Region:Middle East

Author(s):Rebecca

Product Code:KRAA6875

Pages:84

Published On:January 2026

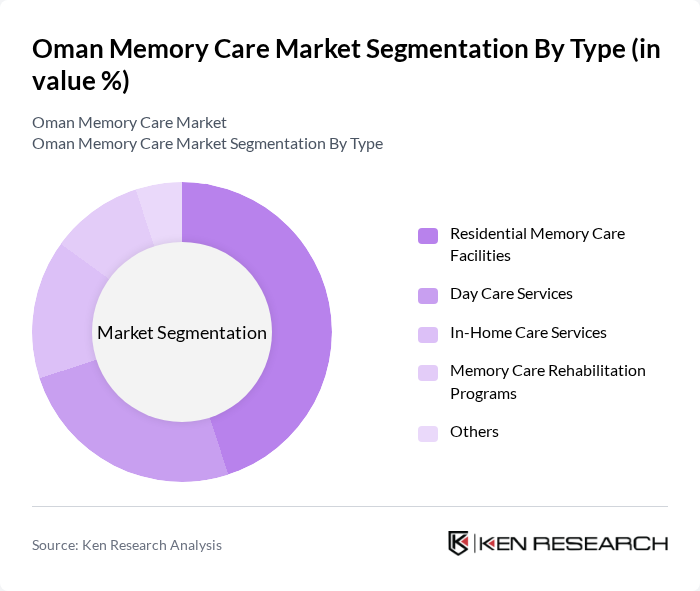

By Type:The market is segmented into various types of memory care services, including residential memory care facilities, day care services, in-home care services, memory care rehabilitation programs, and others. Each of these sub-segments caters to different needs and preferences of families seeking care for their loved ones with memory-related issues. The demand for residential memory care facilities is particularly strong, as they provide comprehensive support and a structured environment for individuals with cognitive impairments.

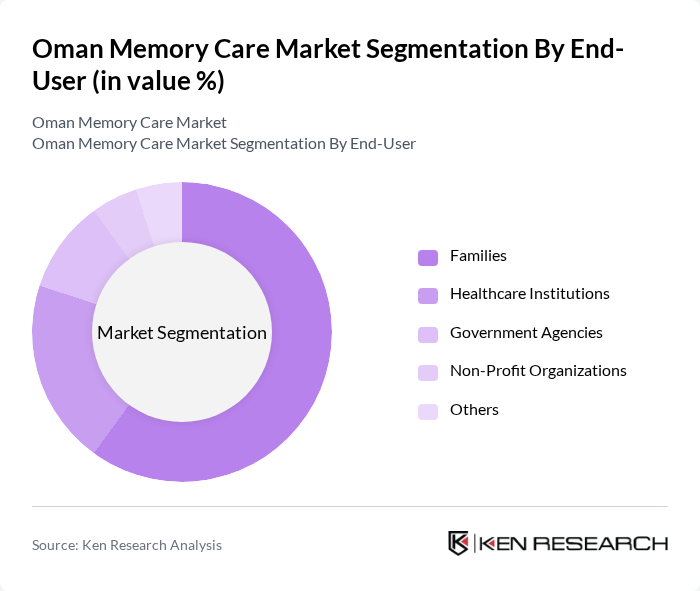

By End-User:The end-user segmentation includes families, healthcare institutions, government agencies, non-profit organizations, and others. Families represent the largest segment, as they are the primary decision-makers when it comes to selecting memory care services for their loved ones. The increasing awareness of the importance of specialized care has led to a growing reliance on professional services, particularly among families seeking to provide the best support for individuals with memory disorders.

The Oman Memory Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Memory Care Center, Al Noor Rehabilitation and Care Center, Muscat Memory Care Services, Al Harthy Memory Care Facility, Oman Elderly Care Association, Memory Care Solutions Oman, Al Jazeera Memory Care Center, Sultan Qaboos University Memory Care Program, Oman Health Services, Al Batinah Memory Care Services, Muscat Elderly Care Center, Al Dakhiliyah Memory Care Facility, Oman Memory Support Network, Al Dhahirah Memory Care Services, Memory Care Innovations Oman contribute to innovation, geographic expansion, and service delivery in this space.

The future of the memory care market in Oman appears promising, driven by demographic changes and increasing awareness of the importance of specialized care. As the elderly population continues to grow, the demand for tailored memory care services will likely rise. Additionally, government support and initiatives aimed at improving elder care infrastructure will facilitate the establishment of more facilities, enhancing service delivery and accessibility for families seeking quality memory care solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Memory Care Facilities Day Care Services In-Home Care Services Memory Care Rehabilitation Programs Others |

| By End-User | Families Healthcare Institutions Government Agencies Non-Profit Organizations Others |

| By Age Group | Seniors (65+ years) Middle-aged Adults (45-64 years) Young Adults (18-44 years) Others |

| By Service Model | Full-time Residential Care Part-time Day Services Telehealth Services Others |

| By Geographic Distribution | Urban Areas Rural Areas Coastal Regions Others |

| By Funding Source | Private Pay Insurance Coverage Government Funding Others |

| By Care Level | Basic Care Intermediate Care Advanced Care Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals in Memory Care | 100 | Neurologists, Geriatricians, Psychiatrists |

| Family Caregivers of Dementia Patients | 80 | Primary Caregivers, Family Members |

| Memory Care Facility Administrators | 60 | Facility Managers, Operations Directors |

| Policy Makers in Health Sector | 50 | Health Ministry Officials, Public Health Advocates |

| Support Organizations and NGOs | 40 | Program Coordinators, Outreach Managers |

The Oman Memory Care Market is valued at approximately USD 100 million, reflecting a significant growth driven by the increasing prevalence of dementia and cognitive disorders, along with rising awareness of mental health issues and an aging population.