Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3429

Pages:86

Published On:January 2026

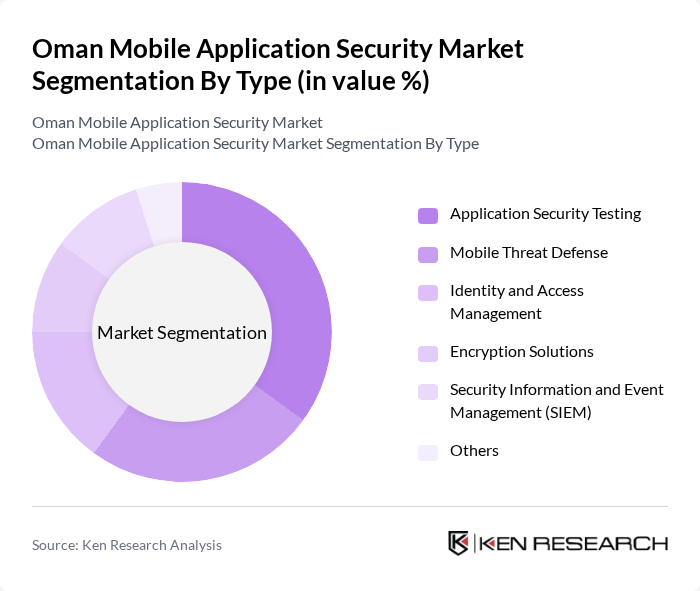

By Type:The market is segmented into various types of mobile application security solutions, including Application Security Testing, Mobile Threat Defense, Identity and Access Management, Encryption Solutions, Security Information and Event Management (SIEM), and Others. Among these, Application Security Testing is the most dominant segment, driven by the increasing need for organizations to identify vulnerabilities in their applications before deployment. Mobile Threat Defense follows closely, as businesses seek to protect their mobile environments from evolving threats.

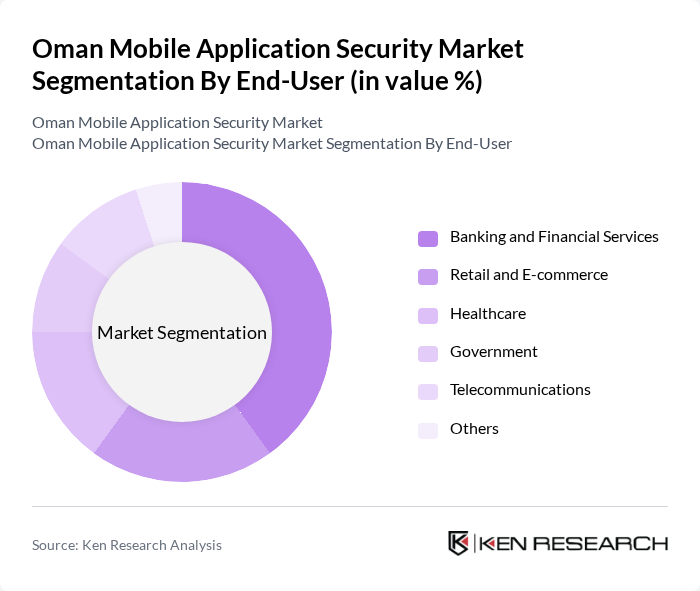

By End-User:The end-user segmentation includes Banking and Financial Services, Retail and E-commerce, Healthcare, Government, Telecommunications, and Others. The Banking and Financial Services sector is the leading segment, as financial institutions prioritize mobile application security to protect sensitive customer data and comply with regulatory requirements. The Retail and E-commerce sector is also growing rapidly, driven by the increasing use of mobile payment solutions.

The Oman Mobile Application Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Data Park, Gulf Cybersecurity, SecureTech, CyberOman, Omani Cybersecurity Center, Al Jazeera Technologies, Oman Telecommunications Company (Omantel), National Bank of Oman, Bank Muscat, Oman Oil Company, Oman Mobile, Muscat Securities Market, Oman Investment Authority, Ministry of Transport, Communications and Information Technology, Oman Air contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman mobile application security market appears promising, driven by increasing digitalization and a growing emphasis on cybersecurity. As businesses and consumers become more aware of security threats, investments in advanced security technologies are expected to rise. Additionally, the integration of AI and machine learning into security protocols will enhance threat detection and response capabilities, making mobile applications safer. The government's commitment to digital transformation will further support the growth of this sector, fostering innovation and collaboration among stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Application Security Testing Mobile Threat Defense Identity and Access Management Encryption Solutions Security Information and Event Management (SIEM) Others |

| By End-User | Banking and Financial Services Retail and E-commerce Healthcare Government Telecommunications Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Industry Vertical | BFSI IT and Telecom Manufacturing Education Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| By Security Type | Network Security Endpoint Security Application Security Cloud Security Others |

| By Service Type | Consulting Services Managed Services Training and Support Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Mobile Security | 120 | IT Security Managers, Compliance Officers |

| Healthcare Application Security | 100 | Healthcare IT Directors, Data Protection Officers |

| Retail Mobile App Security | 80 | eCommerce Managers, IT Security Analysts |

| Telecommunications Security Measures | 110 | Network Security Engineers, Product Managers |

| Government Mobile Application Security | 70 | Cybersecurity Policy Makers, IT Administrators |

The Oman Mobile Application Security Market is valued at approximately USD 140 million, reflecting a significant growth driven by the increasing adoption of mobile applications and rising concerns over data breaches and cyber threats.