Region:Middle East

Author(s):Shubham

Product Code:KRAD3698

Pages:100

Published On:November 2025

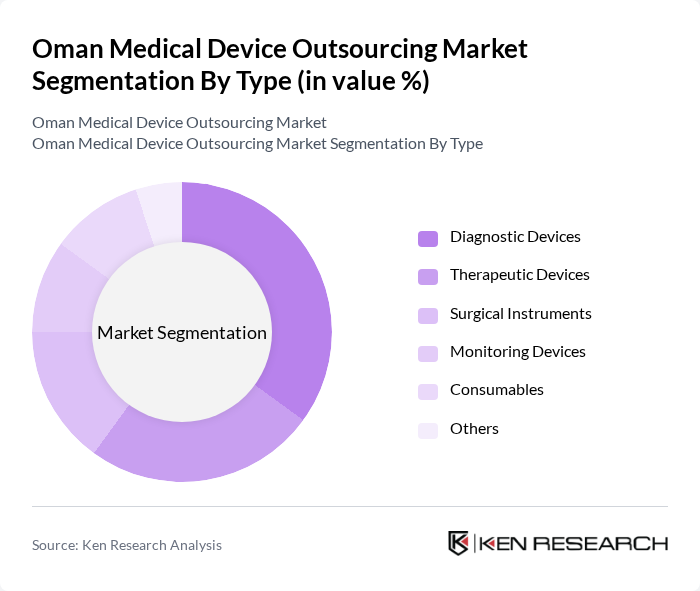

By Type:The market is segmented into various types of medical devices, including diagnostic devices, therapeutic devices, surgical instruments, monitoring devices, consumables, and others. Among these, diagnostic devices are currently leading the market due to the increasing demand for early disease detection and preventive healthcare measures. The rise in chronic diseases has also contributed to the growth of therapeutic devices, while surgical instruments and monitoring devices are gaining traction due to advancements in surgical techniques and patient monitoring technologies.

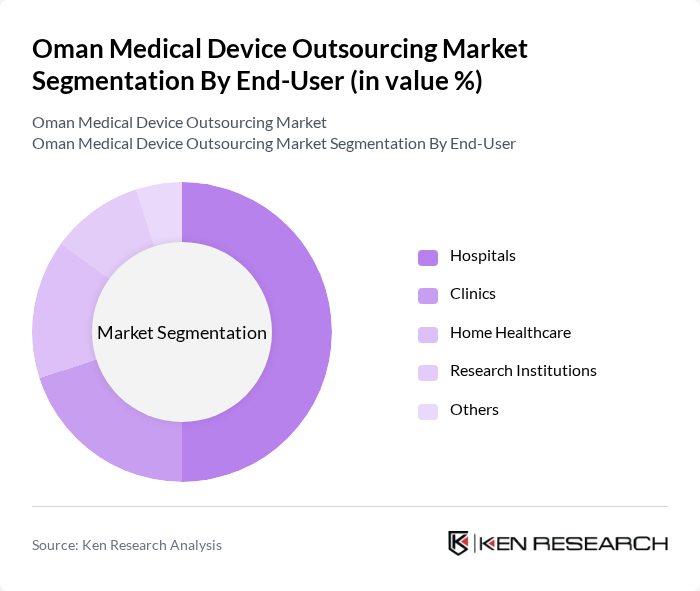

By End-User:The end-user segmentation includes hospitals, clinics, home healthcare, research institutions, and others. Hospitals are the leading end-users of medical devices, driven by the increasing number of patients and the need for advanced medical technologies. Clinics are also witnessing growth as they adopt more sophisticated devices for outpatient care. Home healthcare is emerging as a significant segment due to the rising trend of at-home patient monitoring and care, especially among the elderly population.

The Oman Medical Device Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE Healthcare, Philips Healthcare, Medtronic, Abbott Laboratories, Boston Scientific, Johnson & Johnson, Stryker Corporation, B. Braun Melsungen AG, Zimmer Biomet, 3M Health Care, Cardinal Health, Olympus Corporation, Terumo Corporation, Fresenius Medical Care contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman medical device outsourcing market appears promising, driven by technological advancements and increased healthcare investments. As the government continues to prioritize healthcare infrastructure, the demand for innovative medical devices is expected to rise. Additionally, the integration of digital health solutions and telemedicine will reshape service delivery, enhancing patient care. Companies that adapt to these trends and invest in research and development will likely thrive in this evolving landscape, positioning themselves for long-term success.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Devices Therapeutic Devices Surgical Instruments Monitoring Devices Consumables Others |

| By End-User | Hospitals Clinics Home Healthcare Research Institutions Others |

| By Application | Cardiovascular Orthopedic Neurology Diabetes Management Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| By Technology | Wearable Devices Implantable Devices Point-of-Care Testing Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Device Manufacturers | 100 | Production Managers, Quality Assurance Leads |

| Healthcare Providers | 80 | Procurement Officers, Hospital Administrators |

| Regulatory Bodies | 50 | Compliance Officers, Regulatory Affairs Specialists |

| Outsourcing Service Providers | 70 | Operations Managers, Business Development Executives |

| Industry Experts and Consultants | 60 | Market Analysts, Healthcare Consultants |

The Oman Medical Device Outsourcing Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increased healthcare expenditure, a rise in chronic diseases, and advancements in medical technology.