Oman Luxury Home Décor Retail Market Overview

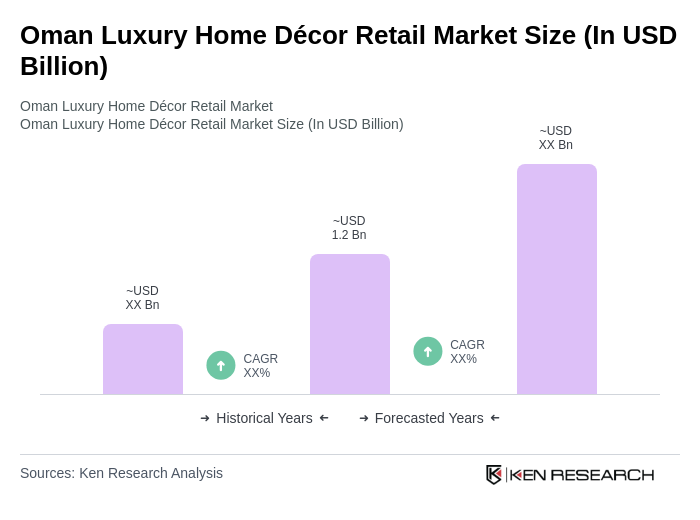

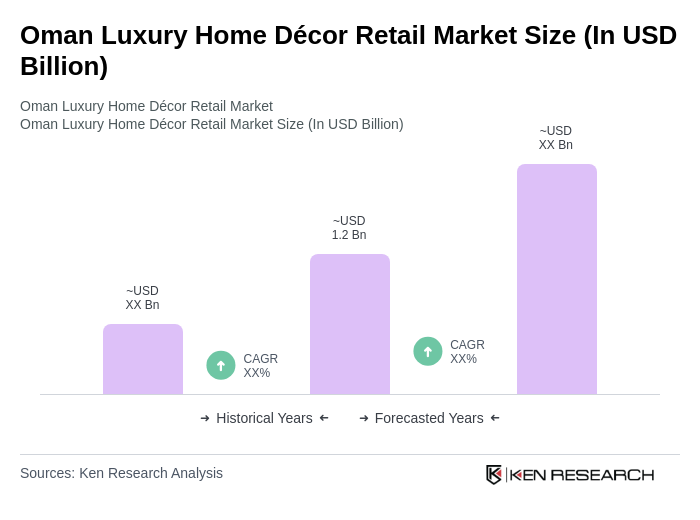

- The Oman Luxury Home Décor Retail Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by rising disposable incomes, a growing expatriate population, and an increasing interest in home aesthetics among consumers. The market has seen a shift towards premium products as consumers seek unique and high-quality items to enhance their living spaces.

- Muscat, the capital city, is the dominant market for luxury home décor in Oman due to its affluent population and concentration of high-end retail outlets. Other cities like Salalah and Sohar are also emerging as significant players, driven by urban development and an increase in luxury housing projects, which further fuels demand for luxury home décor products.

- In 2023, the Omani government implemented regulations to promote sustainable building practices, which include guidelines for the use of eco-friendly materials in home décor. This initiative aims to enhance environmental sustainability and encourage the adoption of green technologies in the construction and interior design sectors.

Oman Luxury Home Décor Retail Market Segmentation

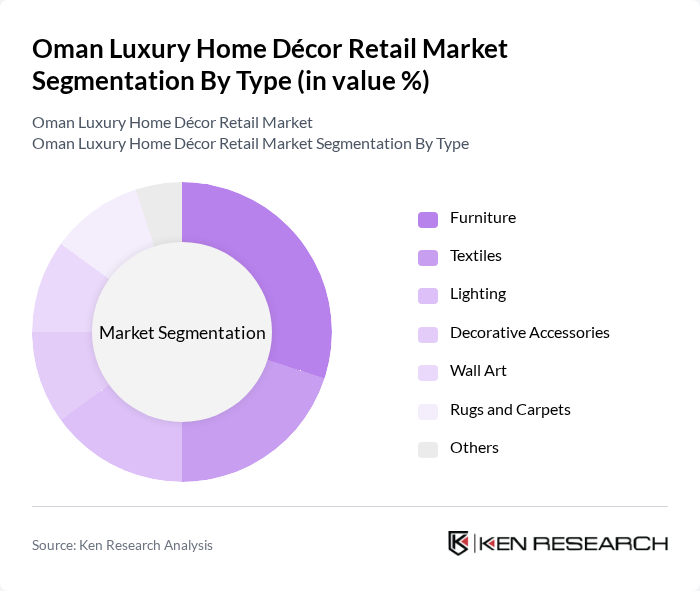

By Type:The luxury home décor market can be segmented into various types, including Furniture, Textiles, Lighting, Decorative Accessories, Wall Art, Rugs and Carpets, and Others. Among these, Furniture and Lighting are the most prominent segments, driven by consumer preferences for stylish and functional home furnishings. The demand for high-quality textiles and decorative accessories is also on the rise, reflecting a growing trend towards personalized home environments.

