Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7307

Pages:84

Published On:December 2025

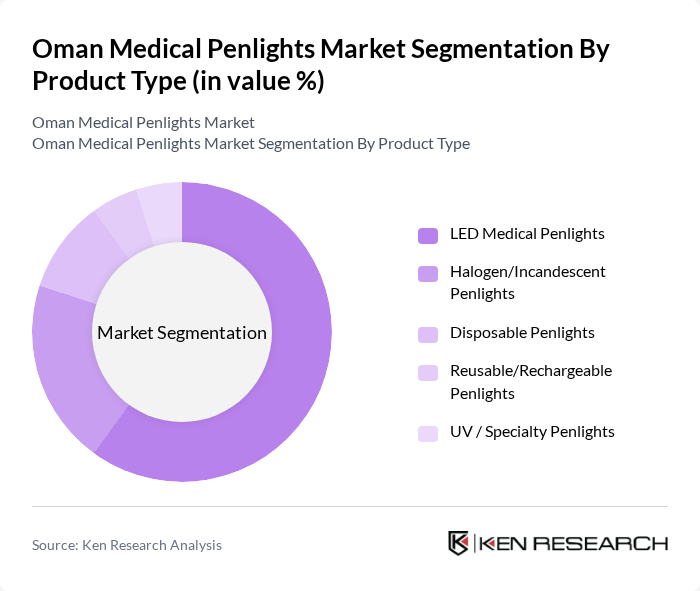

By Product Type:The market is segmented into various product types, including LED Medical Penlights, Halogen/Incandescent Penlights, Disposable Penlights, Reusable/Rechargeable Penlights, and UV/Specialty Penlights. Each of these subsegments caters to different user preferences and clinical requirements.

The LED Medical Penlights subsegment is currently dominating the market due to their energy efficiency, longer lifespan, and superior brightness compared to traditional halogen models. The growing preference for environmentally friendly and cost-effective solutions among healthcare professionals has led to an increased adoption of LED penlights. Additionally, advancements in LED technology have enhanced their functionality, making them a preferred choice in various clinical settings.

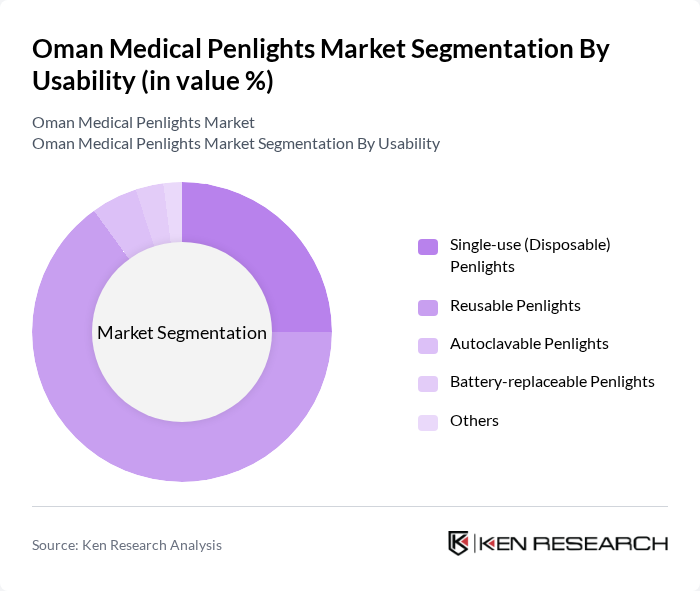

By Usability:The usability segmentation includes Single-use (Disposable) Penlights, Reusable Penlights, Autoclavable Penlights, Battery-replaceable Penlights, and Others. This categorization reflects the different usage patterns and preferences among healthcare providers.

In the usability segment, Reusable Penlights are leading the market due to their cost-effectiveness and sustainability. Healthcare facilities are increasingly opting for reusable options to reduce waste and lower operational costs. The ability to sterilize and reuse these penlights makes them a practical choice for medical professionals, especially in high-demand environments such as hospitals and clinics.

The Oman Medical Penlights Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hillrom / Welch Allyn (Baxter International Inc.), HEINE Optotechnik GmbH & Co. KG, Rudolf Riester GmbH, American Diagnostic Corporation (ADC), Prestige Medical, Spirit Medical Co., Ltd., Medline Industries, LP, MedSource International, Shanghai MDF Instruments Co., Ltd. (MDF Instruments), Omron Healthcare, Inc., 3M Company (3M Health Care), B. Braun Melsungen AG, Mindray Medical International Limited, Philips Healthcare (Royal Philips), Local & Regional Distributors (Gulf Medical Company, Oman Medical Supplies & Services LLC, Others) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman medical penlights market is poised for significant growth, driven by technological advancements and increasing healthcare investments. As the government continues to enhance healthcare infrastructure, the demand for innovative medical devices will rise. The integration of smart technologies and sustainable practices will likely shape product development. Additionally, the expansion of telemedicine services will create new avenues for penlight applications, further driving market growth and encouraging manufacturers to innovate in response to evolving healthcare needs.

| Segment | Sub-Segments |

|---|---|

| By Product Type | LED Medical Penlights Halogen/Incandescent Penlights Disposable Penlights Reusable/Rechargeable Penlights UV / Specialty Penlights |

| By Usability | Single-use (Disposable) Penlights Reusable Penlights Autoclavable Penlights Battery-replaceable Penlights Others |

| By Clinical Application | General Physical Examination ENT & Ophthalmic Examination Neurological Assessment Emergency & Pre?hospital Care Dental & Oral Examination Others |

| By End-User | Public Hospitals (MOH & Government) Private Hospitals Polyclinics & Private Clinics Ambulatory Surgical Centers Emergency Medical Services (EMS) Home Healthcare & Individual Practitioners Others |

| By Distribution Channel | Tender-based Institutional Procurement Local Medical Device Distributors Hospital & Group Purchasing Organizations Online B2B Platforms Retail Pharmacies & Medical Supply Stores Others |

| By Price Band (End-user Procurement Price) | Economy Penlights (< OMR 3 per unit) Mid-Range Penlights (OMR 3–10 per unit) Premium Penlights (> OMR 10 per unit) Value Packs / Bulk Hospital Packs |

| By Governorate / Key Cities | Muscat Dhofar (incl. Salalah) Al Batinah (incl. Sohar) Ad Dakhiliyah (incl. Nizwa) Other Governorates (North & South Sharqiyah, Al Dhahirah, Al Buraimi, Musandam) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Usage of Medical Penlights | 100 | Doctors, Surgeons, Nursing Staff |

| Clinic Adoption Rates | 80 | General Practitioners, Clinic Managers |

| Emergency Services Equipment Preferences | 60 | Paramedics, Emergency Room Physicians |

| Distribution Channel Insights | 70 | Medical Equipment Distributors, Sales Representatives |

| Market Trends and Innovations | 50 | Healthcare Analysts, Medical Device Innovators |

The Oman Medical Penlights Market is valued at approximately USD 13 million, reflecting a growing demand for portable and efficient medical examination tools in healthcare facilities across the country.