Fixation Rapid / Point-of-Care Tests Others |

| By Animal Type | Dairy Cattle Beef Cattle Small Ruminants (Sheep & Goats) Camels Others |

| By End-User | Central & Regional Veterinary Laboratories Private Veterinary Clinics & Hospitals Commercial Livestock & Dairy Farms Research & Academic Institutions Government & Regulatory Agencies Others |

| By Distribution Channel | Direct Tender & Institutional Procurement Local Distributors / Importers Online Procurement Platforms Veterinary Supply Stores & Pharmacies Others |

| By Region | Muscat Governorate Dhofar Governorate Al Batinah North & South Al Dakhiliyah & Al Sharqiyah Other Governorates |

| By Technology Platform | Immunodiagnostics Molecular Diagnostics Culture-based Methods Others |

| By Funding & Policy Support | Government Disease Control Programs Multilateral & Donor-funded Projects Research Grants & Innovation Funds Private Sector & PPP Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cattle Farmers | 100 | Livestock Owners, Farm Managers |

| Veterinary Clinics | 75 | Veterinarians, Veterinary Technicians |

| Livestock Health Inspectors | 50 | Government Inspectors, Agricultural Officers |

| Diagnostic Test Manufacturers | 40 | Product Managers, Sales Representatives |

| Research Institutions | 40 | Researchers, Academic Professors |

The Oman Johne's Disease Diagnostics Market is valued at approximately USD 2 million, based on historical analysis and extrapolation from the global market, which is valued at around USD 650700 million.