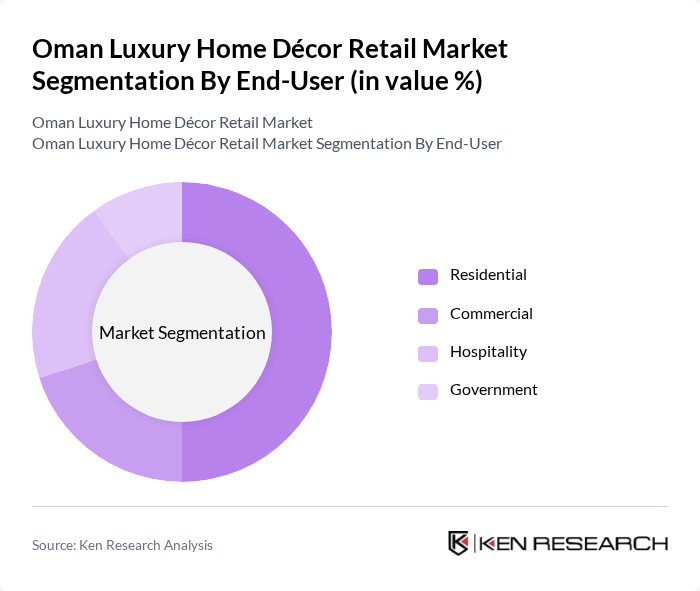

By End-User:The market can be segmented based on end-users into Residential, Commercial, Hospitality, and Government. The Residential segment dominates the market, driven by increasing home ownership and renovation activities. The Hospitality sector is also significant, as luxury hotels and resorts invest in high-end décor to enhance guest experiences, while the Commercial segment is growing due to the rise of upscale office spaces.

Oman Luxury Home Décor Retail Market Competitive Landscape

The Oman Luxury Home Décor Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ameen Home, Home Centre, IKEA Oman, Pan Emirates, The One, Damas, Al-Futtaim ACE, Interiors by Design, Royal Furniture, Mamas & Papas, Home Box, Pottery Barn, Crate and Barrel, West Elm, Habitat contribute to innovation, geographic expansion, and service delivery in this space.

Oman Luxury Home Décor Retail Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The average disposable income in Oman is projected to reach OMR 1,600 per month in future, reflecting a 5% increase from 2023. This rise in income allows consumers to allocate more funds towards luxury home décor items. As the economy stabilizes post-pandemic, the purchasing power of households is expected to enhance, driving demand for high-end products. This trend is supported by the World Bank's forecast of a 3.5% GDP growth for Oman in future, further boosting consumer confidence.

- Rising Demand for Luxury Products:The luxury goods market in Oman is anticipated to grow significantly, with a projected value of OMR 350 million by future. This growth is driven by an increasing number of affluent consumers, particularly among expatriates and local elites. The influx of high-net-worth individuals has led to a greater appreciation for luxury home décor, as evidenced by a 25% increase in luxury retail sales in 2023. This trend is expected to continue, fueled by a growing desire for unique and high-quality products.

- Growth in Real Estate and Construction:The real estate sector in Oman is set to expand, with an estimated investment of OMR 1.2 billion in new residential projects in future. This growth is driven by government initiatives to boost housing availability and urban development. As new homes are built, the demand for luxury home décor items is expected to rise, with homeowners seeking to enhance their living spaces. The construction sector's growth is projected to contribute to a 5% increase in home improvement spending in the coming year.

Market Challenges

- Economic Fluctuations:Oman’s economy is vulnerable to fluctuations in oil prices, which significantly impact government revenues and consumer spending. In future, oil prices are projected to average around $75 per barrel, which may lead to budget constraints and reduced public spending. This economic uncertainty can dampen consumer confidence, resulting in decreased spending on luxury home décor. The International Monetary Fund (IMF) has indicated that economic volatility could hinder growth in non-oil sectors, including retail.

- High Import Duties on Luxury Goods:The import duties on luxury home décor items in Oman can reach up to 20%, significantly increasing retail prices. This high cost can deter consumers from purchasing luxury items, especially in a competitive market where price sensitivity is prevalent. In future, the government is expected to maintain these tariffs, which could limit the availability of international brands and reduce market growth. This challenge necessitates strategic pricing and sourcing for local retailers to remain competitive.

Oman Luxury Home Décor Retail Market Future Outlook

The Oman luxury home décor market is poised for a transformative phase, driven by evolving consumer preferences and technological advancements. As disposable incomes rise and the real estate sector flourishes, demand for luxury products is expected to increase. Retailers are likely to adapt by enhancing their online presence and offering personalized services. Additionally, sustainability trends will shape product offerings, with consumers increasingly favoring eco-friendly options. This dynamic environment presents both challenges and opportunities for market players aiming to capture the affluent consumer segment.

Market Opportunities

- Expansion of E-commerce Platforms:The growth of e-commerce in Oman, projected to reach OMR 250 million in future, presents a significant opportunity for luxury home décor retailers. By establishing robust online platforms, businesses can reach a broader audience, particularly tech-savvy consumers who prefer shopping online. This shift can enhance sales and customer engagement, allowing retailers to showcase their products effectively.

- Collaborations with Local Artisans:Partnering with local artisans can create unique product offerings that resonate with consumers seeking authenticity. In future, the demand for handcrafted items is expected to rise, with consumers willing to pay a premium for unique designs. Collaborations can enhance brand image and support local economies, providing a competitive edge in the luxury home décor market.